Central Staff Committee of the European Patent Office (EPO) Warns That EPO Management is Robbing or Manipulating Pension Funds Again

Old and related:

- New Leak: Today's EPO Breaks Its Contract With Former Staff of the EPO, Not Just Existing Staff

- The Pension Money That EPO Employees Might Never See

- Working Conditions at EPO Deteriorate and Staff Inquires About Pension Rights

- EPO Union Action: Next Week SUEPO The Hague and SUEPO Munich Talk About New Pension Scheme (NPS) and Salary Savings Plan (SSP)

The Central Staff Committee of the EPO has written to colleagues about pensions being changed. The shorter and more punctual communication said:

Dear Colleagues,The administration have announced plans to increase the total pension contribution rate from 32.1% to 37.8% (+5.7%). They claim that this will “strengthen the shared effort principle”.

However, in this paper, you will see that how that effort is shared among staff is far from equal. Yet again, it is those with lower salaries that are expected to shoulder the burden, while a small group benefits significantly from the changes.

This publication is a week old and it presents numerical data as follows:

Zentraler Personalausschuss

Central Staff Committee

Le Comité Central du PersonnelMunich, 06-10-2025

sc25059cpPension contribution increases – A shared effort?

Impact of changes separates those that bear the effort

and those that reap the benefitsThe administration published an Intranet announcement on the recommendation to increase the contribution rates by 6.6%, which takes the global pension contribution rate from 32.1% to 37.8% (+5.7%) and the healthcare contribution rate from 9.6% to 10.5% (+0.9%). The announcement outlines that the Office choice to reduce the “risk tolerance” has led to defining a new hyper conservative probability of achieving the investment returns of 66%, as opposed to the previous 50%. It further states that increasing the contribution rates strengthens the “shared effort” principle. This paper will give an overview of how the effort is really shared, and what the impact of the changes will have for different staff members.

Shared effort – who provides the effort and who reaps the benefits

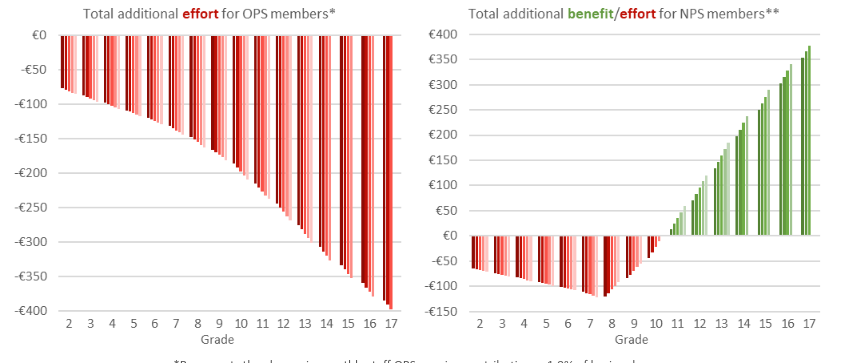

The message from the administration is simple and seems fair at first glance. They state - “To ensure the future financial sustainability of the schemes, the AAG recommends increasing the contribution rates. The Office covers two-thirds of the increase, with staff contributing one- third. This would strengthen the “shared effort” principle of funding our long-term liabilities”.However, it is important to see how that effort is shared among the staff. Our unusual framework of two parallel pension schemes with linked global contribution rates creates complexity in how that effort is actually shared. For Old Pension Scheme (OPS) members, it remains relatively simple – since their pension is solely defined contribution, they all must pay an extra 1.9% (one third of 5.7%) of their basic salary to obtain the same pension when they retire. This can be seen in the graph on the left below. While all OPS members will pay higher contributions during active service, this may be limited in impact for those who are soon to retire, at which point the contribution rate is no longer applicable.

For New Pension Scheme (NPS) members, the picture is not as simple. In this case, the pension is partially defined benefit (the monthly pension) and partially defined contribution (the Salary Savings Plan (SSP) lump sum paid just before retirement). The ratio of defined benefit to defined contribution is also not fixed for NPS members, but depends upon their starting and final salary, and salary progression throughout their career.

