Microsoft's Total Debt Has Just Surged to an All-Time High of 106 Billion Dollar (26 Billion Increase in Just 3 Months Despite Mass Layoffs)

The official data, which the media suppresses or does not bother to even mention:

THINGS are not rosy at Microsoft (mass layoffs and massive decreases in pay are a naked clue). Wall Street has become a pump-and-dump operation, riding hype and speculations like the buzzword du jour ("AI"), even if there's no prospect of profit in chatbots and technically speaking chatbots are not AI at all.

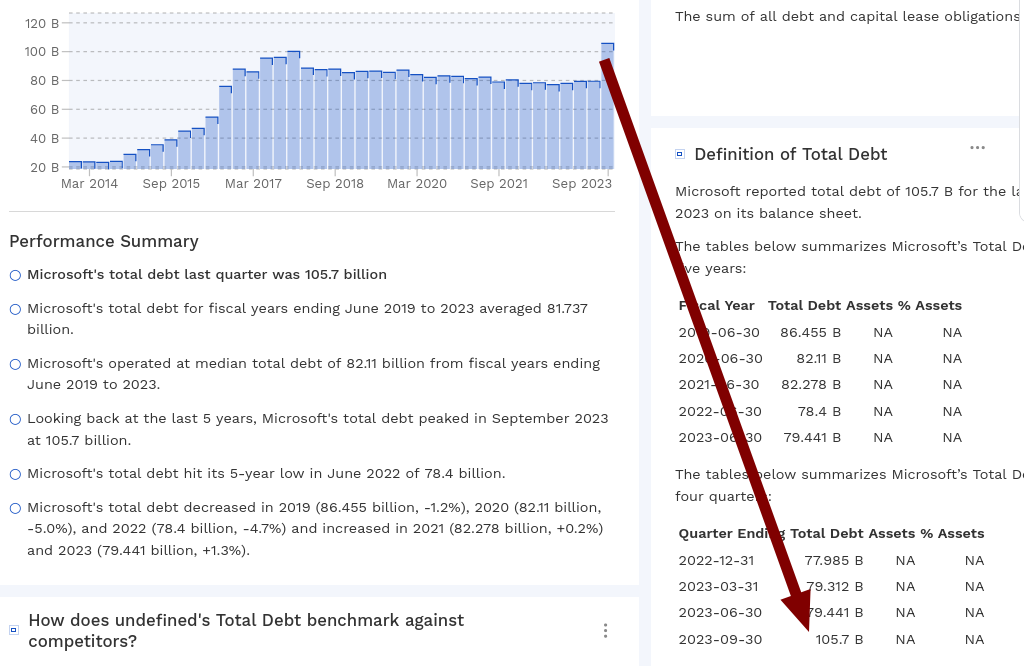

Microsoft now owes the IRS about 30 billion dollars (hard to see how Microsoft gets away from this liability) and last month we noted that Microsoft's debt suddenly rose by about 5.5 billion US dollars after it had already risen for months. But there was even worse news around the corner, as Microsoft's total debt is ballooning this year and bailouts don't come quickly enough (Microsoft remains dependent on cash injections from the government, usually as "defence" contracts).

Corporate debt is not that unusual, but that does not make it okay. For some perspective, Google is about 30 billion dollars in debt, compared to 106 billion at Microsoft. Google is actually selling something (a little less lately), whereas Microsoft mostly churns out vapourware and rebrands everything as "AI" and "clown" (or "Azure"), even to the point of defrauding shareholders.

This is clearly not sustainable. Well, vapourware is a strategy, not a product, and sooner or later investors will realise the company is almost worthless, as its market share continues to decline and its alleged future is just a fantasy.

To put things in more context, the US government took about 2.2 trillion in additional debt in 5-6 months (a lot of that is cash injection for corporations, especially weapons' manufacturers and banks) and even just the interest on this loan is over a trillion dollars a year. Where does this money go? Who is the lender? Putting it another way, how long for can the administration print money to feed corporations which operate at a considerable loss and have enormous debt (their salaries are in effect funded by borrowings)? As someone put it this week: "Bloomberg Intelligence recently released an analysis showing that a year of interest payments on the national debt now exceeds one trillion dollars."

Considering the current interest rates, Microsoft may have to pay about 5 billion dollars a year just in interest on the debt, not even counting towards paying back the debt itself.

Ryan adds that there's "the unfavorable interest rate environment" considering "how long these corporate bonds are on the duration."

"If it's longer term bonds, ouch."

"Selling shares back out into the public would be better" description for the above, he asserts, but those are a form of embezzlement, as we explained many times before.

"You mention one of Microsoft's lifelines is government steering my money there against my will," Ryan concludes. Two consecutive administration from opposing parties did this. █