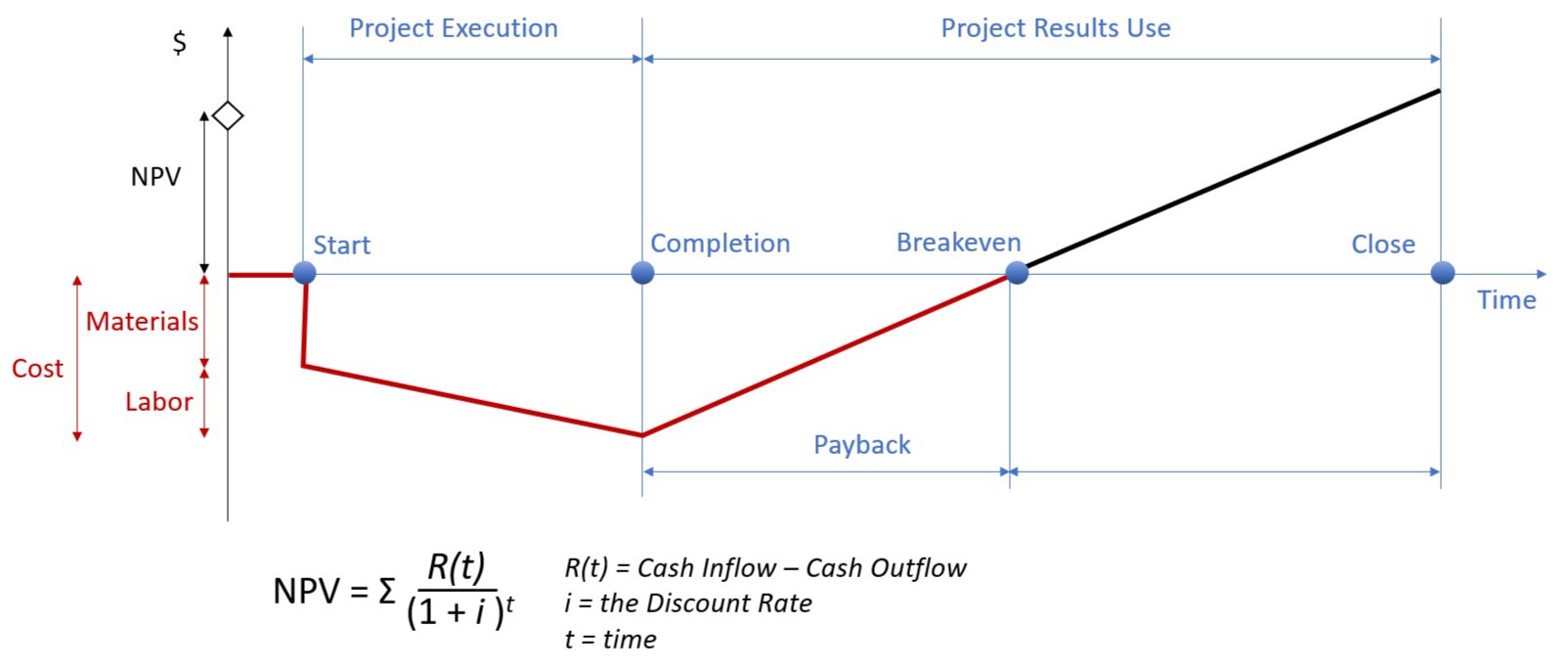

New lines of business are seldom profitable out of the gate. Some take years to€ break even€ and cloud solutions are not exceptions to this. Although Amazon was able to extend its existing infrastructure to its customers with AWS which kept their break-even to a minimum, others such as Microsoft were not equipped to do the same with Azure and had to break new ground to meet would-be demand. As a result, Microsoft incurred substantial infrastructure and development burdens which dramatically extended Azure’s break-even to 5+ years.

However, Microsoft wasn’t only tasked with having to build out or lease new data center space to meet this demand. They also had to consider future demand and capacity restraints since it takes approximately 3 years to develop an enterprise-class data center beginning to end that meets today’s stringent compliance requirements. Although leasing space allows them to get up and running faster than building new, 9 months on average, it creates another man in the middle which eats away at precious margin and does not accrue equity over time, unlike the property that they own.

