THE "new" and "reformed" European Patent Office (EPO) is nothing like the Battistelli era Office. It's worse. If one looks past the shallow nonsense (expensive PR, censorship, and charm offensives), one finds an even greater degree of corruption such as nepotism (e.g. António Campinos bringing all his mates from EUIPO), gross incompetence, technical absurdities (e.g. granting software patents in Europe using new buzzwords), not to mention financial absurdities. American allies of an American president now call the shots. Yes, Europe's largest patent office is now being led by chronic liars employed by Mercer. It makes one wonder what exactly is still "European" in the European Patent Office (other than nationality of staff, whose level of qualifications rapidly decreased in recent years). Will examination be outsourced to "hey hi" (AI) of Google, just like the EPO's automated translations? Will technology be procured by Microsoft, hosting be provided by Amazon and all official EPO communications relegated to a Twitter account?

6 April 2020

What does Campinos’ SAP do?

This publication explains the impact of the Salary Adjustment Procedure (SAP) envisaged by Mr. Campinos. It should be clear to everybody that this SAP will cut the purchasing power of staff mainly when the EPO can afford to adjust the salaries, but has almost no impact in a period of crisis such as the Base 2 Scenario. Indeed, Mr. Campinos’ SAP would have cut the salary scales by 7% or the equivalent of some 3 steps over the last six prosperous years (2014-2019) lagging the evolution of the cost of living in our Places of Employment by around 4%. Contrary to that, from 2008-2013 the same method would have lagged the current method by less than 3%, despite the subprime crisis falling in that period. If Mr. Campinos was told that his method would bring an immediate impact, he should prepare for a surprise. While the initial discussions took place in a friendly environment, we were disappointed by the style that management chose in the technical working group where the salary adjustment procedure should be defined. Shortly after we were asked for a further proposal in writing, management presented their method as an accomplished fact in extensive EPO TV speeches. It is remarkable that these were recorded even before our previous meeting with management. And, they summarize our proposals in a way which we can only perceive as discrediting. We decided not to let drag us down to that style and continue with constructive proposals.

Setting the scene

Last year, the President commissioned a financial study1. It models four scenarios for the EPO’s finances: an Optimistic, a Base 1, a Base 2 and a Pessimistic Scenario. All four scenarios suppose that over the next 20 years, the fees, our only income, are not even adjusted in line with inflation. They all neglect the value of the buildings, some € 2.9

_________ 1 CA/46/19

billion2, and on top of it neglect more than € 6 billion of future National Renewal Fees, which qualify as an asset3 from an economic point of view.

This consistent – wrong – approach suggests that Mr. Campinos’ has a concept of “asset” which is quite singular4. In a normal economic cycle, e.g. underlying the Base 1 Scenario, neglecting these roughly € 9 billion is not even enough to create a substantial gap.

The office went on to select the Base 2 scenario, an economic cycle starting off with a pitch black recession in Europe during 3 years5, something which didn’t happen since WWII - let alone since the existence of the EPO - and which is not even forecasted for the current COVID-19 crisis. In this scenario, the consultants then ââ¬Å¾found“ a gap of € 3.8 billion. Nota bene: This is still far less than the neglected assets of € 9 billion, even when adding the Campinos’ Buffer of € 2 billion.

Eurostat data shows that a negative nominal GDP growth over two consecutive years6 was never observed in Europe since the beginning of the data available there. The period available in Eurostat covers both major crises of the recent past, namely the burst of the dotcom bubble (in 2001) and the subprime crises (in 2009).

Selecting the Base 2 Scenario should thus be done knowing that it is an extreme scenario which requires exceptional measures only if it does actually materialise. Selecting this scenario as a regular case is, however, entirely unreasonable and illustrates that the EPO’s management has the sole intention to cut staff’s purchasing power.

