Summary: Microsoft's recognition of the GNU/Linux threat as shown in its internal, confidential presentations

WE have mountains of antitrust exhibits to show -- material that never reached any public attention because Microsoft settles quickly and buries evidence as part of the settlements. Today we deal with Comes vs. Microsoft Exhibit px07378 (2003) [PDF], from which wallclimber has managed to extract and reconstruct the main slides (high-resolution PNGs below). She could not salvage the entire text, but it was more than workable.

Internal documentation (intelligence) such as this proves truly valuable because it shows just how afraid Microsoft is of GNU/Linux, which Bill Gates calls

the most potent competitor in operating systems. Apple is still a niche which targets mostly rich people, so

surveys in developed countries alone do not tell the truth. In fact, in a recent presentation Steve Ballmer showed that

globally, on the desktop,

GNU/Linux market share is said to have exceeded Apple's.

There are many interesting portions to show in this latest exhibit, but here is some good material on GNU/Linux. From 2003 "IMPERATIVES" for example (highlight in red is ours):

FY 03 IMPERATIVES

* Drive Revenue & XP Excitement

- Promote XP Software, Establish Products, Push to Professional+, Win Emerging

* Turn the corner on Longhorn

- Builds, alignment, execution

* Earn the Trust of Our Customers, Partners, & Government

- Community, closing the loop, compliance with SRPFJ

* Win against Linux

- Government, education, emerging

* Invest in the Ecosystem

- Metrics, roadmap, leadership

* Develop People & Organization

- Hires, communication, cross group, manager span, training

Challenges & Discussion

* Winning Against Linux: government, education, enterprise, embedded

* SRPFJ: OEMs hiding our innovations; Work to deliver, & comply

* Dry spell coming in FY04 - revenue, annuity, competition

* Emerging markets plan - Linux, other OSs, and piracy: ideas welcome

* Improving sick ecosystem - quality, innovation, profit

* Product segmentation - how many "premiums"?

* Finding the right balance on legacy support

* Making customer trust/connection a part of the culture

* Piracy: How to make progress (and yet balance with Linux)

In the part about "COMPETITION", GNU/Linux comes before Apple and they use

the TCO lie to fight against GNU/Linux.

COMPETITION

Linux: Win in edu/gov't/emerging, prove lower TCO

Apple: Partner w/ISVs/IHVs on scenarios, win digital media reviews/leadership

Real: Maintain lead, broader/profitable ecosystem

A lot about media, DRM and also Palladium (Trusted Platform Module) is included in the full exhibit, which can be read as PDF or plain text below. A few slides were not reconstructed due to reading difficulties (the text is sometimes illegible due to scale, so reference to the original is better than a deficient translation).

⬆

Appendix: Comes vs. Microsoft - exhibit px07378, as text

________________________________________________

[Graphic: "OEM & HW Manufacturers" goes here]

Key points to make

Innovation part of step function to drive needed volume

MS is the only one who cares about Windows-centricity

To rally industry around needed bold Innovaton, we need to message roadmap *much* earlier

While ODMs are a design aggregation point, we would prefer they not become a licensing aggregation point

OEMs play a different role than in the past - they now consist of channel partners and other PC brands and fulfill the role of customer touch rather than that of the platform innovator, however, technical engagement Is still required to create needed pull to ODMs.

Drive innovation for PC churn/market expansion/penetration

Investments in quality such as OCA increase Windows value proposition to partners, end users

Investments in bold innovation to surf inflections

After market should not be an after thought. In conjunction with innovation we need to address aftermarket/incremental revenue streams in product development process

Make for frictionless Windows integration, increasing Windows criticality

Operating Margin chart

Compaq: O.M. as reported by Compaq for its Access Business Group (commercial and consumer PCs, workstations, and handhelds)

Dell: O.M. for commercial and consumer desktops, portables and workstations

HP: Figures reported by HP for its personal and embedded systems group

IBM: IBR estimates for IBM's PC business. we have removed the printing business from IBM's personal systems and printing group figures

Forward vertical integration

Smaller ODMs are going direct to end users in targeted regions like Taiwan, larger ODMs don't want to compete directly with their customers

Current turnkey or "no touch" ODMs: Wistron, Compal, Quanta, ECS

Progress on OCA

OCA crash fixes tracking at 26% (goal 33% by SP1)

