The higher the volume of granted patents, the larger cash pool available to be divvied up between the EPO and its contracting states.

In the preceding parts we looked at the EPO’s "grant bubble" which commenced with Benoît Battistelli’s "unprecedented surge" of 2016 and we saw how this "bubble" has started to deflate over the course of the last two years.

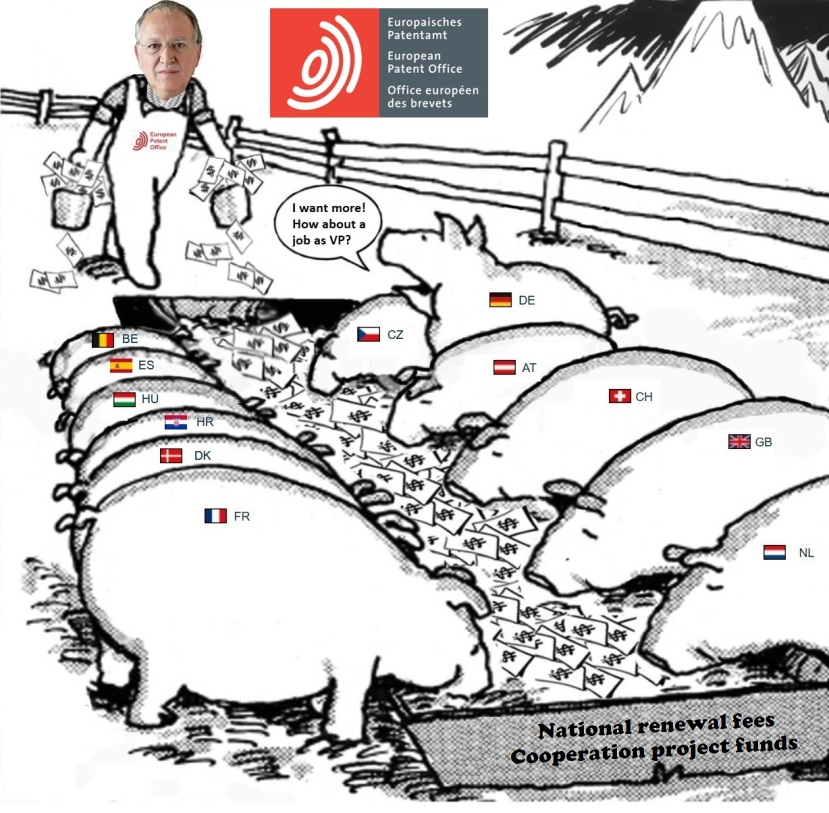

"The essential point to be grasped here is that every granted European patent application generates "national renewal fees" (NRFs) in all of the designated EPO contracting states during the time that it is maintained in force by its proprietor."Those who are inside EPOnia’s "golden circle" have a "vested interest" in propping up the bubble in order to safeguard the lucrative cash flow from the legendary “Dukatenesel”.

The essential point to be grasped here is that every granted European patent application generates "national renewal fees" (NRFs) in all of the designated EPO contracting states during the time that it is maintained in force by its proprietor.

The NRFs generated by these patents are shared between the contracting states and the EPO in accordance with Article 39 EPC (warning: epo.org link). The current split is takes place on 50-50 basis.

Article 39 EPC foresees that the EPO could be awarded as much as 75% of the overall NRF revenue - subject to the Administrative Council agreeing to a change in the distribution ratio.

"In any event, the bottom line here is clear: the higher the volume of granted patents, the larger the cash pool available to be divvied up between the EPO and its contracting states."However, in practice, an increase of the EPO’s NRF dividend is unlikely to be approved by the Administrative Council because the contracting states jealously guard their own share of the loot. If anything, they would prefer to increase this and reduce the EPO’s slice of the cake if only they could find a plausible pretext for doing so.

In any event, the bottom line here is clear: the higher the volume of granted patents, the larger the cash pool available to be divvied up between the EPO and its contracting states.

An increased grant rate at the EPO boosts the revenue of the national patent offices of the contracting states. All of these national offices are financed predominantly by NRFs from granted European Patents.

As an illustrative example, let us briefly consider what this implies in the case of one of the EPO’s most significant contracting states, Germany.

"All of these national offices are financed predominantly by NRFs from granted European Patents."Back in 2014, Germany’s estimated NRF revenue share was € 149 million.

By 2021 this amount had risen to € 211 million, an increase of around 40% compared to 2014.

To put these figures into perspective, in 2021 the total expenditure of the German Patent and Trademark Office (DPMA) was € 248,5 million and it recorded an operating profit of € 214,7 million which was transferred to the federal treasury.

In other words, the revenue accruing to the DPMA from granted European patents in 2021 (€ 211 million) was sufficient to cover about 85% of its expenditure.

This portion of the DPMA’s revenue was also more or less equivalent to its reported operating profit (€ 214,7 million) which was transferred to the federal treasury.

"In other words, the revenue accruing to the DPMA from granted European patents in 2021 (€ 211 million) was sufficient to cover about 85% of its expenditure."No wonder that the German delegation on the EPO Administrative Council was such an enthusiatic supporter and "enabler" of Battistelli’s "reforms" at the EPO!

The EPO for its part receives a 50% share of the total NRF revenue generated in its contracting states.

This means that an increased grant rate also bolsters the EPO’s own internal "slush fund" for keeping delegates from the smaller contracting states "onside" by means of EPO-financed co-operation projects.

In view of these circumstances it should come as no surprise that the ongoing deflation of Battistelli’s "grant bubble" is a cause for concern in some quarters. We shall look into this in more detail in the next part. ⬆