It's not Black Friday and it's not Halloween, either. Tomorrow will be Black Tuesday 2013 [1], which protests against the criminally ruthless nature of some people in New York and elsewhere [2] -- people's whose crimes even result in the deaths of people in poorer nations [3]. A professor of economics protests against this system as a whole [4,5] and another professor, Larry Lessig, hopes to save democracy [6] by raising funds for real elections (despite the fact that defaulting seems imminent, as money-printing practices bring back memories from Germany in the 1930s [7]).

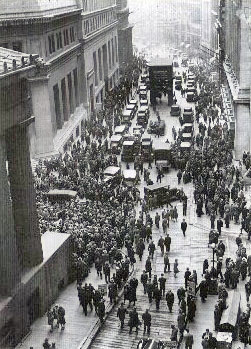

On Tuesday October 29, 2013. We will hold a demonstration to raise awareness that if Wall Street is allowed to continue greedy corrupt practices history will repeat itself.

Billionaire Mark Brodsky’s New York hedge fund is, as one financier put it: “like the Terminator – [it] just keeps on coming”.

The Co-operative Bank this week discovered the truth of that when, despite months of claims it could remain true to its mutual roots with its members in charge, Mr Brodsky and other aggressive hedge funds triumphed in their relentless bid to seize control.

For Co-op members, the sudden turn of events was baffling. Hadn’t the bank agreed a rescue deal to resolve the €£1.5bn black hole in its finances? Hadn’t it told the likes of Brodsky that they would have to sacrifice €£500m and accept a minority stake in the business?

For seasoned observers of Brodsky and his Aurelius fund his victory was no surprise. The former bankruptcy lawyer has made himself and his investors very rich from similar situations. “They are legal tourists, going around the world looking for opportunities to freeze assets and gain control,” says Tim Jones of the Jubilee Debt Campaign. Once they find their target, they will litigate patiently until achieving their profit. Aurelius’s Manhattan boardroom is said to be decorated with a timeline of a previous Brodsky project – the bankruptcy of satellite phone company Iridium. It spans a decade.

Kalai, like many other villages in Bangladesh, appears a rural idyll at first sight. But several villagers here have resorted to selling organs to pay back microcredit loans that were meant to lift them out of poverty. Journalist Sophie Cousins reports on an alarming consequence of the microfinance revolution.

Professor Wolff joins Grant Reeher on The Campbell Conversations and argues that our economic recovery has so far been a “fiction,” unless you’re in the top one percent, and he further claims that this problem reflects something much more fundamentally wrong with our modern system of capitalism. He finds a solution to the problem in a reconsideration of the way we govern the workplace.

The shutdown — and the threat of default — cost the economy billions. (Here’s one estimate of $24 billion. The NYT has some lower (though in the billions) estimates.)

As we noted last year, this is the first time in history that all central banks have printed money simultaneously … And that’s terrifying.

His latest disclosures showed that the United States may have tapped the phone of German Chancellor Angela Merkel, adding to the growing outrage against U.S. data-gathering practices abroad and prompting a phone call between Merkel and President Barack Obama.