From OCA crashes determined Dell was still shipping old nVidia image, causing 70k blue screens a month; working with Dell to fix

OPK improvements

On track for covered OEMs

-Componentization of the OS for ease of image creation, install and distribution

-Imagability of the OS (both online and offline configuration) for creation, modification, and testing of the image

-Full scriptability of the manufacturability tools suite complete with an SDK (Incl WinPE, Storage mgr, and updated scripting tool WH)

-Total OS hardware independence (1 image for all models)

-Reduction in the number of required SKUs/Images (HE/PRO become switches, Languages become optional components and hardware independence goes away with HAL PnP)

Additional examples of a much-needed OPK improvement

-Automatic download of the latest QFEs which are seemlessly integrated into the preinstall process

-Potentially have web "offers" that the OEMs can integrate into the preinstall from 3rd parties as well

Security/data protection after market programs suggestions

-anti-virus packs

-Palladium-related services

-cross firewall management services

Home networking

-Upsell of remote management

-Management SW

-Physical needs (note that UI will make the OS networking aspect transparent)

-Demand marketing to push to high touch environments like Gateway stores, Best Buy etc.

Two ways to address IP Pooling.

1.Participate in industry pool where everyone pays to enter and then per unit cost. Not a good solution for Windows integration, but reasonable for a plus pack format. OEM channel would need to be set up to address integration of pack offerings.

2.We create the pool, offer TTM advantage, fee to enter for non-participants

30

Plaintiff’s Exhibit

7378

Comes v. Microsoft

MS-CC-Bu 000000180667

HIGHLY CONFIDENTIAL

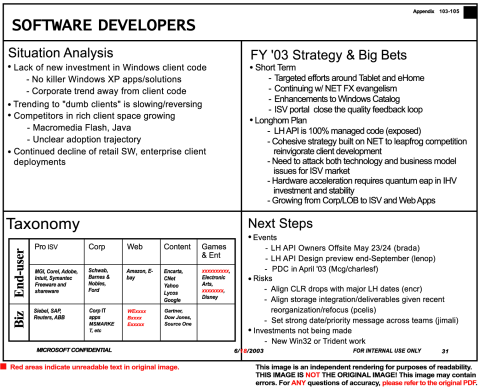

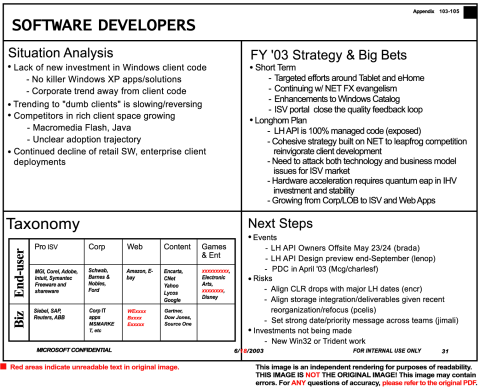

[Graphic: "Software Developers" goes here]

______________

[rectangle top left]

SOFTWARE DEVELOPERS

Situation Analysis

Lack of new investment in Windows client code

No killer Windows XP apps/solutions

Corporate trend away from client code

Trending to "dumb clients" is slowing/reversing

Competitors in rich client space growing

Macromedia Flash, Java

Unclear adoption trajectory

Continued decline of retail SW, enterprise client deployments

[rectangle top right]

FY '03 Strategy & Big Bets

Short Term

Targeted efforts around Tablet and eHome

Continuing w/ NET FX evangelism

Enhancements to Windows Catalog

ISV portal close the quality feedback loop

Longhorn Plan

LH API is 100% managed code (exposed)

Cohesive strategy built on NET to leapfrog competition reinvigorate client development

Need to attack both technology and business model issues for ISV market

Hardware acceleration requires quantum eap in IHV investment and stability

Growing from Corp/LOB to ISV and Web Apps

[rectangle bottom left]

Taxonomy

End-user

Pro ISV

MGI, Corel, Adobe,

Intuit, Symantec

Freeware and

shareware

Siebel, SAP,

Reuters, ABB

Corp

Schwab,

Barnes &

Nobles,

Ford

Corp IT

apps

MSMARKET, etc

Web

Amazon, E-

bay

[can't read

this entry]

Content

Encarta,

CNet

Yahoo

Lycos

Google

Gartner,

Dow Jones,

Source One

Games

& Ent

xxxxxgamer,

Electronic

Arts,

xxxxxxxx,

Disney

[rectangle bottom right]

