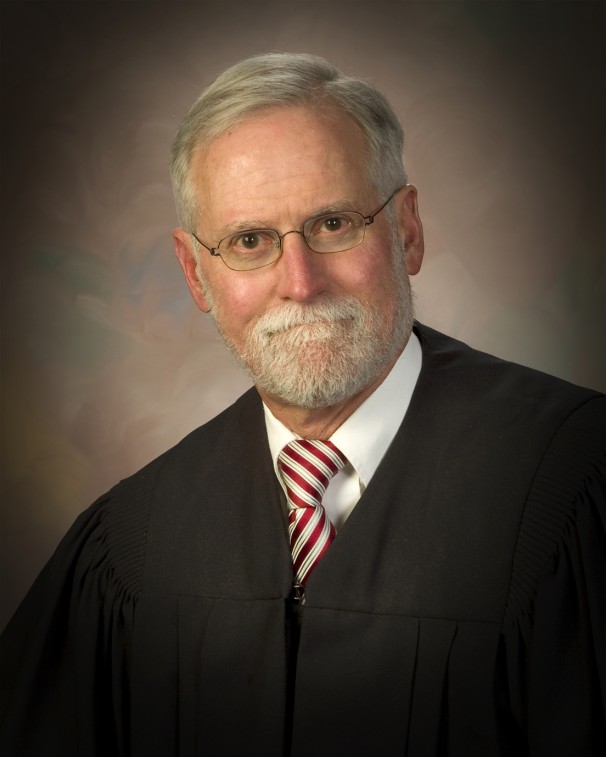

THE above judge, Judge Bryson, called it a "sham" and US Congress got involved too. It's an old issue [1, 2, 3] that emerged a few months back. Can tribes exploit their sovereign immunity to help patent trolls and other aggressors?

A federal judge ruled today that patents protecting Allergan's $1.5 billion blockbuster dry-eye drug, Restasis, are invalid due to obviousness. The international drug company's stock dropped about five percent on the news.

The ruling by US Circuit Judge William Bryson could have wide effects on the patent landscape because the Restasis patents are at the center of a novel legal strategy that involves using Native American sovereignty rights to avoid certain types of patent reviews, called inter partes reviews, or IPRs.

[...]

Restasis was approved by the FDA in 2002, three years after Allergan began the drug-approval process. Allergan had an original patent on the formulation, known in the case as the Ding I patent, US Patent No. 5,474,979, which was filed in 1994 and expired in 2014.

In a 135-page opinion (PDF) published today, Judge Bryson found that Allergan's patents on later formulations were obvious in light of the Ding I patent, as well as two other patents known as the Sall patent and the Ding II patent.

The AIA was intended to stymie patent trolls that bought up patents they never intended to use. Hedge funds, individuals and companies purchased patents not with the intent to protect their manufacture of innovative products, but to sue innovators who had their own, similar patents. Stopping this practice was a laudable goal that made sense for technology like software code and cell phone hardware.

However it was never intended to be applied to pharmaceutical innovation, where the so-called Hatch-Waxman law, which created a pathway for generic drugs, had already effectively balanced the interests of brand-name and generic drug manufacturers. Especially with regard to pharmaceuticals, the 2011 AIA was a solution in search of a problem.

The PTAB alternative to the courts has been widely condemned by patent-holders in a number of industries, chiefly the innovative pharmaceutical industry, which considers it to be unfair, unnecessary and anti-innovation. (The Supreme Court will take that up next year). Other, non-stakeholder observers, including one Federal Circuit Court decision, have reservations as well, calling the panels’ actions “arbitrary and capricious.”

Senator Hatch discussed venue in non-practicing entity cases, possible reforms to IPR proceedings, and recent Supreme Court subject-matter eligibility case law. While Senator Hatch essentially punted on IPRs as something warranting Congress’s attention, he did not mince words when criticizing “patent trolls” and praising the Supreme Court’s recent TC Heartland decision. But he also expressed concerns about whether the Court’s subject-matter eligibility case law has gone too far, endangering life sciences and software development companies as a result.

Senator Hatch was blunt in expressing his views on non-practicing entities. He wrote that patent trolls “extort settlements” and “have become a serious drain on our economy.” He approved of the Supreme Court’s recent decision in TC Heartland, arguing that it “put a stop to rampant forum-shopping.” He nevertheless believes that “some unanswered questions remain” in the wake of TC Heartland. He cited, for example, the need to develop an answer to what constitutes a “regular and established place of business.”