Social Control Media as a Bubble: Facebook (Meta) is in Debt Greater Than the Company is Really Worth or Has in the Bank

- Dr. Roy Schestowitz

- 2023-07-29 23:25:19 UTC

- Modified: 2023-07-29 23:25:19 UTC

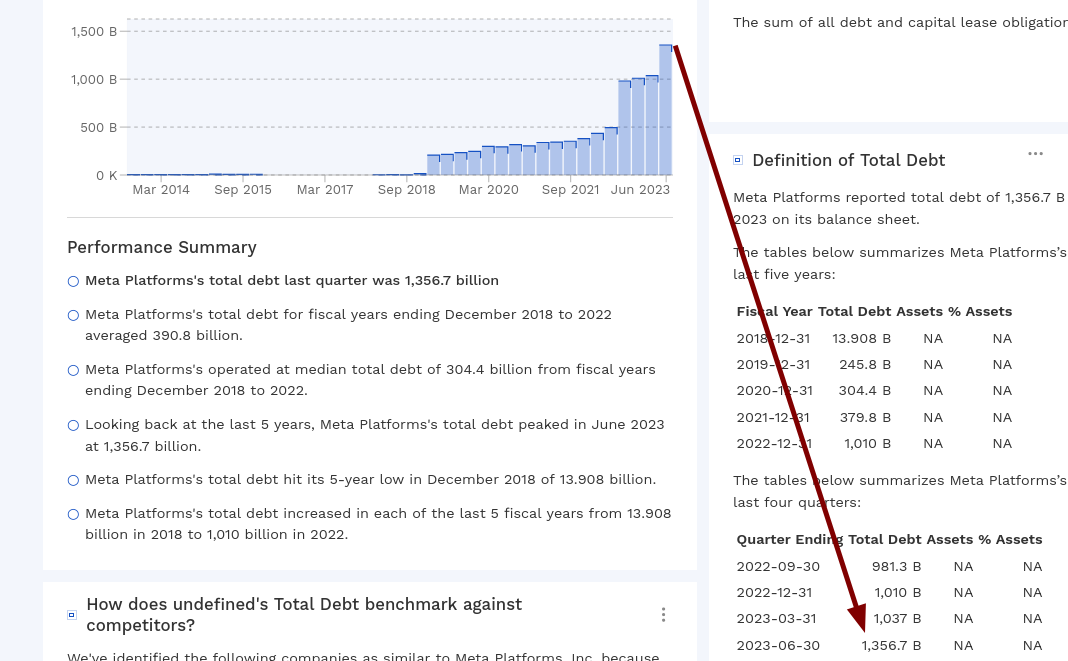

In the bizarre world of

Ponzi (Wall) Street, rich-by-obfuscation companies like GAFAM can even exceed in debt their

real worth; TWTR (Twitter) was one example of it because it's worse than worthless now. Here's

Facebook:

No wonder Sandberg

et al left.

So Facebook is in deeper debt than TWTR was in and

it is running low on cash (Microsoft's debt is similar to what it

claims to have in the bank and

Apple's debt is

twice as big as what it has at hand). Threads is also failing, just like Metaverse.

Debt economy is an economy wherein borrowings are gradually becoming like a "currency" rather than positive cashflow (buying one's own shares is just plain embezzlement).

Due to a name change some sites

get confused, but it would be funny

if the following was true too:

Incorrect numbers

Summary: The financial state of GAFAM (Google, Facebook, Amazon, Apple, Microsoft) isn't quite as the media makes it seem; there's lots of debt in the mix and market valuations are faked, based upon speculations or "pump and dump" tactics, with "mergers and acquisitions" being a cover for passing debt around

"Microsoft, the world’s most valuable company, declared a profit of $4.5 billion in 1998; when the cost of options awarded that year, plus the change in the value of outstanding options, is deducted, the firm made a loss of $18 billion, according to Smithers."

--The Economist, 1999