Next Steps

Events

LH API Owners Offsite May 23/24 (brada)

LH API Design preview end-September (lenop)

PDC in April '03 (MCG/charlesf)

Risks

Align CLR drops with major LH dates (encr)

Align storage integration/deliverables given recent reorganization/refocus (pcelis)

Set strong date/priority message across teams (jimali)

Investments not being made

New Win32 or Trident work

Microsoft Confidential

6/12/2003

FOR INTERNAL USE ONLY

31

______________________

Top 3 takeaways for bpr

1. Work in short term is minimal and not about new api's -- more about marketing/positioning. Even w/tablet and ehome, these are niche efforts for small segments of developers.

2. Longhorn API effort is all about managed code exposure. This creates conflict w/the "legacy" teams such as office, who want an unmanaged (exposed) solution, and solutions for issues like management/delivery for unmanaged code as well.

3. The CLR focus must move from LOB/Corp to also include Pro-ISV (ms internal as well as external consumer ISV) - this is a change and a challenge

31

MS-CC-Bu 000000180668

HIGHLY CONFIDENTIAL

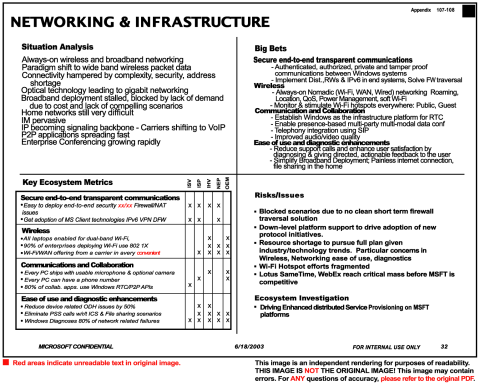

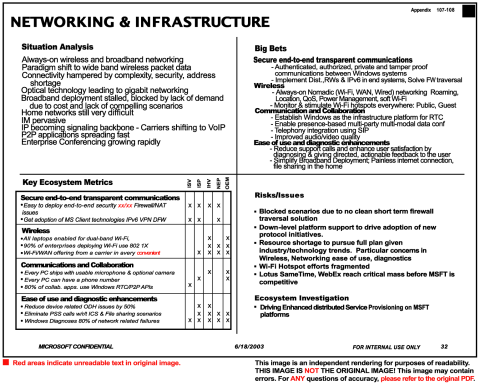

[Graphic: "Networking & Infrastructure" goes here]

______________________

NETWORKING & INFRASTRUCTURE

[top left rectangle]

Situation Analysis

Always-on wireless and broadband networking Paradigm shift to wide band wireless packet data Connectivity hampered by complexity, security, address shortage Optical technology leading to gigabit networking Broadband deployment stalled, blocked by lack of demand due to cost and lack of compelling scenarios Home networks still very difficult IM pervasive IP becoming signaling backbone - Carriers shifting to VoIP P2P applications spreading fast Enterprise Conferencing growing rapidly

[top right rectangle]

Big Bets

Secure end-to-end transparent communications

- Authenticated, authorized, private and tamper proof communications between Windows systems

- Implement Dist. RWs & IPv6 in end systems, Solve FW traversal

Wireless

- Always-on Nomadic (Wi-Fi, WAN, Wired) networking Roaming, Location, QoS, Power Management, soft Wi-Fi

- Monitor & stimulate Wi-Fi hotspots everywhere: Public, Guest

Communication and Collaboration

- Establish Windows as the infrastructure platform for RTC

- Enable presence-based multi-party multi-modal data conf

- Telephony integration using SIP

- Improved audio/video quality

Ease of use and diagnostic enhancements

- Reduce support calls and enhance user satisfaction by diagnosing & giving directed, actionable feedback to the user

- Simplify Broadband Deployment; Painless internet connection, file sharing in the home

[lower left rectangle]

Key Ecosystem Metrics

Secure end-to-end transparent communications

-Easy to deploy end-to-end security xx/xx Firewall/NAT issues

-Get adoption of MS Client technologies IPv6 VPN DFW

Wireless

-All laptops enabled for dual-band Wi-Fi,

-90% of enterprises deploy Wi-Fi use 802 1X -Wi-Fi/WAN offering from a carrier in a very convenient

Communications and Collaboration

Every PC ships with usable microphone and optional camera

Every PC can have a phone number

80% of collab. apps. use Windows RTC/P2P APIs

Ease of use and diagnostic enhancements

Reduce device related ODH issues by 50%

Eliminate PSS calls w/r/t ICS & File sharing scenarios

Windows Diagnoses 80% of network related failures

ISV

ISP

IHV

NEP

OEM

[lower right rectangle]

Risks/Issues

Blocked scenarios due to no clean short term firewall traversal solution

Down-level platform support to drive adoption of new protocol initiatives.