If Microsoft undershot on these projections and didn’t build enough data centers, then they’d have to lease out additional space and extend their break-even. But if they overshot, then they stood to lose margin building unnecessary data centers which would take years to offset while also extending their break-even just the same. Needless to say, even a small oversight on this tight rip could prove to be anywhere from profit prohibitive to completely self-defeating.

To do this successfully, Microsoft had to hit a moving target while being in motion themsef. Not only did they have to build out new data centers, they also had to build them in accommodation with hardware that didn’t exist yet in an effort to maximize efficiency and profit. Since server technology is constantly evolving to do more with less of a footprint as time goes on, Microsoft would be able to leverage newer iterations of their old servers to a great benefit. They naturally would be denser with memory and processor cores while reducing their footprint as time goes on. But that understanding alone wasn’t enough and Microsoft needed to know how much space they would need to achieve these efficiency gains.

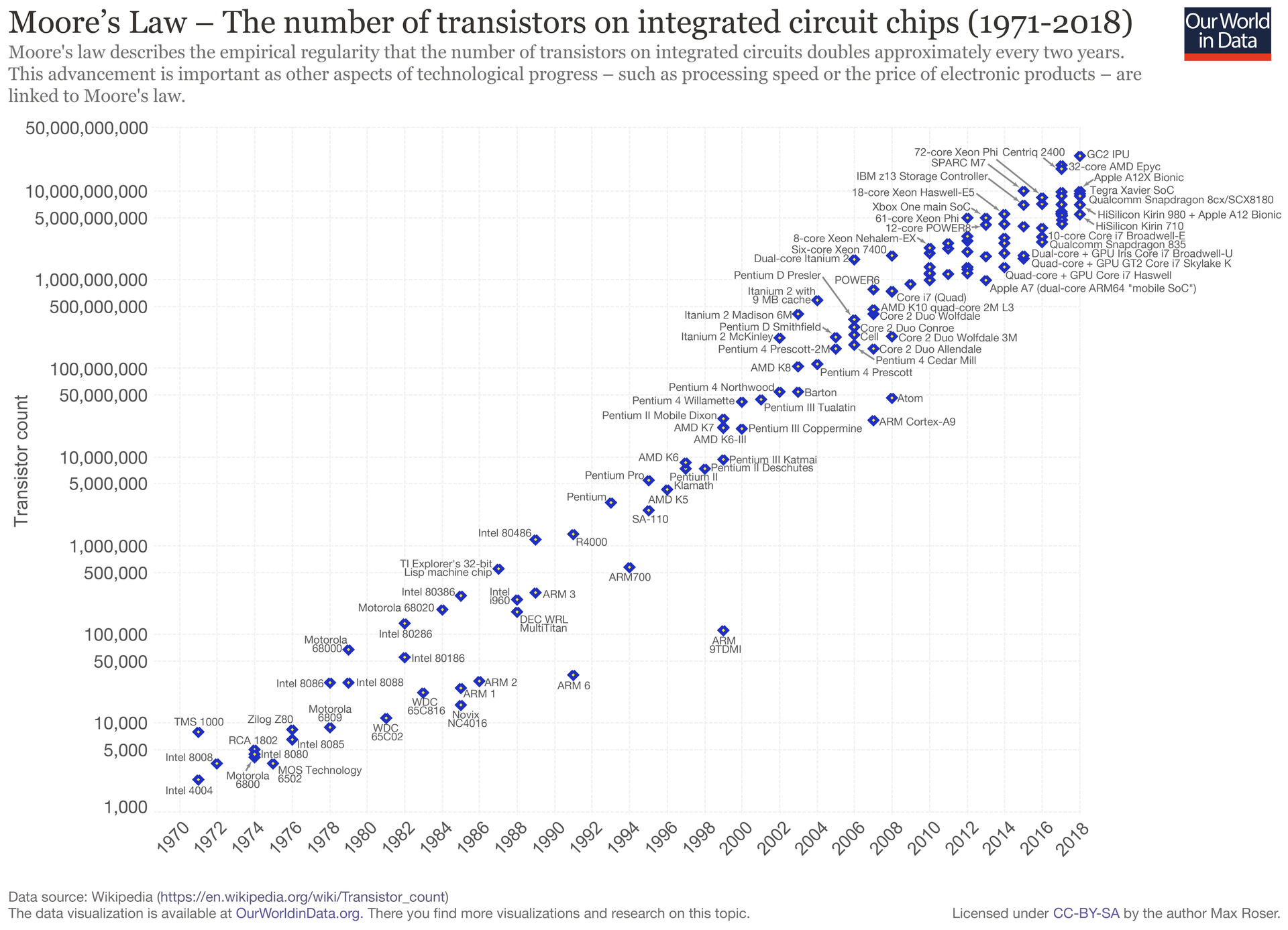

In order to anticipate future core density and project the efficiency gains associated with them, Microsoft and presumably others banked on€ Moore’s Law€ in 2012 which predicted transistor and core density to double every two years. As such, Microsoft projected how core-dense racks of servers could be 2–4–6–8 years in advance just as they have done successfully in the past. While a single 1x20 