Summary: The fourth part of the series exploring the debt crisis at Battistelli's town (where he's deputy mayor) in light of the EPO's gambling with financial speculators, potentially adding to the many EPO scandals

Summary: The fourth part of the series exploring the debt crisis at Battistelli's town (where he's deputy mayor) in light of the EPO's gambling with financial speculators, potentially adding to the many EPO scandals

The judgment of the Court of Appeal of Paris in the case of the DEPFA loan in November 2016 did not bring the saga of SIDRU and its "toxic loans" to a close.

A little over a year later in December 2017, the local newspaper La Gazette en Yvelines reported that Lamy’s successor as Chairman of SIDRU, Jean-Frédéric Berçot, had been replaced by Jean-Luc Gris, the Mayor of Gaillon-sur-Montcient and communal delegate for the urban agglomeration of Grand Paris Seine et Oise.

The article is titled Dette du Sidru : le président éjecté, les agglos devront payer [Translation: SIDRU’s debt – chairman dismissed, the urban agglomerations have to pay] and we have made local copies of the text [PDF] and the original [PDF] with a screenshot below (click to 'zoom').

After SIDRU had failed to raise a new loan to pay off the outstanding amounts due on the DEPFA loan, the liabilities were finally taken over by two urban agglomerations of Grand Paris Seine et Oise and Saint Germain Boucles de Seine.

La Gazette en Yvelines also reported that a second "toxic loan" which SIDRU had contracted with the bank Natixis was due to be the subject of a court judgment in 2018.

The expected liabilities for SIDRU in relation to the Natixis loan are estimated to be of the order of € 50 million.

Until all of the pending legal actions are concluded, it is difficult to put a final figure on the total financial fallout from the affair but it is likely to be of the order of at least € 70 million:

€ 20 million from the DEPFA loan and € 50 million from the Natixis loan.

For readers who are unfamiliar with local politics in France it may also be worth mentioning that the case of SIDRU is merely one example of a much more widespread problem which has caused a lot of controversy and unrest at the municipal political level throughout the country.

"During the period 2013-2014, it is estimated that the average rate of interest on these “toxic loans” was around 25%."Over the last decade and a half many communities have been devastated by the predatory financial practices of banks such as Dexia, Deutsche Bank, Calyon (Crédit Agricole), Depfa, Natixis, and Royal Bank of Scotland.

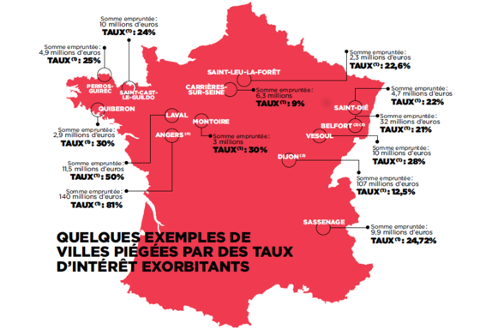

An article published in the French magazine Capital in December 2016 explained how these communities had permitted themselves to be trapped into "toxic loan” contracts with banks and included a map of France showing some of the most noteworthy examples of towns which were suffering under exorbitant interest rates. See “Emprunts toxiques : comment les villes se sont laissé piéger par les banques” [Translation: Toxic loans: how municipalities let themselves be trapped by the banks] with the image below.

Similar to the loans which Lamy contracted on behalf of SIDRU, these "structured debt products" were long-term loan arrangements over periods ranging from ten to thirty years which offered an attractive fixed rate of interest for the first number of years, typically somewhere between 0% and 3% depending on the term of the loan.

But once the "honeymoon period" was over the debtors were thrown to the mercy of global financial markets.

During the period 2013-2014, it is estimated that the average rate of interest on these “toxic loans” was around 25%.

"According to Capital, the bankers involved in pushing these "structured debt products" referred to them internally under the code-name POTT ("Prends l'oseille et tire-toi!") which translates into English as "Take the money and run!""In a number of cases it rose above 50% and in one extreme example in the town of Angers it even reached 81%!

One specific example cited by Capital is the case of the town of Nîmes where an original loan for the amount of € 12.5 million resulted in estimated liabilities for the municipality of € 59 million!

According to Capital, the bankers involved in pushing these "structured debt products" referred to them internally under the code-name POTT ("Prends l'oseille et tire-toi!") which translates into English as "Take the money and run!" ⬆