Resource shortage to pursue full plan given industry/technology trends. Particular concerns in Wireless, Networking ease of use, diagnostics

Wi-Fi Hotspot efforts fragmented

-Lotus SameTime, WebEx reach critical mass before MSFT is competitive Ecosystem Investigation

Driving Enhanced distributed Service Provisioning on MSFT platforms

MICROSOFT CONFIDENTIAL 6/18/2003 FOR INTERNAL USE ONLY 32

______________________

32

MS-CC-Bu 000000180669

HIGHLY CONFIDENTIAL

[Graphic: "Digital Media Ecosystem" goes here]

33

MS-CC-Bu 000000180670

HIGHLY CONFIDENTIAL

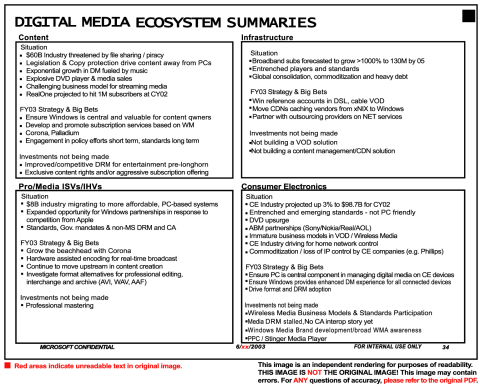

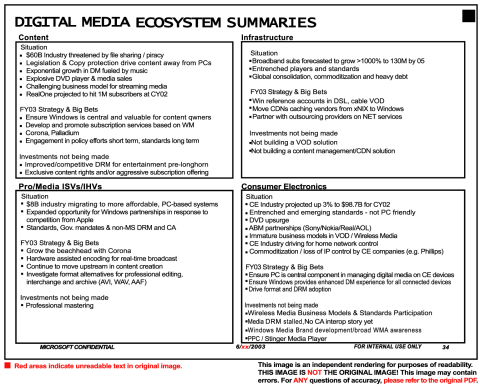

[Graphic: "Digital Media Ecosystem Summaries" goes here]

______________________

DIGITAL MEDIA ECOSYSTEMS SUMMARIES

[top left rectangle]

Content

Situation

$60B Industry threatened by file sharing / piracy

Legislation & Copy protection drive content away from PCs

Exponential growth in DM fueled by music

Explosive DVD player & media sales

Challenging business model for streaming media

RealOne projected to hit 1M subscribers at CY02

FY03 Strategy & Big Bets

Ensure Windows is central and valuable for content qwners

Develop and promote subscription services based on WM

Corona, Palladium

Engagement in policy efforts short term, standards long term

Investments not being made

Improved/competitive DRM for entertainment pre-longhorn

Exclusive content rights and/or aggressive subscription offering

[bottom left rectangle]

Pro/Media ISVs/IHVs

Situation

$8B industry migrating to more affordable, PC-based systems

Expanded opportunity for Windows partnerships in response to competition from Apple

Standards, Gov. mandates & non-MS DRM and CA

FY03 Strategy & Big Bets

Grow the beachhead with Corona

Hardware assisted encoding for real-time broadcast

Continue to move upstream in content creation

Investigate format alternatives for professional editing,

interchange and archive (AVI, WAV, AAF)

Investments not being made

Professional mastering

[top right rectangle]

Infrastructure

Situation

Broadband subs forecasted to grow >1000% to 130M by 05

Entrenched players and standards

Global consolidation, commoditization and heavy debt

FY03 Strategy & Big Bets

Win reference accounts in DSL, cable VOD

Move CDNs caching vendors from xNIX to Windows

Partner with outsourcing providers on NET services

Investments not being made

Not building a VOD solution

Not building a content management/CDN solution

[bottom right rectangle]

Consumer Electronics

Situation

CE Industry projected up 3% to $98.7B for CY02

Entrenched and emerging standards - not PC friendly

DVD upsurge

ABM partnerships (Sony/Nokia/Real/AOL)

