The cautionary tale which follows concerns the Syndicat Intercommunal de Destruction des Résidus Urbains (SIDRU), a communal waste disposal service which is a joint enterprise of fifteen municipalities in the Greater Paris region, including the township of St. Germain-en-Laye.

[PDF] (local copy [PDF]).

"Between 2003 and 2007, that is to say under Lamy’s chairmanship, SIDRU concluded a number of loan contracts with various banks."This report confirms that from 1999 onwards the chairman of the SIDRU was none other than the late Emmanuel Lamy, the longtime Mayor of St. Germain-en-Laye from 1999 until 2017.

Between 2003 and 2007, that is to say under Lamy’s chairmanship, SIDRU concluded a number of loan contracts with various banks.

The loans were related to the financing of a new intercommunal waste processing and incinerator facility Azalys located in Carrières-sous-Poissy.

The Azalys incinerator had initially been financed with a conventional loan totalling around € 49 million at a fixed interest rate of about 5%.

After some time the SIDRU management came to the conclusion that the interest rate was too high. During the period 2003 to 2007 it was decided to "swap" the original fixed interest loan for a number of more sophisticated "structured debt products". These "structured debt products" took the form of adjustable-rate loans whose interest rates were indexed to the movements of foreign exchange rates between the Euro and other currencies.

Back in 2003, or even in 2007 before the collapse of Lehman Brothers, such "structured debt products" may have seemed like a good idea.

"DEPFA has since been "wound down". It achieved notoriety in 2008 after it ran into liquidity problems as a result of the economic and financial turmoil in the United States which in turn unleashed shock-waves in the German financial sector and ultimately necessitated a multi-billion bailout of its parent company Hypo Real Estate."Or at least it was comparatively easier for the snake-oil salesmen pushing them to dazzle prospective customers by exaggerating the claimed advantages while downplaying the risks.

However as chaos and instability engulfed the financial markets in 2008, the unfortunate customers all too often woke up to find that what had been sold to them as sophisticated "structured debt products" had suddenly metamorphosed into "toxic loans" saddling them with dire financial consequences which in many cases still remain to be resolved.

One of the SIDRU loans negotiated by Lamy in 2007 was with the DEPFA Bank, the Dublin-based public-sector financing subsidiary of the German Hypo Real Estate (HRE).

DEPFA has since been "wound down". It achieved notoriety in 2008 after it ran into liquidity problems as a result of the economic and financial turmoil in the United States which in turn unleashed shock-waves in the German financial sector and ultimately necessitated a multi-billion bailout of its parent company Hypo Real Estate.

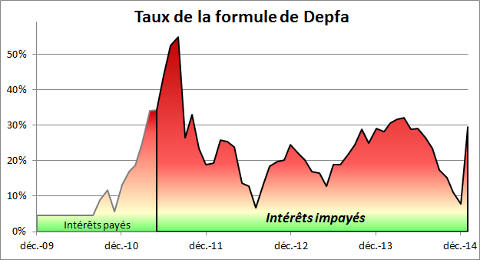

"The interest rate of the DEPFA loan rose dramatically in 2011, jumping from 13.35% to 25% in March, then reaching 34% in April and eventually hitting a peak value of 55% in August 2011!"The loan which Lamy concluded with DEPFA for a tranche of SIDRU’s debt was scheduled to run for a ten year period.

For the first year from 15 December 2008 to 15 December 2009 a fixed rate of interest of 3.68% was to be charged.

For the remaining 9 years the interest rate on the loan depended on the difference between the exchange rate of the Euro in US Dollars and the exchange rate of the Euro in Swiss francs and it was to be calculated based on the following formula:

4.68 + 1.7 x max (0; EURUSD – EURCHF)

"In July 2011 SIDRU decided to suspend its payments on the DEPFA loan."The controversy surrounding the DEPFA loan and other "toxic loans" dragged on [PDF].

After the local elections in 2014 Lamy was replaced as Chairman of SIDRU by Jean-Frédéric Berçot, the Deputy Mayor of the neighbouring municipality of Poissy.

Following SIDRU’s suspension of payments in July 2011 the matter of the DEPFA loan eventually ended up in court.

"On 4 November 2016 the Court of Appeal of Paris issued a final judgment against SIDRU and ordered it to pay DEPFA all outstanding debts plus other charges which in total amounted to just over € 20 million!"On 4 November 2016 the Court of Appeal of Paris issued a final judgment against SIDRU and ordered it to pay DEPFA all outstanding debts plus other charges which in total amounted to just over € 20 million!

A PDF file of the judgment can be found here [PDF] (local copy [PDF]).

The judgment underlined the personal responsibility of Emmanuel Lamy in the affair.

"The SIDRU is an informed party to the contract, whose director, Emmanuel Lamy, Mayor of the commune of Saint-Germain-en-Laye, ENArque, head of mission for general economic and financial control for the Ministry of Finance, had all the skills required to understand and analyse the possible consequences of both a strong rise in the Euro against the Dollar and a strong rise in the Swiss Franc against the Euro even if such a scenario had been presented as unlikely".

In a statement published in the "Free Opinion" column of issue no. 697 [PDF] of the Journal de Saint-Germain the opposition group Saint-Germain Autrement spoke in terms of a “damning judgment” against Lamy: "SIDRU: le jugement accable E. Lamy". ⬆