Financial Engineering at IBM (Faking Growth Where None Exists)

"At the end of Arvind Krishna’s fourth year as chief executive officer (2020–2023) his performance continues as it started which can be described with one word: unremarkable. Revenue fell -19.8% to $61.9 billion and profits fell -20.5% to $7.5 billion" -Former IBMer, now author

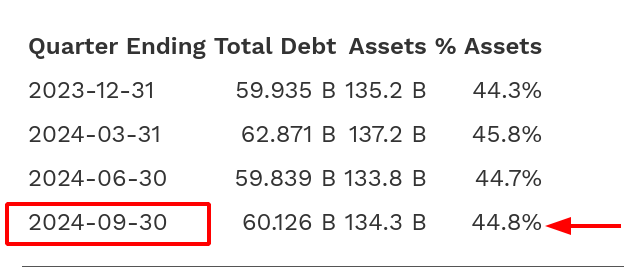

IBM's debt numbers are finally out (they typically come or arrive at public portals days after the "results", as usual). They weren't available a few hours ago, but we keep checking several times per day.

Here we go:

For the latest quarter, ending September 30, IBM's debt is up ~300 million dollars, or ~100 million per month, as the profits are spent buying mostly worthless companies for their revenues, or basically faking revenue "growth". A saner leadership would pay back the debt while interest rates are this high, but Wall Street won't be charmed by a responsible and sane fiscal policy. It's growth for growth's sake, even if debt soars and there's no money at the bank (all the profits are spent buying companies).

That's the same as what Microsoft did with Activision to hide XBox sales collapsing over 50% in one year while Microsoft's debt rose to 111.4 billion dollars.

Yet worse, talking about IBM, the revenues overlook something more sinister going on in the background. IBM's vessel is shedding off its most valuable asset: experienced and highly paid staff.

As someone put it 3 hours ago: "That has not just happened in consulting services. Higher band levels have been demoted. Global Sales Markets can only hire at band 7 or above. Band 9s and 10s in the Global Markets are being RAed left and right. Early professional hires are being put in customer facing roles with no prior customer experience and very limited technical experience."

Meanwhile, as noted last night, AP's headline says that "IBM slumps" [ 1, 2]. The opening paragraph says "IBM slumped to its worst in six months."

And that's despite IBM faking all sorts of things. As the above-mentioned ex IBMer puts it: "Workforce rebalancing is an unrealized financial promise because the last of these conditions—operating at the same or higher levels of sales and profit productivity—has not been realized. IBM has been increasing profits by lowering wages..."

Another aspect of IBM's "Financial Engineering" deals with the pensions of workers: "The U.S. meaning of "scheme" is probably correct as applied to all IBM's pension changes since 1995: scheme: /skēm/ - to make plans, especially in a devious way or with intent to do something illegal or ethically wrong."

IBM recently decided to "take $2.7 bln charge related to transfer of pension obligations". To quote Reuters: "Under the deal, nearly $6 billion of IBM's defined benefit pension obligations will be transferred to Prudential Insurance Company of America."

Buybacks aside, it seems like IBM's alleged "growth" (that is illusion) comes at the expense of others. IBM is chewing its own fats or taking capital from existing, former, and future workers (who aren't paid much). █