*Represents the change in monthly staff OPS pension contributions - 1.9% of basic salary

** Represents the change in monthly staff NPS pension contributions offset by the increase in monthly Office SSP contributions

In the graph above right, it can be seen that for NPS members in the lower grades that although they experience a very small positive increase in SSP contributions from the Office below the cap (0.3% total, 0.2% from 2/3 Office contributions), this is negligible compared to the increase in staff NPS contributions (5.4% total, 1.8% from 1/3 staff contributions). Therefore, those in lower grades also bear the effort of paying for the increased pension security. However, for NPS members in higher grades, the increase in SSP contributions above the cap are the critical factor, for which the rate is set equivalent to the increase in OPS contribution rate (5.7% total, 3.8% from 2/3 Office contributions). For these colleagues, an increase in OPS contribution rates are very beneficial, since this equates to the Office paying significant amounts more into their individual SSP accounts. It is further noted that the above considerations only take into account the contributions. Any interest accrued on the SSP investments are not considered since significant assumptions with large uncertainty would be required to do so. However, it is clear that the benefits would be even higher once the interest on these contributions are added.

So, this casts the “shared effort” in a new light. It is only effort by some, with most weight borne by those in the lowest grades who joined the Office more recently (due to the longer duration they will pay the higher rates), and those that will come in the near future. On the other hand, there are few who financially benefit significantly from the application of the increasingly “conservative” approach. This is a structural problem, because when the Office takes measures to increase the “security” of the pension liabilities, a natural consequence is staff from upper management who joined the Office since 2009 increase the size of their projected pensions via increased Office SSP contributions to their individual SSP accounts.

Deficit between contributions and pension payments

The announcement notes that “Since 2021, contributions have not been sufficient to cover the payment of pension benefits, and the growing yearly deficits have been covered each year by sums drawn from the Office’s operational surplus.” When presented out of context, this appears to be a troubling situation and that increased contributions are justified to solve it. However, this situation has always been expected and is a simple consequence of the Pension Scheme reform. The NPS, that applies to all staff who joined since 2009, limits the pension liabilities of the Office (monthly pension payments), and at the same time limits the pension contributions into the defined benefit system with a capping mechanism. Above the cap, SSP benefits are accrued instead under a separate defined contribution system. Therefore, it is clear that for a certain transition period, the majority of pensioneers will be OPS members with higher monthly defined benefits, while active staff will comprise NPS members paying lower capped contributions. To imply that this “deficit” between pension payments and contributions during the transition period ought to be paid for by higher contributions of the active NPS and remaining OPS members is completely unjust.Pensions currently fully funded, even with the conservative assumptions

The announcement further admits that the pension liabilities for past service are currently fully funded, at a level of 100.3%, and this is with the application of the new conservative assumptions. When questioned, the actuaries claimed that under the old assumptions, this funding ratio would have been even higher. This raises the following question - are these highly conservative assumptions necessary and/or reasonable?The move to a 66% probability of achieving the investment returns has various consequences. First, it drives the discount rate down, since in order for it to be more probable that we will achieve a certain return, the goal for that investment return must be lower. In our case, the discount rate dropped from 3.25% to 2.2%, a huge and never before seen reduction, bringing it to an all-time low. However, the actual return on our RFPSS investments in 2024 was 10.3%, or 7.7% net of German CPI, and the value of the RFPSS as of August 2025 was €14.1bn.

Secondly, it is known that when the probability of achieving the investment returns varies from 50%, intergenerational fairness is not respected, as confirmed by a consultant to the Office, PPC metrics (slide 20). If the probability is set lower than 50%, it implies the current staff would not be paying enough contributions to pay for their own pensions in retirement. When the probability is set higher than 50%, in our case a huge 66%, it implies that the current staff are paying more than necessary for their own pension. Thus, the current generation of active staff are being used to pay for past and potentially future pension liabilities.

Thirdly, an increase in probability imposes a reduction of the discount rate, which forces an increase in the total pension contributions. As explained above, these increases in pension contributions are, counterintuitively, substantially beneficial for a small, well-defined group of staff. There is no wonder that this group finds the conservative assumptions both necessary and reasonable.

The Central Staff Committee

It is worth recalling that Benoît Battistelli's faithful buddies who essentially mock the highest court in The Netherlands try to control the pensions: Willy Minnoye, Who Helped Benoît Battistelli Break the Law and Publicly Boasted About Immunity, Wants to be 'King' of EPO Pensions

How much worse will the EPO get under António Campinos and how much faking will be done by breaking rules (doing patently illegal things), e.g. forcing examiners to grant European software patents - i.e. patents which are both illegal and undesirable?

Faking "growth" is just about as bad as forgery. █