Graph of IBM's Debt Helps Shed Light on the Red Hat Squeeze

- Dr. Roy Schestowitz

- 2023-07-10 13:52:25 UTC

- Modified: 2023-07-10 13:52:25 UTC

Let's see how IBM is doing

at the bank by examining debt. The following are deficits and totals (running sums), not savings.

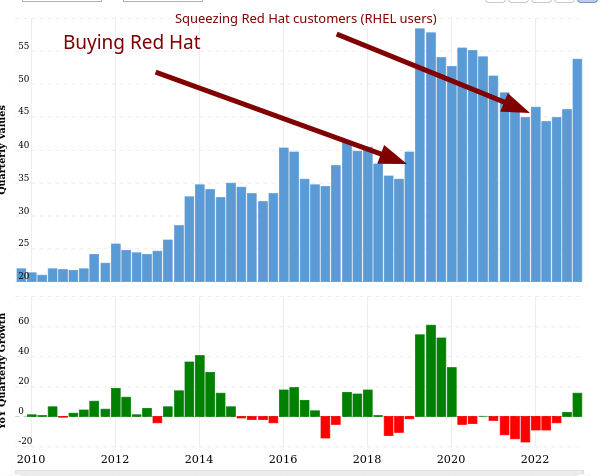

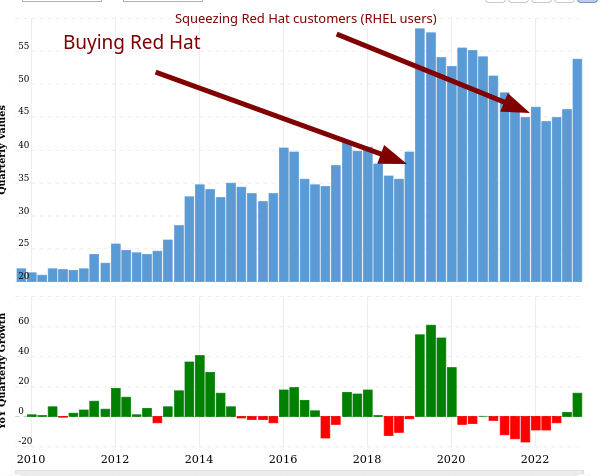

Long Term Debt ($53.826 billion in March):

Buying Red Hat was like paying for a 'trophy' while burying the "legacy" parts (Kyndryl) and selling some to China (Lenovo). Notice how debt grew.

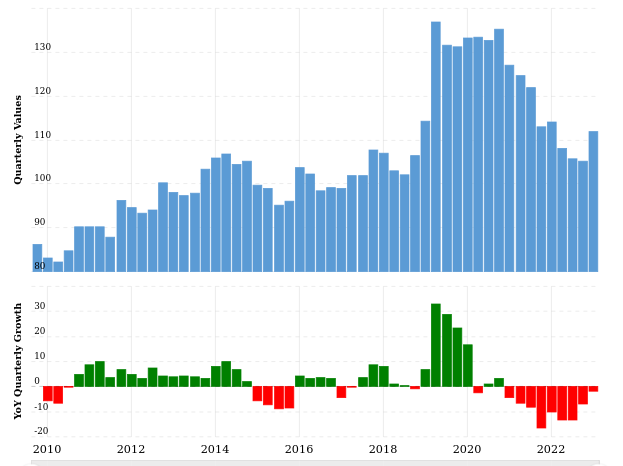

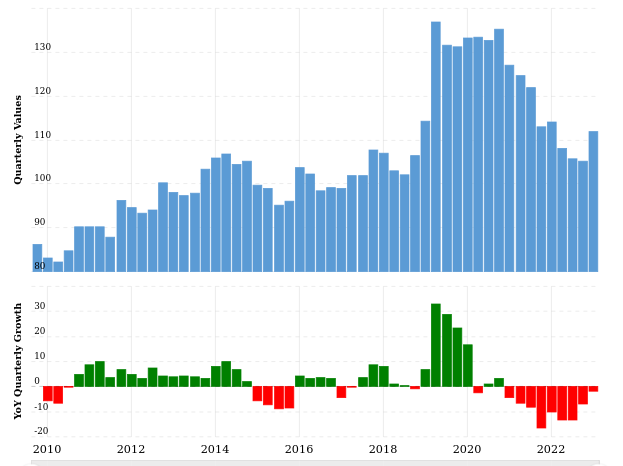

Total Liabilities ($111.964 billion in March):

These are liabilities. Squeezing Red Hat customers (RHEL/CentOS users) for money is classic IBM, being a company that -- despite many people forgetting it or not knowing it -- extorts clients through lawyers.

Summary: The media does not often talk about the debt of the dying giant. IBM's total liabilities for the quarter ending March 31, 2023 were $111.964 billion and long term debt for the same quarter was $53.826 billion. Like many other companies, IBM is buying back its own shares, faking stability and "growth". IBM has not been a 'household name" or even prominent in business for nearly two decades already, so its contemporary existence is largely speculative and the company still makes a lot of its revenue by (software) patent blackmail, using patents that last 20 years.