Immature business models in VOD / Wireless Media

CE Industry driving for home network control

Commoditization / loss of IP control by CE companies (e.g. Phillips)

FY03 Strategy & Big Bets

Ensure PC is central component in managing digital media on CE devices

Ensure Windows provides enhanced DM experience for all connected devices

Drive format and DRM adoption

Investments not being made

Wireless Media Business Models & Standards Participation

Media DRM stalled. No CA interop story yet

Windows Media Brand development/broad WMA awareness

PPC / Stinger Media Player

MICROSOFT CONFIDENTIAL

6/18/2003

FOR INTERNAL USE ONLY

34

______________________

WW Sales of recorded music fell 6.8% last year

1.6B consumer spend on burners, blank CDs & digital media players

Content sourced through file sharing and ripping v. subscription

-Downloading music is number 1 digital media activity

-Morpheus/Kazaa users >7M v. RealOne ~600K

34

MS-CC-Bu 000000180671

HIGHLY CONFIDENTIAL

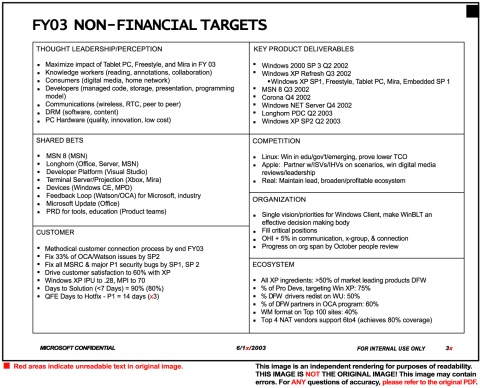

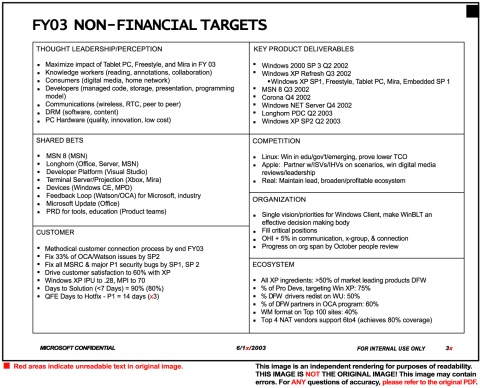

[Graphic: "FY03 Non-Financial Targets" goes here]

______________________

FY03 NON-FINANCIAL TARGETS

[top left rectangle]

THOUGHT LEADERSHIP/PERCEPTION

Maximize impact of Tablet PC, Freestyle, and Mira in FY 03

Knowledge workers (reading, annotations, collaboration)

Consumers (digital media, home network)

Developers (managed code, storage, presentation, programming model)

Communications (wireless, RTC, peer to peer)

DRM (software, content)

PC Hardware (quality, innovation, low cost)

[middle left rectangle]

SHARED BETS

MSN 8 (MSN)

Longhorn (Office, Server, MSN)

Developer Platform (Visual Studio)

Terminal Server/Projection (Xbox, Mira)

Devices (Windows CE, MPD)

Feedback Loop (Watson/OCA) for Microsoft, industry

Microsoft Update (Office)

-PRD for tools, education (Product teams)

[bottom left rectangle]

CUSTOMER

Methodical customer connection process by end FY03

Fix 33% of OCA/Watson issues by SP2

Fix all MSRC & major P1 security bugs by SP1, SP 2

Drive customer satisfaction to 60% with XP

Windows XP IPU to .28, MPI to 70

Days to Solution (<7 Days) = 90% (80%)

QFE Days to Hotfix - P1 = 14 days (43)

[top right rectangle]

KEY PRODUCT DELIVERABLES

Windows 2000 SP 3 Q2 2002

Windows XP Refresh Q3 2002

Windows XP SP1, Freestyle, Tablet PC, Mira, Embedded SP 1

MSN 8 Q3 2002

Corona Q4 2002

Windows NET Server Q4 2002

Longhorn PDC Q2 2003

Windows XP SP2 Q2 2003

[top-middle right rectangle]

COMPETITION

Linux: Win in edu/gov't/emerging, prove lower TCO

Apple: Partner w/ISVs/IHVs on scenarios, win digital media reviews/leadership

Real: Maintain lead, broader/profitable ecosystem

[lower-middle right rectangle]

