Following the judgment of the Court of Appeal of Paris which found SIDRU liable for all of the outstanding debts and interest charges on its DEPFA loan, the former SIDRU chairman Emmanuel Lamy was obliged to defend himself at the meeting of the municipal council of St Germain-en-Laye which took place on 16 November 2016.

"Following the judgment of the Court of Appeal of Paris which found SIDRU liable for all of the outstanding debts and interest charges on its DEPFA loan, the former SIDRU chairman Emmanuel Lamy was obliged to defend himself at the meeting of the municipal council of St Germain-en-Laye which took place on 16 November 2016."See "Emprunts toxiques du SIDRU, qui paiera ?" [Translation: "SIDRU's toxic loans, who is going to foot the bill?"]

As for the financial consequences Lamy tried to reassure the taxpayers of St Germain-en-Laye that the financial consequences of Court of Appeal judgment were being discussed by the affected urban agglomerations with a shared will to define "a course of action that would not impact the level of local taxes of the 200,000 inhabitants concerned".

Without providing precise details he indicated that the two urban agglomerations of Grand Paris Seine et Oise (covering 73 municipalities and more than 400 000 inhabitants) and Saint Germain Boucles de Seine (covering 20 municipalities and 340 000 inhabitants) could be relied upon to absorb the fallout from SIDRU's toxic loans (which directly affected 200,000 inhabitants).

"According to a commentary on the affair written by Jean-Claude Merle, a former municipal councillor of the neighbouring municipality Marly-le-Roi, Lamy tried to evade the question of his personal responsibility for the débâcle by referring to the collective responsibility of the 15 municipal councils that are the stakeholders of SIDRU as well as to the roles of other authorities such as the regional Prefect and the regional Chamber of Auditors."The local left-wing opposition group Saint-Germain Autrement, formerly Saint-Germain Gauche Plurielle, has been a longtime and persistent critic of Lamy’s management of SIDRU and his imprudent dabbling in speculative "financial instruments".

As far back as July 2007 the group published a short party political statement in the local Journal de Saint-Germain under the title “Doit-on spéculer avec l’argent public?”.

See below (click to 'zoom' in).

In this statement the group expressed its serious concerns about the speculative nature of the financial contracts concluded by Lamy in his role as chairman of SIDRU and warned of the potential for losses of the order of several millions of Euros for the public purse.

"In this statement the group expressed its serious concerns about the speculative nature of the financial contracts concluded by Lamy in his role as chairman of SIDRU and warned of the potential for losses of the order of several millions of Euros for the public purse."Throughout the remainder of 2007 the group published a series of articles on its website presenting a detailed analysis of the situation at SIDRU and the risks involved, e.g. [1, 2, 3, 4, 5, 6].

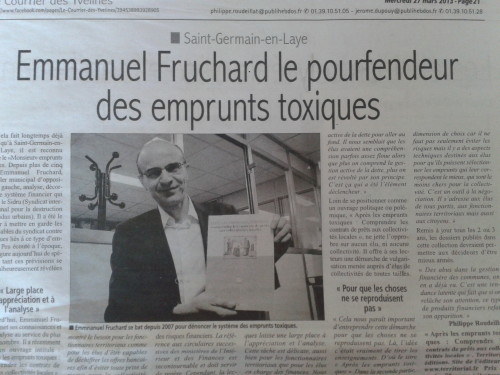

One of the leading figures in the group’s campaign for transparency about SIDRU’s finances and its criticism of Lamy’s speculative use of public funds is Emmanuel Fruchard (pictured below), a financial analyst by profession, who has been fêted in the local press as “the sworn enemy of toxic loans”.

Some video footage of the “two Emmanuels” – Fruchard and Lamy – each presenting his own view of the SIDRU affair can be found in an online report from 2011 by a freelance French journalist, Mélanie Houé.

"One of the leading figures in the group’s campaign for transparency about SIDRU’s finances and its criticism of Lamy’s speculative use of public funds is Emmanuel Fruchard..."After its initial series of articles in 2007 the Saint-Germain Autrement group continued to monitor the situation at SIDRU over the course of the next decade and regularly published updates on its website.

In November 2016 in response to the judgment of the Court of Appeal of Paris, the group published a statement in the "Free Opinion" column of issue no. 697 [PDF] of the JSG in which it spoke in terms of a “damning judgment” against Lamy: "SIDRU: le jugement accable E. Lamy".

"Criticism of Lamy’s management of SIDRU has also come from the local conservative opposition group Agir pour Saint-Germain whose members include the former Deputy Mayor, Anne Gommier."Ms Gommier had already expressed a general dissatisfaction with Lamy’s political style in an interview given to the local press during the 2014 municipal election campaign.

