A YEAR and a half ago we took note of the "hoax" EPO so-called 'study' commissioned by Team Campinos only months after Benoît Battistelli had robbed the Office (his friend at the Commission covers up for him, not just the person he left in charge of the EPO). What on Earth is going on here?! How can they get away with it? Politics and career politicians have devoured an institution that was supposed to be scientific (and originally was).

"How can they get away with it?"We've already published part 4's text, but parts 1-3 have not been reproduced here, until today (seeing that talks broke down regardless; Campinos really sucks at negotiations). The staff representatives called part 4 a "[r]ecap and what about an effort by the Office?"

The series was composed by multiple authors. "As already stated in our first publications [...] on this matter," they said, "in the EPO financial studies tend to be a prelude to cuts in staff benefits. The latest financial study is no exception. Our previous publications showed that the study grossly underestimates expected fee income as well as expected income from cash reserves as well as overestimates staff costs."

It was in the middle of June last year that they published it. "The present paper provides a recap," they noted, "and asks: What about an effort by the Office?"

It was in the middle of June last year that they published it. "The present paper provides a recap," they noted, "and asks: What about an effort by the Office?"

It's probably worthwhile to not only share this recap but also publish the gory details predating this recap. Back in May they said something similar to the above: "In the EPO, financial studies tend to be a prelude to cuts in staff benefits. The latest study is no exception. The present publication explains one of the tricks used to make the Office look poor. More publications will follow. The recently published financial study by Mercer and Oliver Wyman seems to indicate that more bad news is to come."

Some key parts:

The studies’ conclusions...

The key message of the financial study (p 34) is: “The EPO faces a structural operational gap, with costs increasing faster than revenues, leading in the future to significantly decreasing cash flows.

The EPO has greater control of cost levers than revenue levers which presents an opportunity to better meet its future obligations through careful cost management.“ In other words: the Office must be reducing costs – staff costs.