ORGANIZATION

Single vision/priorities for Windows Client, make WinBLT an effective decision making body

Fill critical positions

OHI + 5% in communication, x-group, & connection

Progress on org span by Oct people review

[bottom right rectangle]

ECOSYSTEM

All XP ingredients: >50% of market leading products DFW

% of Pro Devs, targeting Win XP: 75%

% of DFW drivers redist on WU: 50%

% of DFW partners in OCA program: 60%

WM format on Top 100 sites: 40%

Top 4 NAT vendors support 6to4 (achieves 80% coverage)

MICROSOFT CONFIDENTIAL

6/18/2003

FOR INTERNAL USE ONLY

35

______________________

Guidelines

Purpose: Highlight the non-financial performance metrics/goals your business will be measuring in FY03. Assume that these metrics will be reviewed at the mid-year Scorecard Review next year.

Instructions:

*Here are some ideas of things to include:

- Thought Leadership

*Shared Bets

- What investments are you making in support of key cross-company initiatives?

- What will you deliver in the current fiscal year?

*Key Product Deliverables

- Major product milestones/launches/important feature/product deliverables in FY03

- Product shipment dates

- PSS/QFE response/service level commitments

- Key trustworthy metrics (security, availability, privacy)

- If acquisitions are a part of this process please discuss

*Customer Goals

- Customer/product satisfaction goals

- Support for communities

- Important flagship customer situations

*Organizational Goals

- OHI, People goals and initiatives

35

MS-CC-Bu 000000180672

HIGHLY CONFIDENTIAL

[Graphic: "FY01-FY05 Windows Client P&L" goes here]

36

MS-CC-Bu 000000180673

HIGHLY CONFIDENTIAL

[Graphic: "FY 03 Imperatives" goes here]

[Contents of "FY 03 Imperatives" graphic as text:

************************************]

FY 03 IMPERATIVES

* Drive Revenue & XP Excitement

- Promote XP Software, Establish Products, Push to Professional+, Win Emerging

* Turn the corner on Longhorn

- Builds, alignment, execution

* Earn the Trust of Our Customers, Partners, & Government

- Community, closing the loop, compliance with SRPFJ

* Win against Linux

- Government, education, emerging

* Invest in the Ecosystem

- Metrics, roadmap, leadership

* Develop People & Organization

- Hires, communication, cross group, manager span, training

Challenges & Discussion

* Winning Against Linux: government, education, enterprise, embedded

* SRPFJ: OEMs hiding our innovations; Work to deliver, & comply

* Dry spell coming in FY04 - revenue, annuity, competition

* Emerging markets plan - Linux, other OSs, and piracy: ideas welcome

* Improving sick ecosystem - quality, innovation, profit

* Product segmentation - how many "premiums"?

* Finding the right balance on legacy support

* Making customer trust/connection a part of the culture

* Piracy: How to make progress (and yet balance with Linux)

MICROSOFT CONFIDENTIAL

6/18/2003

FOR INTERNAL USE ONLY 37

[************************************]

37

MS-CC-Bu 000000180674

HIGHLY CONFIDENTIAL

________________________________________________

Credit: wallclimber

Comments

twitter

2009-07-15 19:16:47

Fortunately for everyone but M$, most of these plans and pushes have come to nothing. Customers don't want digital restrictions and loathe the broken restrictions M$ provides more than the rest.

Roy Schestowitz

2009-07-15 19:19:55

Microsoft planning to use media patents against GNU/Linux

David Gerard

2009-07-15 16:17:50

cies

2009-07-16 04:58:12

a top priority, but not a single bit about how they'd like to accomplish that. linux (and the freesoftware movement as a whole) is not an entity you can win from. it's not a business, a person, a country... it's virtual, it's more like a ghost.

i wonder how they'd like to win, the patent gun (another ghost-realm thing) is the only weapon they have left. and that one's crumbling already.

im looking forward to the day that they present a spreadsheet+chart showing that maintaining windows is simply to expensive for them. that they therefor will opensource it, or move over to linux.

office is a product that (i believe) people actually _want_, in contrast to windows that people are basically forced to use. i think there is room for office on various platforms. but the times of m$ monopoly are coming to an end.

sorry ballmer.

(i wrote this from novell's opensuse, running kde (no mono!), i think its quite a brilliant product they produce on a loss)