On that occasion she spoke of an unacceptable “disconnect” with the local populace as well as problems with a lack of transparency and consultation.

"On that occasion she spoke of an unacceptable “disconnect” with the local populace as well as problems with a lack of transparency and consultation."She also deplored the way in which the municipal council had been turned into a rubber-stamping chamber: “Le conseil municipal est une chambre d’enregistrement”.

In October 2016 the Agir pour Saint-Germain group joined in the chorus criticising Lamy’s handling of the SIDRU affair. It published a statement in the "Free Opinion" column of issue no. 695 [PDF] of the Journal de Saint-Germain under the title “La Dette du SIDRU: un mauvais suspense” which could be translated freely into English as “SIDRU’s debt: the suspense is killing us”.

In this statement the group complained that although the annual report of SIDRU had been placed on the agenda for the municipal council meeting of 29 September 2016 there had in fact been no discussion at the meeting and the council had not been informed of the state of SIDRU’s finances. They referred to estimated losses of the order of € 70 million from SIDRU’s toxic loans (€ 20 million from the DEPFA loan and € 50 million from a second loan with Natixis). In view of Lamy's status as a graduate of the illustrious Institut d'études politiques de Paris (Sciences PO) and the Ecole Nationale d’Administration, a former advisor to the Minister of Finance and someone who had held a senior position in the Finance Ministry (“Bercy”), one could only surmise that he must have known the risks involved. But irrespective of whether or not he was aware of the risks, in the end it was the local taxpayers who were the “turkeys” (“dindons de farce”) left to foot the bill.

"In view of Lamy's status as a graduate of the illustrious Institut d'études politiques de Paris (Sciences PO) and the Ecole Nationale d’Administration, a former advisor to the Minister of Finance and someone who had held a senior position in the Finance Ministry (“Bercy”), one could only surmise that he must have known the risks involved."In November 2016, following the judgment of the Court of Appeal of Paris, the group published a further statement in the issue no. 697 of the JSG under the title "Monsieur le Président, expliquez-vous" in which it strongly criticised the use of public monies for speculative purposes and called on Lamy to account for his actions as the chairman of SIDRU at the time when the DEPFA loan contract was signed.

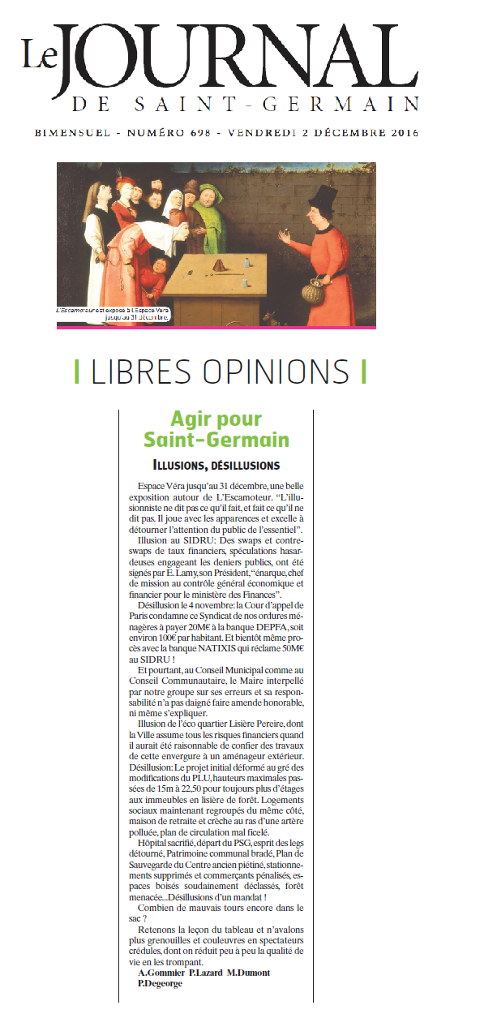

In December 2016 the group published a follow-on statement in the JSG [PDF] under the title of “Illusions, Désillusions” which could be translated into English as “Illusions and rude awakenings”.

Starting off with an ironic reference to the famous picture (at the top of this article) of “the Conjurer” by the Dutch Renaissance painter Hieronymous Bosch which was on display in Saint-Germain as part of an exhibition of his works, they repeated their criticism of Lamy’s financial conjuring tricks at SIDRU (the “illusion”) and referred to the findings of the Court of Appeal of Paris (the “rude awakening”).