rack of servers could provide Microsoft with 10,400 cores to sell on Azure in 2012, Moore’s Law projected that this same amount of rack space would be able to host 20,800 cores by 2014, 41,600 cores by 2016, 83,200 cores by 2018, and 166,400 cores in 2020 (roughly). But this did not happen.

Processor improvements were already stagnating by 2012 which continued midway through the decade and the predictions made by Moore’s Law were falling short with no end to this on the horizon. Many were beginning to€ realize€ that it wasn’t a law at all, but an observation instead. While racks of servers became more dense over time, they indeed achieved greater efficiency with regard to their energy burden and their reduced footprint but this was nowhere near the rate predicted by Moore’s Law. Consequently, where Microsoft was anticipating being able to host 83,200 sellable cores in a 1x20 rack in 2018, they were only able to host roughly 28,000 cores, less than 1/3 of their projections.

As a result of undershooting their projected capacity by such a large margin, Microsoft was way off on their capacity projections with Azure and only built roughly 1/3 of the data center capacity that was actually necessary. Consequently, they had to over-provision their existing data centers to the point of tripping the breakers and rapidly fill the gaps with an excessive amount of leased space to meet the demand that they projected. All of which effectively doubled the amount of leased space in their portfolio from 25% to 50%, extended their break-even to nearly a decade, and killed their hopes of profitability any time soon.

