"Money corrupts. EPO budget corrupts absolutely. It can even buy votes and journalists in order to ensure they play along, in effect siding with the abuser."We have already seen the EPO shelling out stakeholders' money for illegal activities like obtrusive surveillance, plenty of bodyguards for Battistelli and his cronies, a secret little pub for Battistelli and his cronies, alleged 'bribe' money for votes, money for lawyers who financially destroy staff (e.g. in ILO), several law firms that legally bullied me on behalf of Team Battistelli, 'soft' bribes to media companies, 'soft' bribes to academia and so much more. The EPO is being treated like a bottomless money pit, mostly by Battistelli. It's a new thing. He also pockets some more money along with his cronies (they give themselves generous 'bonuses'). Stakeholders deserve to know all this. It's their money; they're being milked.

Well, mentioned by SUEPO earlier today was this new Kluwer Patent Blog post from Samuel Adams. It's about the EPO thinking that it's an investment bank, as anonymous EPO insiders have warned.

Here's how it starts:

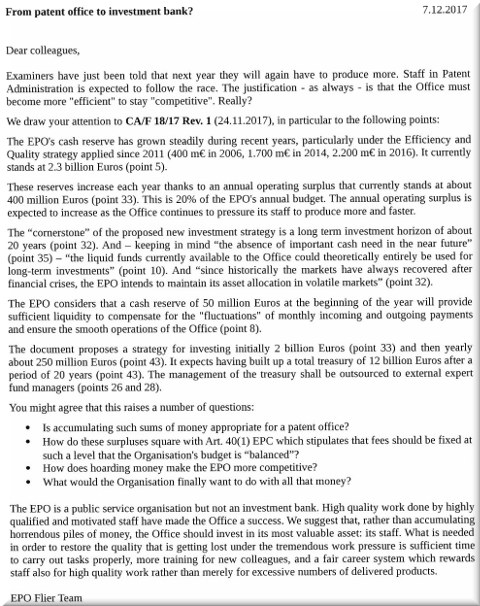

Recently, “New Investment Guidelines of the European Patent Office” (CA/F 18/17 Rev. 1) was published among the “Administrative Council documents” on the EPO web site.

The Investment Guidelines relate to management of the treasury of the EPO and outline a more flexible approach for investing the funds in the treasury. In particular, rather than being limited to fixed income bonds and income bearing securities, as in the replaced Guidelines (CA/F 11/15), the EPO will be allowed to invest according to a more flexible strategy. In principle, this sounds sensible. However, the Investment Guidelines include the following disconcerting text...