… and how they came about

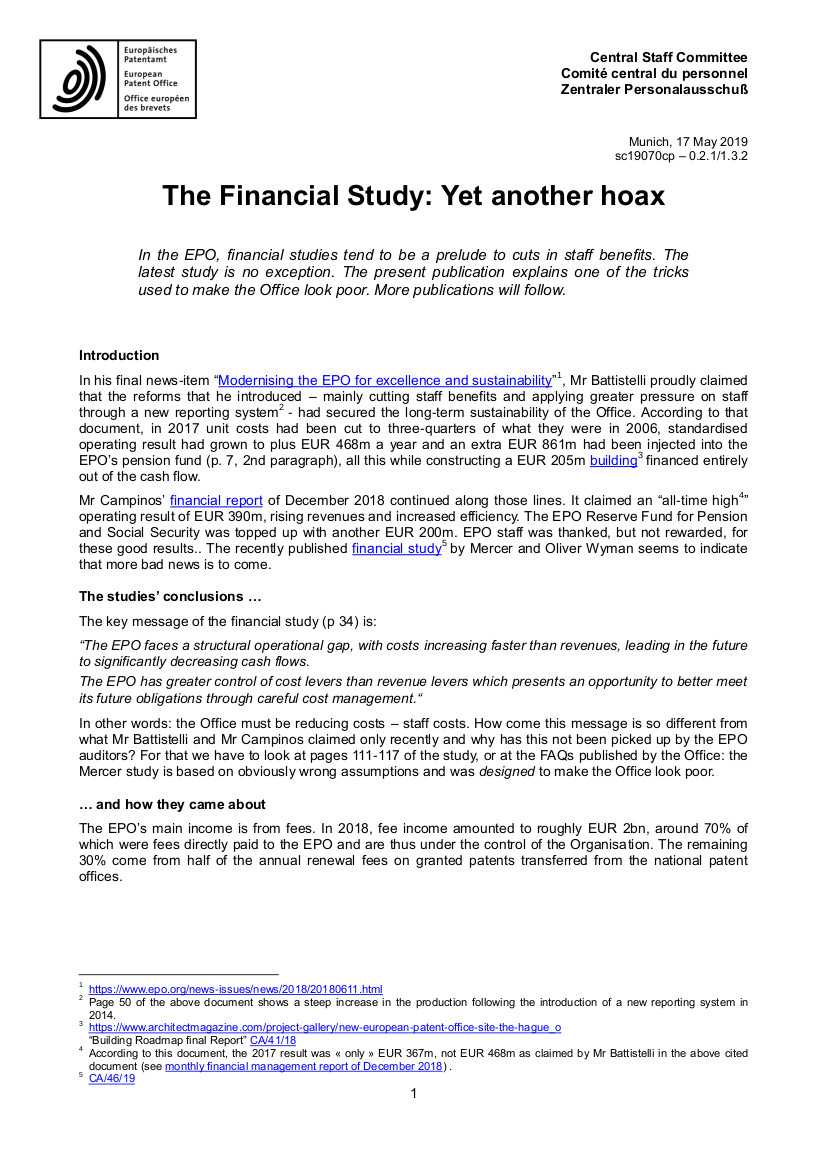

The EPO’s main income is from fees. The Financial Study includes a 4% fee increase for 2020 but assumes that there will be no further fee increases from then on till 2038. On the other hand Staff salaries and pensions follow the normal increase. For any organisation - as rich as it may be - such an approach will lead in the end to budgetary gaps. According to our first calculations the alleged gaps could be offset by merely continuing the biennial 5% fee adjustments in place.

Part 2: The income from cash reserves is deliberately underestimated

Dear colleagues,

As already stated in our first publication on this matter, in the EPO financial studies tend to be a prelude to cuts in staff benefits. The latest financial study is no exception. Our previous publication explained how the study’s unrealistic assumptions artificially create a gap between fee income and salaries.

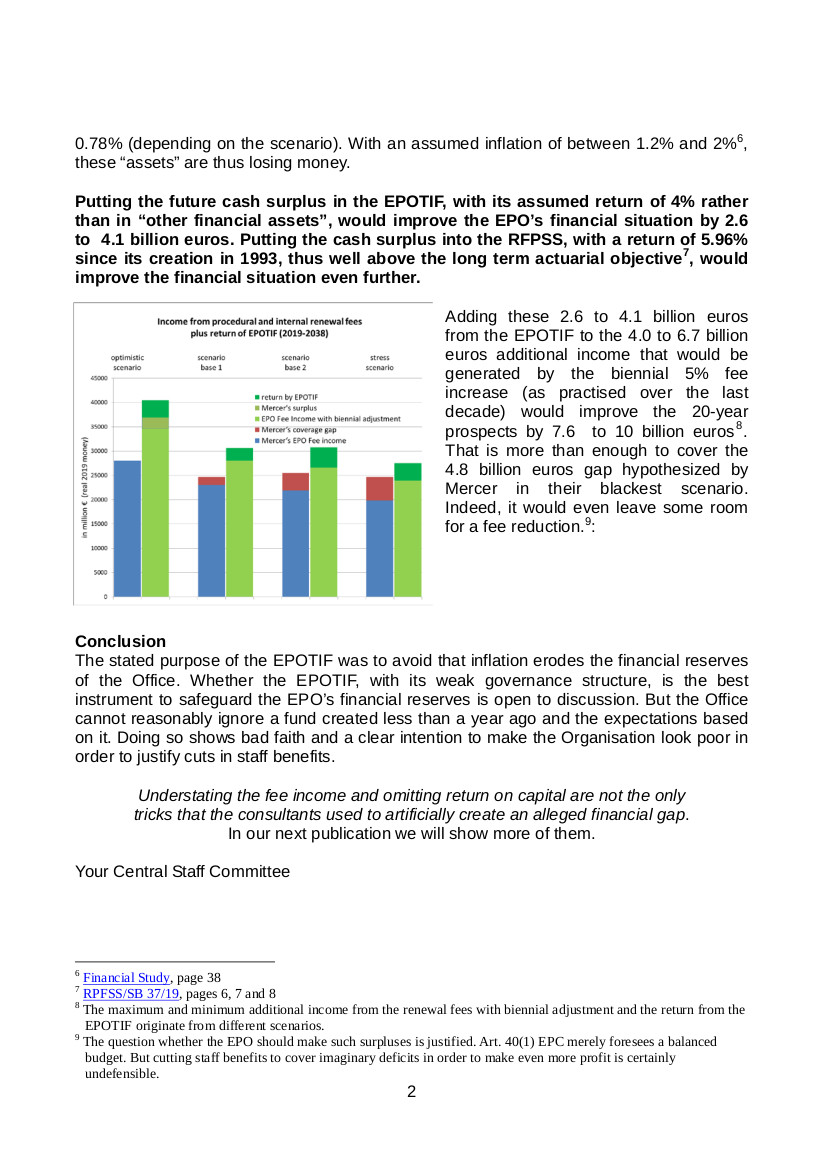

The present paper shows how the income from cash reserves is deliberately underestimated.

Part 3: The study overestimates expenditure – more specifically, staff costs

Dear colleagues,

As already stated in our first publications part 1 and part 2 on this matter, in the EPO financial studies tend to be a prelude to cuts in staff benefits. The latest financial study is no exception. Our previous publications showed that the study grossly underestimates expected fee income as well as expected income from cash reserves.

The present paper shows how it overestimates staff costs.