"But irrespective of whether or not he was aware of the risks, in the end it was the local taxpayers who were the “turkeys” (“dindons de farce”) left to foot the bill."They deplored the fact that despite repeated calls for Lamy to account for his role in the affair he had not seen fit to offer an apology for his mistakes nor had he even made any attempt to explain himself: “Et pourtant, au Conseil Municipal comme au Conseil Communautaire, le Maire interpellé par notre groupe sur ses erreurs et sa responsabilité n’a pas daigné faire amende honorable, ni même s’expliquer.”

[Translation: "And yet, in the municipal council as in the communal council the Mayor, having been questioned by our group about his mistakes and his responsibility, did not deign to make amends, nor even explain himself."]

"The concluding advice given to the citizens of Saint-Germain was to pay attention to the lesson of Bosch’s painting and not to be gullible spectators who passively watched as their quality of life was whittled away by the deceit and legerdemain of others."After referring to a number of other contentious local issues, they asked how many more “bad tricks” remained to be pulled out of the conjurer’s bag: “Combien de mauvais tours encore dans le sac ?”

The concluding advice given to the citizens of Saint-Germain was to pay attention to the lesson of Bosch’s painting and not to be gullible spectators who passively watched as their quality of life was whittled away by the deceit and legerdemain of others. ⬆

__________

* An article by Carmen Nobel, senior editor of Harvard Business School Working Knowledge, provides some additional background information about the "toxic loan" crisis in France. We covered that in previous parts and would like to highlight some selected bits:

A new study by Boris Vallée and Christophe Pérignon offers evidence that local politicians in France (and probably elsewhere) used high-risk loans for political gain in the years leading up to the recent financial crisis. The strategy worked: Toxic loans helped mayors get reelected.

[...]

The researchers focused their study on France, having gained access to two valuable data sets: The first contained the entire debt portfolio for most of the 300 largest French local governments as of December 31, 2007; and the second contained the loan-level data for all the outstanding structured transactions of Dexia, the leading bank in the market as of December 31, 2009. (Shortly thereafter, Dexia fell apart in the European debt crisis.) The data showed that so-called structured loans accounted for 20.1 percent of the 52 billion euros in total debt for the municipal sample.

Similar to subprime mortgages, structured loans usually carry a few years of guaranteed low interest, which allows local governments to reduce the cost of their debt quickly and obviously. But after the honeymoon period, these loans end up carrying highly variable interest rates resulting from exotic exposures. For example, the City of Saint-Etienne saw the interest rates on one of its major loans rise from 4 percent to 24 percent in 2010, due to the depreciation of the pound sterling. In total, losses on toxic loans doubled the city's debt levels.

[...]

Toxic loan transactions were especially frequent for incumbent politicians running in "swing" areas. Incumbent politicians running in politically contested areas (where the local government had been ruled by the same party for fewer than 10 years) were more inclined to use structured loans than those in political strongholds (where the ruling party had been in power for more than 20 years).

Vallée and Pérignon analyzed how the politicians used the loans—whether they had invested the money in equipment or services for the city, or used the cash to lower taxes for their constituents, or both. It turned out that for the most part, they had used the short-term savings from the loans to lower taxes. "This action is consistent with politicians seeking reelection by catering to taxpayers' preference for low taxes, which represents a likely channel for the previous result on the effects on reelection," the researchers write.

The strategy apparently worked. Controlling for potential selection effects, the researchers found that using structured loans led to an increase in the likelihood that a politician was reelected.

[...]

"These financial innovative products appear, therefore, to have aligned banks' incentives, as the transactions were highly profitable, with local politicians [who] had an interest in getting reelected," Vallée says. "However, this happened at a large cost to the taxpayer, as the positive effects of the loans were short-lived, and interest on toxic loans ballooned when the crisis hit."

In the wake of the financial crisis, many local politicians filed suits against their banks, claiming that they had not comprehended the risky nature of the loans they undertook.

[...]

That said, the researchers did assess the role of financial sophistication on the use of structured loans. They considered the size of each municipality, understanding that larger governments were more likely to employ specialized financial advisors. And they obtained the mayors' current or former occupations, educational backgrounds, and age at the time of election.

The data suggested that mayors with the most-educated backgrounds were actually more likely to take out structured loans than those with less education. Those who took out the most structured (or toxic) loans had worked previously as corporate executives or senior-level civil servants. Former blue-collar workers, farmers, and artists, on the other hand, largely stayed away from these products.

The likelihood to use structured and toxic loans increased with local government size, indicating that bad loan decisions couldn't be blamed on a lack of staff expertise. Meanwhile, the use of structured loans decreased with the mayors' ages. "This was not a senility effect," Vallée says.

[...]