Debt as the New Currency?

How much longer can the slop bubble [1, 2] hold together Wall Street? Who will be fast to dump all the shares and at whose expense? What will then happen to the global economy, which makes false assumptions about capital (that simply doesn't exist; there's nothing actually backing its alleged existence!)?

The year is nearly over and a lot of the US "capital gain" under the Cheeto regime isn't anything but plunder, or money taken from the taxpayers in the form of debt (loans, borrowing), right?

Then you wonder why prices go up so fast?

Now the private sector is becoming sort of Soviet, with the regime taking "stakes" in Intel for example.

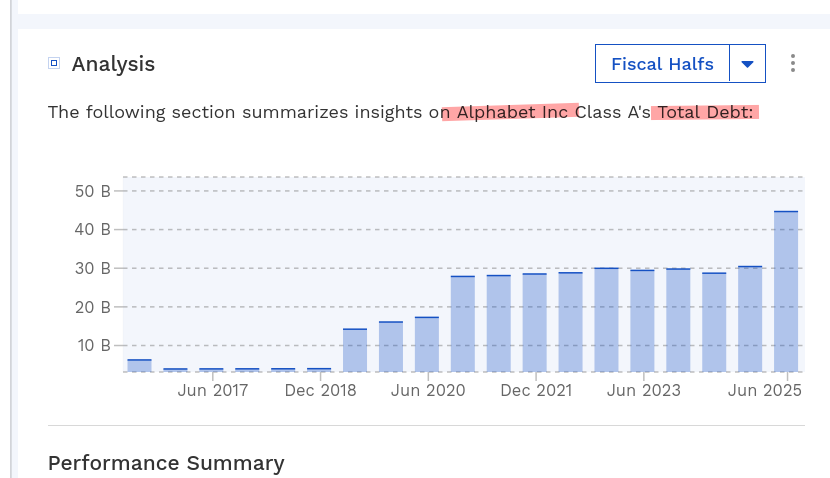

We've just notice that Cisco's debt trebled in a year and a half, we mentioned Microsoft's and Apple's debt last night, and then consider Google:

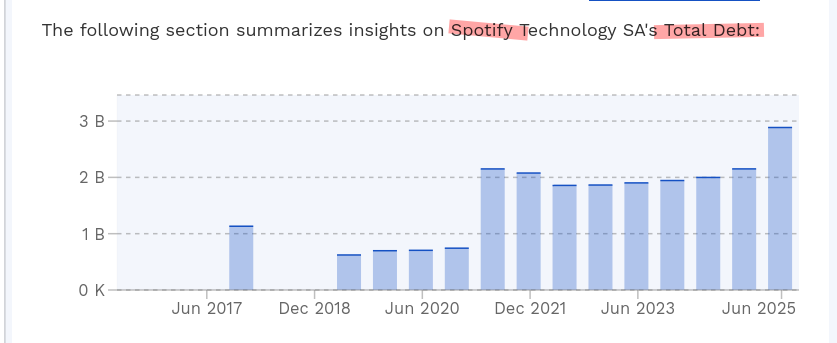

Streaming is another bubble. Operating costs are high.

Rich people get richer not because they're smarter. Rich people get richer because they take money from the rest of us, if not directly then by compelling us (collectively) to borrow money at a national level, then "invest" in them. Or to effectively bail them out in the form of "government contracts" or "stimulus". █