The Finances of GAFAM Aren't as They Seem

Best performers? Best cheaters? Best bailout? Where's the canary?

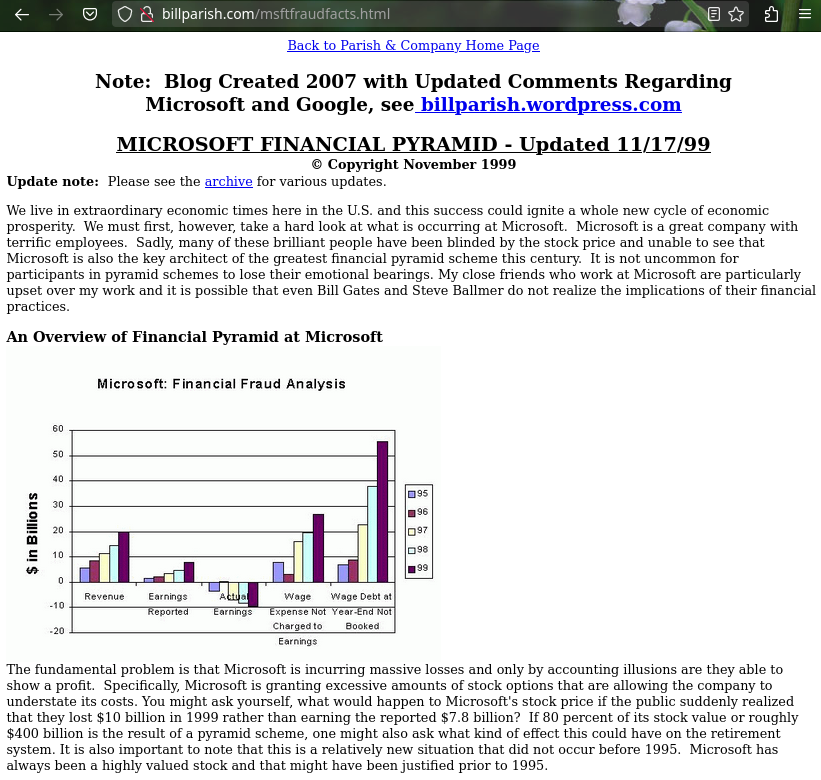

"MICROSOFT FINANCIAL PYRAMID" revisited.

"Microsoft, the world’s most valuable company, declared a profit of $4.5 billion in 1998; when the cost of options awarded that year, plus the change in the value of outstanding options, is deducted, the firm made a loss of $18 billion, according to Smithers."

A valued reader wrote to us regarding Microsoft's financial situation (there's massive debt that's still growing fast). It remains a critical topic (likely to attract SLAPPs; Microsoft did target Bill Parish for publishing the above, trying to deplatform him), which we commented on in recent days, sometimes in response to alleged leaks about a gigantic next wave of Microsoft layoffs [1, 2] (around 30,000 layoffs this year alone, not counting contractors or parallel workforces).

The reader spoke of the "Goose that lays golden eggs" (or "The Goose that Laid the Golden Eggs" - there are variations in translations). The reader said: "Suppose I have a keen eye for geese with unusual qualities. I spot a gosling with certain features, purchase it from its owner, give it the right care and food and watch it grow into a goose that lays golden eggs."

"If I could do that, I'd be rich."

Now think of what Skype became or what happened to it last week. Days ago we pointed out that traffic to GitHub was down, traffic to LinkedIn was down, and even Microsoft.com saw a decrease in traffic (other than LLM slop). Not many people still remember that Minecraft exists and both LinkedIn and GitHub have had several large waves of mass layoffs; even entire offices shut down for good. It didn't go well. From a financial perspective, they're like YouTube. Yes, revenue exists, but not profits.

The reader said: "In the past Microsoft did something like that. When IBM launched their personal computer in 1981, Microsoft provided the OS. At that time Microsoft's main products were language interpreters (mostly BASIC.) Microsoft purchased the base of the OS (=the gosling) from another company. MS-DOS (originally IBM-PC-DOS) became a lucrative product (=the goose that lays golden eggs) and made a fortune for Microsoft and its founder Gates."

That's based on the Microsoft-edited Wikipedia, which has a severe revisionism problem.

"Let me first check if this is accurate history of IBM and Microsoft," I told the reader. Associates checked and said: "I think the topic to look up is 'illegal, per-processor fees' in relation to IBM and Microsoft" (Microsoft didn't have a better product, it just cheated as usual).

"I don't understand how Microsoft's recent purchases are helping its finances," the reader said. "It's like buying a goose only to discover that it lays but few eggs while consuming much corn. The new owner loses money this way."

We've been saying this for a long time. The above are just a few examples among so much more: Hotmail, Danger, FAST...

The cost of buying a userbase from another company can be very high and sooner or later you fall deep into debt. Worse yet, the longer you keep this newly-purchased userbase, the more money you will lose. Then you start doing utterly illegal things in pursuit of money.

The reader asked: "Is there some clever way to use the hungry goose that lays few eggs to make farm accounts look better?"

Yes, it's called cooking the books [1, 2], e.g. reclassifying things to make a mere illusion of growth (where none exists or there is actually degrowth). Think of servers becoming "the clown" and then "hey hi workloads". Cannibalisation does not count.

"I don't understand this well. Can you explain?"

Many people who "invest" their money ask similar questions because they're sceptical of "endless growth" claims from companies that clearly have difficulties (with visible symptoms such as mass layoffs).

"The following two books are well known," the reader said. "If you have read either of them and you disagree with what they say you should make public your view."

"Bill Gates and the Making of the Microsoft Empire by James Wallace, Jim Erickson. Biography of Gates. I felt it was quite critical of him."

"Accidental Empires: How the Boys of Silicon Valley Make Their Millions, Battle Foreign Competition, and Still Can't Get a Date by Robert X. Cringely" (it was "First published January 1, 1992")

"A report of the PC industry by a writer of the industry's first trade journal."

"IIRC," an associate said, "Cringley wrote quite well but stopped kind of suddenly."

He's not young anymore and his capacity to write (even in his own blog) declined greatly about a decade ago. He had, prior to that, correctly predicted (based on sources) what would happen to IBM.

His last blog post was two years ago:

Apple has since then had a massive problem with the tariffs because the vast majority of its expensive products come from China. In its last report it still speaks of pre-tariffs sales or presales (preorders) or people hoarding things before the price increases "kick in" (post-tariffs). Air-lifting over a million products from India (where the manufacturing quality isn't up to speed/par) is only a temporary measure.

The truth of the matter is, GAFAM and IBM are in mud and the more they move, the deeper they sink (quicksand). Amazon, seeing the loss of AWS lustre, is trying to reinvent itself as an ISP now. █