"In later parts we'll detail (with some evidence) the role played by the press, keeping these scandals under wraps by falsely assuming that women are liars and accused men need to be protected from embarrassment.""I don't want to get involved" is not a legitimate excuse (direct quote by the way). If more information becomes available, we'll also add some parts about the new CEO and what the past teaches us about the CEO's future direction at GitHub, which is more like a trap than "free hosting". As always, we encourage people to leave GitHub. The sooner, the safer. Make exit plans.

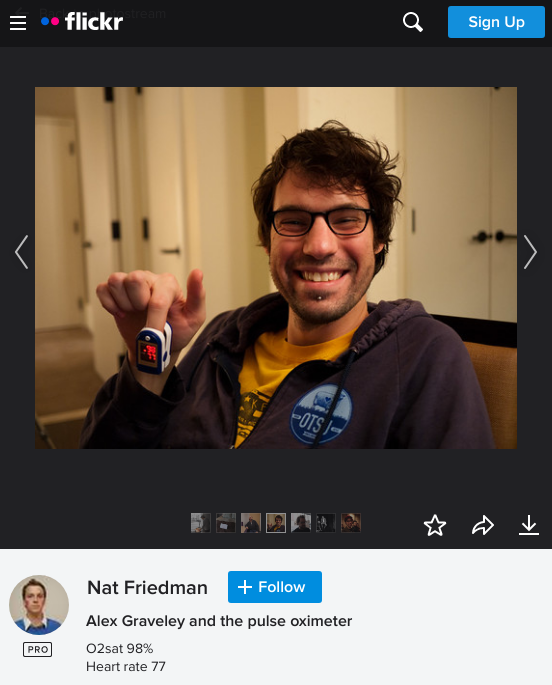

Nat Friedman should have known better, especially considering his father's work. Friedman surely knew how this law works (he could ask dad), but he chose to ignore it; he got greedy (which wasn't needed; he was very rich to begin with, even well before Microsoft). To put this in the correct context we'll need to introduce readers, perhaps belatedly, to Friedman's good friend, whom he used to get very badly drunk with (substance abuse will be the subject of much later parts in this series). The friend's name is Alex and they're pretty close. From their very own (still online) record:

There's more, but some of it is so old that it's difficult if not impossible to find now. This pair goes well over a decade back.

We did not want to bring up Alex Graveley (or mention him by name), but that's essential for those wishing to understand what's going on. Or his current job title at Microsoft.

According to our source, Alex Graveley and Nat Friedman made a 'pinky promise'; "he also said that the original plan for Copilot was Alex would start a company and work with Nat behind the scenes to build it to get acquired by Github, which sounds like securities fraud, but I'm not a lawyer..."

"So it seems like Friedman set him up for richness; but at whose expense?"Graveley and Friedman know who the source is, but that does not matter.

So it seems like Friedman set him up for richness; but at whose expense? By funnelling Microsoft shareholders' money to a friend he likely breached several ethical rules ("make this company; do this thing; I will tell my bosses (Board and CEO of a company called Microsoft) to make this next move and we'll give you lots of shares").

If he instructs the employer to pay an old mate, that's a very big deal. It makes one wonder what technical merit -- if any -- this thing has. It was acquired by means of nepotism, not really pragmatic interest, then hyped up in the media even though it's worthless as a tool (some people have demonstrated this point). At Microsoft, they use that to push proprietary IDE (Visual Studio) and teach people not to worry about GPL compliance.

As our source stresses strongly, and more so repeatedly: "The original plan was to have Alex build it as a start up. And then Microsoft would acquire it. Which sounds a bit like fraud."

"If he instructs the employer to pay an old mate, that's a very big deal."Well, that sounds illegal because it is. He's playing with money that isn't his own; he's passing Microsoft shareholders' capital to a friend, and maybe he can then get kickbacks off of him (one can only guess how the favour can be repaid).

Our source says that "this never happened, even if it was contemplated, [as] Alex was not in any place mentally to do this..." (based on texts, he had booze issues if not other, far more severe issues with heavy narcotics -- a subject we set aside for later parts)

The Microsoft modus operandi has long been to attack Free software while giving the false impression that Microsoft means well and is a friend, a "co-pilot". Don't fall for it...

Securities fraud was in the books.

Wikipedia defines the term as follows: "Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information, frequently resulting in losses, in violation of securities laws.

"...shareholders ought to know that they may have paid -- or fallen -- for a weak or defective product, merely for the benefit of the CEO's friend."It further notes: "Securities fraud can also include outright theft from investors (embezzlement by stockbrokers), stock manipulation, misstatements on a public company's financial reports, and lying to corporate auditors. The term encompasses a wide range of other actions, including insider trading, front running and other illegal acts on the trading floor of a stock or commodity exchange."

Assuming the above was true, as was heard directly by our source, Friedman sought to divert Microsoft shareholders' money to a friend. Friend-man? Either way, shareholders ought to know that they may have paid -- or fallen -- for a weak or defective product, merely for the benefit of the CEO's friend. This isn't even the sole case of nepotism -- a point we shall discuss later. ⬆