IBM's Debt Increasing for Three Years in a Row

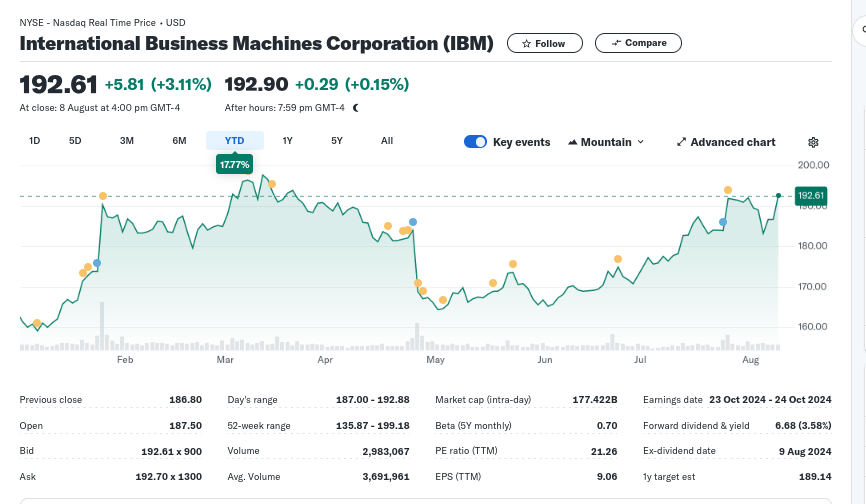

The stock (shares) cannot tell the full story

In the IBM layoffs forum someone seems to be provoking the lurkers (see replies) and I thought I'd weigh in by studying the financial situation of IBM (cash 'in bank' and 'on hand' is not the same) rather than swallow their accountants' spin (analysis or pure fiction). First of all, notice how they used to have close to 50 billion 'cash on hand' (this means they lost a lot of 'cash' when they bought Red Hat around 2019 pending regulatory approval; Ginni Rometty left months later).

"Unfortunately the definition provided on that page means that 'cash' is not necessarily cash," an associate explains. "It can be any number of tangled investments which are expected to be available soonish. The problem is that there are no hard requirements for that."

"On the topic of bluffing like that, Cory [Doctorow] wrote a clear explanation of how leveraged buyouts are where hostile entities use the defending companies own assets as collateral for the loans used to buy them out along with a little board intrigue."

"Remember, that [Bill] Gates's 2 skills are bluffing and extending monopolies. I speculate those came from his college dropout days of playing Poker and Risk*. Then when IBM was convinced by Gates's mom to hand over their software, specifically OS, monopoly he could apply both to real money at a scale where advancement was unavoidable."

_______

* Instead of studying.