IBM's Accounting Claims Don't Add Up

A rather bizarre, mystifying new thread was posted less than an hour ago by an apparent victim of the "silent layoffs": (same in Kyndryl)

That is strange, isn't it?

Does IBM have very serious financial problems? PIPs are used to skirt severance obligations, and moreover we showed claims that HR was trying to deny money dismissed people were fully entitled to.

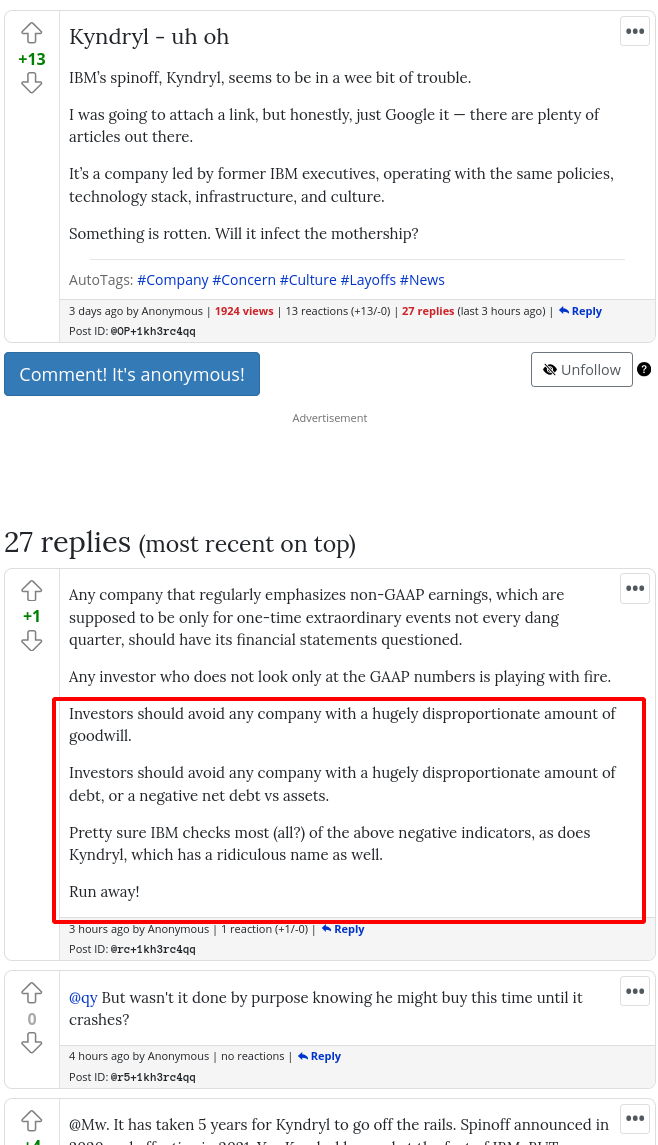

Meanwhile there's this other new comments which makes the case for accounting fraud at IBM. It does mention the odd "goodwill" value and the growing debt:

Any company that regularly emphasizes non-GAAP earnings, which are supposed to be only for one-time extraordinary events not every dang quarter, should have its financial statements questioned.Any investor who does not look only at the GAAP numbers is playing with fire.

Investors should avoid any company with a hugely disproportionate amount of goodwill.

Investors should avoid any company with a hugely disproportionate amount of debt, or a negative net debt vs assets.

Pretty sure IBM checks most (all?) of the above negative indicators, as does Kyndryl, which has a ridiculous name as well.

Run away!

Will the SEC ever bother looking into it? Would the US Government rather not even know what's really going on?

IBM is an enigma. To Wall Street is claims to be doing extremely well, but insiders tell the complete opposite. █