This is What the Slop Bubble Popping Can Look Like

Maybe not an overnight collapse, but getting there gradually

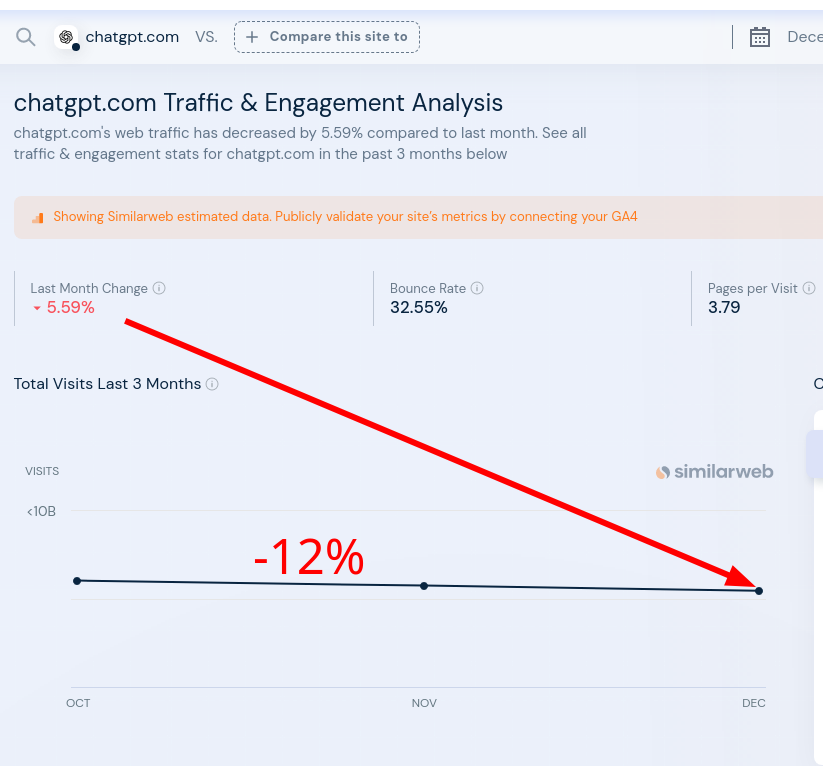

Serious sites with serious (not fake/glorified) experts say that slop usage is down. This is why GAFAM - notably Microsoft, Google, and Facebook ("Meta") - will try hard to fake or 'manufacture' usage (so-called 'demand') for slop.

A day ago the author of What Kind of Bubble is AI? (2023) published the following in The Guardian, doubling down on his prior assertion and many detailed publications:

Start with monopolies: tech companies are gigantic and they don’t compete, they just take over whole sectors, either on their own or in cartels.Google and Meta control the ad market. Google and Apple control the mobile market, and Google pays Apple more than $20bn a year not to make a competing search engine, and of course, Google has a 90% search market share.

Now, you would think that this was good news for the tech companies, owning their whole sector.

But it’s actually a crisis. You see, when a company is growing, it is a “growth stock”, and investors really like growth stocks. When you buy a share in a growth stock, you are making a bet that it will continue to grow. So growth stocks trade at a huge multiple of their earnings. This is called the “price to earnings ratio” or “PE ratio”.

But once a company stops growing, it is a “mature” stock, and it trades at a much lower PE ratio. So for every dollar that Target – a mature company – brings in, it is worth $10. It has a PE ratio of 10, while Amazon has a PE ratio of 36, which means that for every dollar Amazon brings in, the market values it at $36.

It’s wonderful to run a company that has a growth stock. Your shares are as good as money. If you want to buy another company or hire a key worker, you can offer stock instead of cash. And stock is very easy for companies to get, because shares are manufactured right there on the premises, all you have to do is type some zeros into a spreadsheet, while dollars are much harder to come by. A company can only get dollars from customers or creditors.

So when Amazon bids against Target for a key acquisition or a key hire, Amazon can bid with shares they make by typing zeros into a spreadsheet, and Target can only bid with dollars they get from selling stuff to us or taking out loans, which is why Amazon generally wins those bidding wars.

That’s the upside of having a growth stock. But here is the downside: eventually a company has to stop growing. Like, say you get a 90% market share in your sector, how are you going to grow?

Those companies obviously fake their "worth" and Doctorow is hardly the first to point this out. █

2024: Baidu’s CEO Believes 99% of AI Companies Won’t Survive After the Bubble Bursts