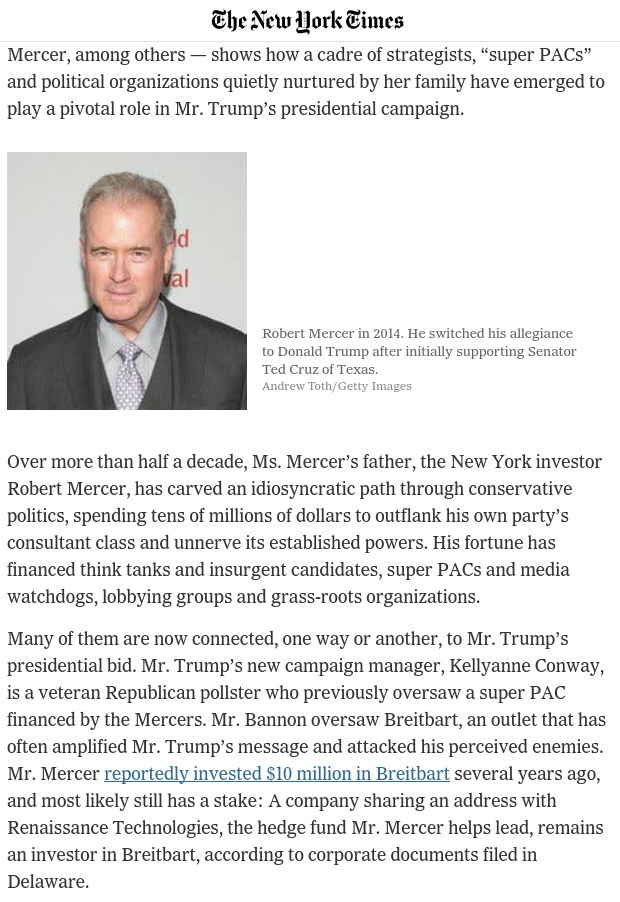

The Base 2 Scenario Mr. Campinos‘ consultants decided to analyse the financial situation starting from the Base 2 Scenario. However, it should then be done consistently and in view that it is an extreme scenario. What the consultants (Mercer) did, is to start from this pitch black recession of the Base 2 Scenario, yet they combined it with estimates of the result of the current SAP, thus with adjustments of the salaries, allowances, pensions, etc., which in the past were seen only in a rosy economic environment.

The trouble with all the ââ¬Å¾simulations“ and “analysis” done by Mercer is that they actually did not simulate the salary development but rather applied a rough average over inflation

_________ 2 CA/69/19 Table 3 3 Forgotten income of €6 billion in Financial Study and Decision not to include National Renewal Fees explained 4 Decision to forget €6bn in Financial Study - Some basics of assets and liabilities 5 three years in a row of nominal negative growth in whole Europe 6 June to June figures, consistently with the SAP

for the salary adjustment, thereby artificially inflating the salary mass, above what the current salary method would do. In the last meeting, Mercer even stated that they are unable to model the salary adjustment. However, past data shows that whenever Europe entered even a short recession, the civil servants saw no salary adjustments above inflation for the years following the recession7. The salary adjustment method currently in force, immediately reflects that in our salary adjustments too - which is what a proper salary method should do.

Confronted with this fact the consultants stated in a nutshell that this time is different8 and that assuming 0,5% salary increase above inflation, also during a period of pitch black recession, is just fine. In other words, Mercer assumes that e.g. Germany, who just lifted the constitutional limit to take on additional debt, will go on to increase the salaries of their civil servants above inflation, contrary to the very purpose of these monies and also contrary to the accompanying law. And that something alike should be expected e.g. from Italy, Spain and the UK ...

Since Mercer did not create a meaningful model for the salary adjustment, they can evidently not simulate any useful measure which becomes only effective in a crisis. Besides the fact that they largely overestimate expenditure and thus misstate the financial situation, it makes it close to impossible to show savings other than by systematically cutting the purchasing power, irrespective of the economic environment.

Prudently assuming, in line with past data, the salary development during and after a 3 years nominal recession, reveals that Mercer had overstated the expenditure for salaries by more than € 750 Mio9. When this money would be invested in the RFPSS, at the return that Mercer assumes in their pitch black scenario, the overstatement of expenditures exceeds € 1.2 billion. This was eventually also confirmed by Mercer - but rejected as a valid approach because they claimed that this would change their model... Nota bene: These € 1.2 billion in combination with the neglected EPO real estate of € 2.9 billion already adds to € 4.1 billion - much more than the gap of € 3.8 billion “found” by Mercer.