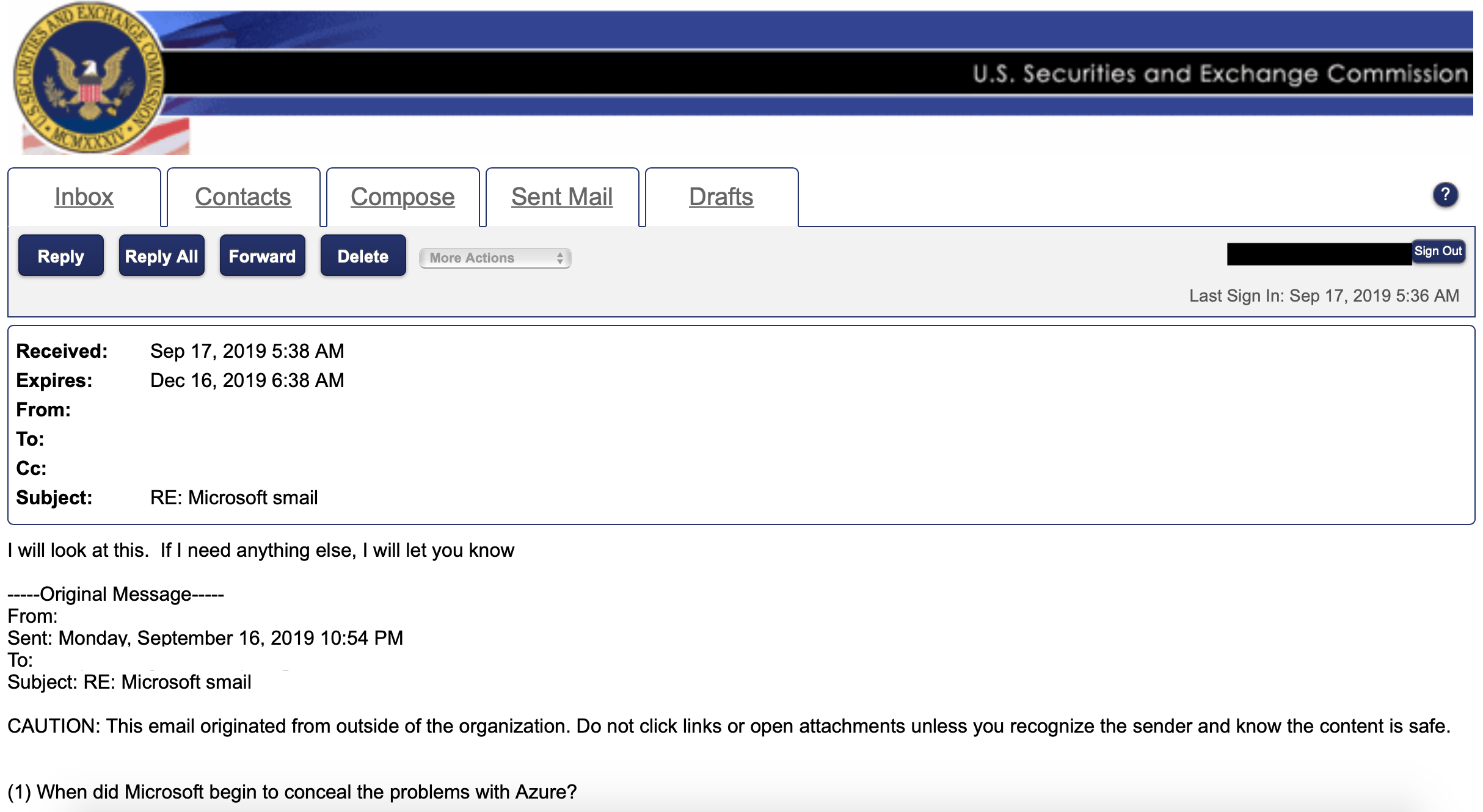

While an honest mistake and not being able to foresee the future is forgivable, knowingly omitting a mistake of this magnitude is criminal when considering how much Microsoft is hedging its future on Azure. On top of supplying€ misleading revenue metrics€ in their quarterly 10K filings to fortify a position of strength and being second only to AWS, Microsoft seems to be wary about reporting Azure’s individual performance metrics or news of these failings that would enable investors to conclude this for themselves. Instead, Microsoft appears to be averaging out Azure’s losses with their legacy mainstays that are profitable by reporting its revenue within their Intelligent Cloud container instead of itemizing it.

Their incentive for hiding such a failure is obvious since much of their future is hedged on Azure. If it was proven to be woefully inefficient and unprofitable, then clients would expect price hikes and an influx of hidden costs on the horizon along with the potential burden of having to migrate away prematurely. Hosting services on an inefficient platform also puts companies at a tactical disadvantage in comparison to those hosting their services on more efficient platforms. That said, I can see why Microsoft would prefer to keep this quiet and why Amazon isn’t in tears when their competition opts to host their workloads on Azure instead of AWS.

Between these capacity failings and its embarrassing€ ARPA€ relative to AWS, it’s difficult to see how Azure could be profitable at the moment. Microsoft seems to be attempting to bury this by omitting statistics while relying on financial containers that serve no purpose other than being a means of deception. Whether this is lying by omission and misleading investors on matters regarding major mistakes that threaten the long-term viability of their investment or simply creative accounting practices at work is ultimately up to the SEC. As an engineer, I can only report my findings to them and offer speculation to the three people reading my blog; done and done.