Source: OpenSecrets

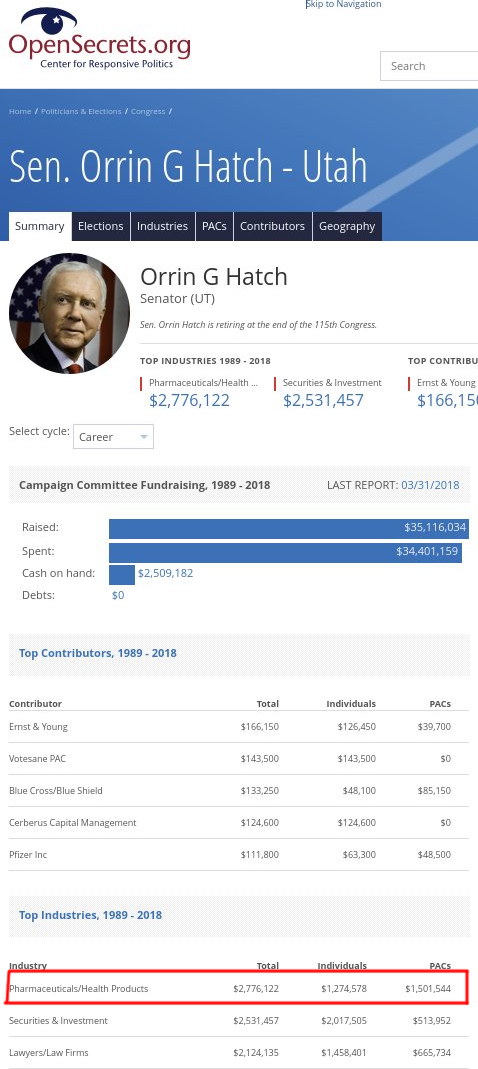

"Watchtroll likes to heckle politicians who receive money from technology firms, but what about pharmaceutical firms?"To be clear, in the area of technology pretty much all the companies -- both large and small -- support PTAB, except a few like IBM, which nowadays relies on patent shakedowns rather than sales (we have been saying this for years [1, 2, 3, 4, 5]). Watchtroll likes to heckle politicians who receive money from technology firms, but what about pharmaceutical firms? Or law firms (third in Orrin Hatch's list)? We'll come to that in a moment. In case it's not obvious, in the pharmaceutical sector the notion of patent trolls is rare and practically ineffective because the number of producing firms is relatively small. It just doesn't scale. So PTAB is of virtually no use for large pharmaceutical firms; it mostly puts them under the 'threat' from generics (we use scare quotes because this the real threat is a threat to people's lives due to the price of certain medicine -- monopolised medicine).

The USPTO's SAS decision "isn't good for the efficiency of the PTAB inter-partes review (IPR)," Florian Müller wrote a short time ago (as noted in yesterday's post of ours), unlike Oil States. Here are some passages:

Samsung challenged multiple claims of two of Huawei's patents-in-suit. The USPTO decided to institute reexamination with respect to some of them, but it had to issue a supplemental order in the wake of SAS and look--nolens volens--at all challenged claims, though it encouraged Samsung to drop its challenge to the ones with respect to which the USPTO was originally unconvinced.

Huawei had actually focused, for the purposes of infringement litigation, on the claims the USPTO viewed more favorably, but the SAS decision changed everything.

As I wrote in my commentary on SAS, this isn't good for the efficiency of the PTAB inter-partes review (IPR) process, but the conservative Supreme Court majority was right that the way the law was worded didn't leave room for any other decision, short of legislating from the bench, which most justices declined to engage in.

The basics of the amendment is that the results of an IPR/PRG proceeding cannot serve as its Paragraph IV certification that the patent is invalid. A parallel provision is designed for biologics under the BCPIA.

And so Attaran is suggesting that Canada take aim at U.S. drug patents.

The U.S. holds more pharmaceutical patents and other intellectual property licences than any other country. But that strength could become a vulnerability if Canada took action to suspend American patents on Canadian soil. Canadian companies would then be able to produce those drugs.

"You hit us on tariffs, we hit you on patents," he said.

How scary is the impending patent cliff? It's not as bad as you might think.

The worst brunt won't be felt until 2023. Total sales at risk due to patent expiration will actually be much lower than in recent years in 2020, 2021, and even 2024.

Also, just because sales are at risk doesn't mean that those sales will completely be lost. EvaluatePharma projects that roughly $139 billion in sales will be lost between 2018 and 2024 for drugs that go off-patent. That's a big number, but it's also much lower than the $250-plus billion in sales that are at risk during the period.

Humira, for example, is still expected to be the world's No. 1 drug in 2024, with sales of more than $15.2 billion. EvaluatePharma thinks that Revlimid will slip a spot from No. 2 to No. 3, but will still grow robustly and generate revenue of close to $8.2 billion annually seven years from now.

Johnson & Johnson has demonstrated the ability to hold on to most of the revenue for Remicade despite losing patent exclusivity. However, J&J's tactics have been controversial and spurred Pfizer to sue for alleged violation of antitrust laws.

EvaluatePharma's report noted that many analysts aren't too concerned about Novo Nordisk's patent cliff. The firm stated that sales expectations for Novo's drugs that have or will lose patent protection continue to remain relatively high, probably because of "the historical sales erosion seen for injected diabetes therapy."