Despite the obvious lack for a need of salary cutting measures, even in the Base 2 scenario, the SR was willing to negotiate on measures which will become effective if a

_________ 7 crisis in 1993: neg. or zero adjustment over inflation from 1993-1995; crisis in 2009: neg. adjustments over inflation from 2010-2013; the burst of the dotcom bubble did yield negative or very low adjustments over inflation from 2004-2008 despite the nominal EU-GDP did actually not shrink a single year 8 ‘this time it’s different' are the most costly words in finance, according to Sir John Templeton. It’s the trap of self-declared smart people, in other words a bias known as overconfidence. 9 We did particularly not suggest any amendment to the EU GDP forecast, as suggested by Mr. Campinos in his latest letter. We are at a loss how he can publish such a statement.

Base 2 Scenario would effectively materialize, as additional clauses supporting the financial sustainability.

Measures, which become effective in extreme events, such as an unprecedented 3 year nominal recession in whole Europe, are covered in the SAP proposed by us under the chapter ââ¬Å¾Exception Clause“.

The statements by the consultants, that the savings from the proposals by the SR are inadequate and further not mentioning important conditions for our proposals, are thus entirely misleading for both the savings and the proposed method10.

The volatility of the adjustments One of the major concerns raised by management was the high volatility of the salary adjustments because it complicates the predictability of the budget. These are driven by the volatility of the Specific Indicator11. We have some sympathy with this concern and addressed it in our proposals. When confronted with a volatile parameter, the first thing to do is to smoothen it without changing the long-term result.

Cutting, according to Mercer’s proposal, will not only reduce the volatility but also change the long-term result.

We proposed therefore an averaging mechanism as it is also done in the Coordinated Organisations, and which had reduced in the past 20 years the maximum change of the SI from one year to the next from 4.3% to 2.23%. One could think of other smoothing methods like the one in place for the PPP of the rents12, which would bring down the maximum change of the SI from one year to the other to even 0.63%13.

Double counting This mechanism avoids that increases in the contributions to social schemes would be counted twice, thereby affecting the principle of parallelism. It is an important mechanism since social security and pension contributions in the EPO have increased a lot recently (to pensions, to healthcare insurance and to LTCI).

_________ 10 Mercer’s assessment, page 8 11 The average salary increase of the national civil servants in real terms, thus without inflation. 12 Average over the past 6 years with successive decreasing weights: 25%, 21%, 18%, 14%, 11%, 11%. 13 from 1999-2019

Assume that all national civil servants had a 0% salary adjustment at 0% inflation. Assume further, that during this time both the national pension contributions and the EPO pension contributions were increased by 3%. Since for the salary adjustment method only the net income is considered, this increase of the national pension contribution would translate into -3% salary adjustment for the EPO salaries. Combined with the 3% increase of our own EPO pension contributions at this same time, the overall effect is that our net salaries would have decreased by -6% while the salaries of the national civil servants would have decrease by -3%. The mechanism against double counting exists to neutralise such effects of counting increases in pension and social security contributions twice.

We want to keep this mechanism: particularly now where contributions to social and pension schemes are on the rise everywhere.

Shifting the payout to January The current SAP adjusts the salaries with effect of 1st July. Mr. Campinos proposes to change that to 1st of January.

We have some sympathy with that proposal as it improves the possibility to properly budget the results of the SAP. Indeed, this was also done in the Coordinated Organisations some time ago. Nevertheless, a delay in paying an adjustment must be properly compensated. In the Coordinated Organisations this delay was compensated by a one-off increase of the scales.

We asked also to be compensated for this delay in the same manner. After all, the immediate economic consequence is that the Office cuts the retroactive payment of the salary adjustment staff had so far, each year in December.

It appears that Mr. Campinos does not foresee any compensation for the shifting of the payout, resulting directly into a loss for staff.

