THE business model of BlackBerry is a big unknown. Reuters was very, very late to pick up this news regarding the departure of BlackBerry's patent chief/strategist. IAM mentioned it again yesterday. To quote: "This year, things were made even more complicated by three high-profile corporate moves in late summer: Allen Lo’s switch from Google to Facebook, Brian Hinman’s decision to leave Philips and Mark Kokes’s sudden departure from BlackBerry."

The man who was leading BlackBerry Ltd’s efforts to make money from its patent portfolio has left to join a health technology company, two sources with knowledge of the move said on Monday.

Mark Kokes left the Canadian company last month to join privately held NantWorks LLC, the sources said. NantWorks was founded in 2011 by billionaire Patrick Soon-Shiong and houses a string of startups looking to transform global health information and develop next-generation pharmaceuticals.

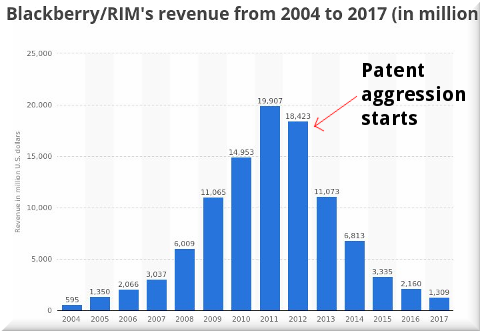

BlackBerry saw its IP revenues almost double in the second quarter, jumping from $32 million in the first three months of the fiscal year to $56 million for the period ending August 31st (the company accounts on a March to February fiscal year). On a call with analysts BlackBerry CEO John Chen revealed that the company had recognised IP revenues from three licensing deals with Ford, Blue and Timex and added that the business had “a good pipeline of opportunities”.

[...]

While Kokes was responsible for building a licensing team in-house, several outside observers suggested that a number of more senior executives were closely involved in the commercialisation efforts. Kokes reported into Sandeep Chennakeshu, president of BlackBerry Technology Solutions, while Chen himself is thought to have kept close tabs on the licensing efforts.

[...]

That message clearly didn’t reach Kokes who was known to be particularly bullish about the monetisation prospects for BlackBerry’s IP assets and told IAM earlier this year that his mandate was simply to, “monetise the BlackBerry portfolio using every means possible”. That saw him strike a number of licensing deals but also sell some assets such as a 2015 disposal to investment firm Centerbridge Partners