It is generally known that the soon-to-depart (to be replaced by António Campinos) EPO "Sun-King" Battistelli sat on the municipal council of St. Germain-en-Laye as Deputy Mayor for culture from 2008 to 2014.

"From 2014 to 2017 he was a delegated councillor in charge of the Théâtre Alexandre Dumas."Battistelli’s official EPO profile (see CV [PDF]) also emphasises that he plays “an active role in public and community life” in France. So it would also be surprising if he was not au fait with the more general problems caused by “toxic loans” in his home country and the risks of speculative gambling with public money in the global casino of the international financial markets.

Against this backdrop it remains a mystery as to why Battistelli in his role as EPO President has been so keen to push for the inclusion of exotic and speculative “financial products”, such as derivative instruments, asset-backed securities (ABS), mortgage-backed securities (MBS) and Credit Default Swaps (CDS), in the provisions of the EPO’s New Investment Guidelines.

It is also something of an enigma as to why the Administrative Council was so quick to rubber-stamp these questionable proposals and to subsequently approve the allocation of the EPO’s whopping cash surplus of around € 2.3 billion to the newly established "treasury investment fund".

According to EPO insiders the sole dissenting voice on the Administrative Council was that of the German delegation which seems to have been the only one of the 38 national delegations to have done its homework properly.

"Against this backdrop it remains a mystery as to why Battistelli in his role as EPO President has been so keen to push for the inclusion of exotic and speculative “financial products”, such as derivative instruments, asset-backed securities (ABS), mortgage-backed securities (MBS) and Credit Default Swaps (CDS), in the provisions of the EPO’s New Investment Guidelines."One might have expected more prudence and “due diligence” from the governing body of such an economically significant pan-European intergovernmental organisation.

However, when we recall that this is basically the same Administrative Council which agreed to the abolition of its own independent Audit Committee at the behest of Battistelli in 2011, then perhaps current events surrounding the New Investment Guidelines and the "treasury investment fund" are not really so surprising.

Defenders of the New Investment Guidelines will undoubtedly point out that the inclusion of exotic and speculative “financial instruments” is limited to 15% of the total investment portfolio.

But to argue like this is to miss the point.

Even if only a subset of the investments within this 15% speculative slice were to turn “toxic” the fallout could be catastrophic. A few “bad apples” have the potential to significantly reduce or even obliterate the return from other more conservative investments. In a worst case scenario if some of the speculative investments were to go "pear-shaped" this could lead to an erosion of the fund's capital.

"According to EPO insiders the sole dissenting voice on the Administrative Council was that of the German delegation which seems to have been the only one of the 38 national delegations to have done its homework properly."Those who try to dismiss such “horror scenarios” by saying that they are unlikely to materialise need look no further than the débacle of SIDRU’s “structured debt products” and the myriad other cases of “toxic loans” which continue to plague municipal councils throughout France.

Another as yet unsolved riddle relating to the EPO’s new "treasury investment fund" concerns its management.

From the comments made by Dr. Thorsten Bausch on the Kluwer Patent Blog in March of this year it seems that the general idea is to have "a diversified portfolio managed by external experts".

Information from EPO sources indicates that a decision has already been approved by the Administrative Council’s Budget and Finance Committee to allocate the EPO’s surplus of around € 2.3 billion to the new fund.

"Information from EPO sources indicates that a decision has already been approved by the Administrative Council’s Budget and Finance Committee to allocate the EPO’s surplus of around € 2.3 billion to the new fund."However, it has not yet been revealed which "external experts" will be entrusted with the management of this impressive cash pile and how their “compensation package” is going to be structured.

Presumably these details will be revealed in due course.

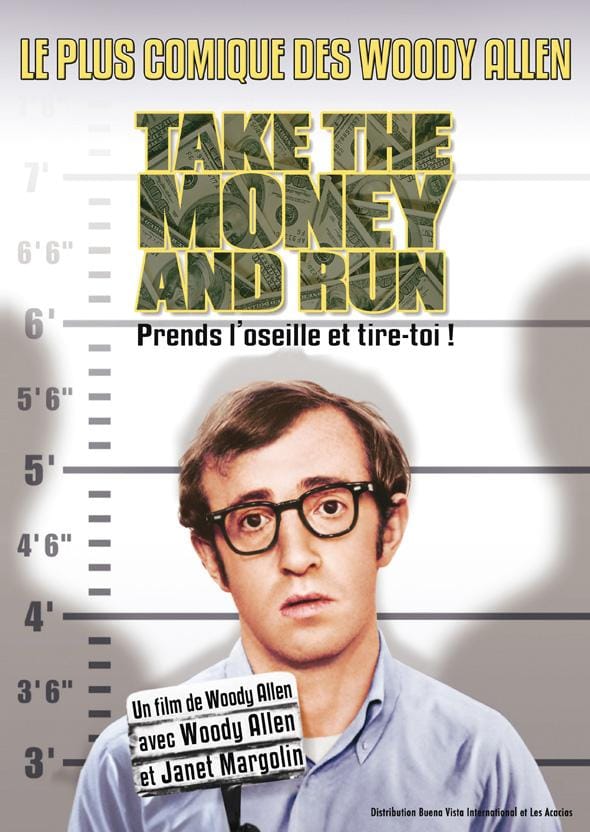

In the meantime let us hope for the sake of all concerned that the persons selected for this task will not be "experts" from the POTT school of investment management who operate according to the motto: "Prends l'oseille et tire-toi!" - "Take the money and run!" ⬆