Reversibility Management now claims that the reversibility is reflected in the 6 year duration of the salary adjustment procedure. This isn’t reversibility but procrastination. A reversible measure is something which is reversed within the current method.

Despite the endless reiteration by management representatives, there is thus no reversibility in their proposal. Indeed, PD Finance stressed that these measures should be integrated in an SAP which in the long run – meaning over the coming 20 years - saves € 2 billion14,

_________ 14 speech by the CFO, time stamp: 13s

again contrary to the President’s latest letter15, where he states that the SAP applies only to the coming 6 years.

Inflation16

In the Financial Study Phase II17, Mercer states the sensitivities of the different measures. In particular, when using a cap of EU-HICP18 + 0.25%, the savings are in the order of € 1.6 billion. The proposed cap of 0,2% for achieving € 2 billion of savings, might appear for the trusting reader as reasonable, as it appears consistent with and as a compromise close to the low impact limit within the range disclosed in the financial study.

The current proposal is however, to use a cap of 0,2% over the Eurozone-HICP, not over the EU-HICP19. The Eurozone-HICP was at an annual average of 1.72% over the last 20 years whereas the EU-HICP was at an annual average of 1.84% over this same period - thus 0.12% higher20.

Silently replacing the EU-HICP with the Eurozone-HICP is equivalent to reducing the cap of 0.2% to 0.08%. This little detail will cut the salaries more likely by € 2.7 billion21 than the communicated € 2 billion - or another € 100,000 per person in loss of purchasing power.

Having said that, neither the EU-HICP nor Eurozone-HICP are in any way representative for the evolution of the cost of living in any of the Places of Employments. Indeed, over the last 6 years, in these cities, the cost of living as calculated by Eurostat for Munich and The Hague increased in total around 5% faster than EU-HICP, and almost 6% faster than Eurozone-HICP.

The switch of the relevant inflation can only be qualified as a clumsy attempt to fool staff pretending that the proposal is close to the lower range communicated earlier, anyway.

_________ 15 Mr. Campinos letter published on EPO Intranet dated 31 March 2020 16 Data based on Eurostat figures 17 page 9 18 EU-HICP : Harmonised Index of Consumer Prices in the European Union which includes many more countries than the Eurozone. 19 Eurostat Data for HICP 20 It is highly probable that this trend will continue because the EU-HICP includes countries with higher economic growth than the Eurozone. Higher economic growth normally comes along with higher inflation. 21 linear interpolation between the central and the low impact case in CA/83/19 page 9, fist measure: €1.6 bn + (€ 3.2 bn - € 1.6 bn)/0.25%*(0.25%-0.08%)

Payout of withheld adjustments Since the current proposal will lead to consistent cuts except during periods of severe crisis, such as the Base 2 Scenario, it foresees a cash payout of the withheld adjustment in non-pensionable cash to the employees22.

What this exactly entails, and how much money is actually paid out is entirely unclear. Where the Mr. Campinos’ SAP is clear is that it is subject to the Administrative Council’s approval - which means that the president must propose it in the first place.

These are a lot of “ifs” to expect from a President who started by neglecting some € 9 billion23 in assets, only to cut staffs purchasing power.

Conclusion In a nutshell, Mr. Campinos’ SAP does not include a single proposal or idea coming from the SR, no matter how minor, anywhere, at all.

It is not how we understand “the middle of the bridge”.

Yet, it is now blatantly obvious what the President means with the middle of the bridge: either you cross it and you give me what I want - or I take it anyway. Either way, you lose. We are back to Battistelli’s times.

We can only wonder what the impact on staff engagement will be, how this will affect trust in senior management.

And why all this? Because the President decided to disregard some € 9 billion worth of assets? We consider that management should ensure a balanced financing via reasonable fees, not through cutting salaries and pensions.

And please don’t forget, in all this, stay motivated in keeping up business as usual during the corona crisis, a time which very much impedes any action against this madness.

_________ 22 Art. 10 of the SAP proposed by management 23 € 2.9 billion of real estate assets and more than € 6 billion of future national renewal fees