THE resurgence of software patents in Europe, due to the EPO's abhorrent attitude (the management not obeying the law), is a very serious issue, but it's one that we regularly cover. In the US, for example, the sheer abundance of software patents (granted before Alice) continues to feed patent trolls and other parasites. It's destroying the industry.

With all the attention ride-sharing has been getting lately, some might think Uber and Lyft were highly inventive apps. But according to at least one company, the apps are just highly infringing. Who’s right? Probably neither.

Hailo Technologies, LLC (“Hailo”) has recently sued both Uber and Lyft, alleging they infringed Hailo’s taxi dispatch patent, U.S. Patent No. 5,973,619 (“the ’619 patent”). The patent claims a method for a “computer system” that: (1) displays a list of transportation options; (2) asks the customer for a number of passengers; (3) shows destinations graphically; (4) displays the approximate fare; (5) calls a selected taxi company up for a ride; and (6) gives an estimated arrival time. A few months ago, Hailo also sued a few other companies for infringing a different patent, U.S. Patent No. 6,756,913 (“the ’913 patent”), which claims a method for keeping track of available taxis on the road. More specifically, it claims a method where a computer (1) determines if a taxi is free (i.e. currently has no rider); and if free (2) sends the current location of the taxi to the taxi dispatch server.

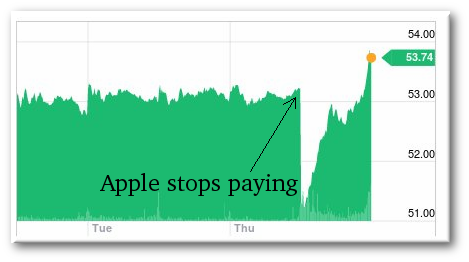

Bloomberg reports that Apple confirms having "suspended [license fee] payments [via its contract manufacturers in China to Qualcomm] until the correct [fair, reasonable and non-discriminatory = FRAND] amount can be determined by the court" and that Qualcomm therefore has reduced its revenue forecast for the quarter ending June by $500 million. Given that the spring quarter is not the strongest one for mobile phones (the closest the next iPhone model is, the more customers wait until they buy), this indicates more than a $2 billion impact on Qualcomm's annual revenue and profit.

Just like the analyst quoted by Bloomberg, I've previously described patent disputes as an "all-out war," but I try to use the term sparingly. I'm not saying that's not what it is. I just want to wait and see how the dispute unfolds. There can be no doubt, however, that the stakes are high.

The $500 million figure for a quarter that is not the strongest one of the year is not really inconsistent with what I recently estimated to be Qualcomm's royalty demands.