Bernard Arnault - a trusted friend of Thierry Breton

You might have thought that all that wheeling and dealing as Atos CEO would be enough to keep anybody fully occupied. But not so with our Thierry…

"It seems to be some kind of tax avoidance vehicle that was set up in Belgium just as France was preparing to introduce a 75 % "supertax" on incomes in excess of € 1 million after the election of François Hollande as President in 2012."The statutes of Protectinvest state that it "has as its disinterested aim, assuming the death of Mr Bernard Arnault and until October 23 2023, of protecting directly the financial and family interests of the Pilinvest company".

Pilinvest is another Belgian-based holding company owned 99.99 per cent by Mr Arnault.

It seems to be some kind of tax avoidance vehicle that was set up in Belgium just as France was preparing to introduce a 75 % "supertax" on incomes in excess of € 1 million after the election of François Hollande as President in 2012.

Arnault transferred his 31% stake in Groupe Arnault, the family firm that runs LVMH, to Pilinvest in December 2011. At the time the stake, was valued at € 6.5 billion. In November 2013, the Belgian authorities started an investigation into Pilinvest.

"In November 2013, the Belgian authorities started an investigation into Pilinvest."In 2017, it was reported that Arnault had accepted a deal to end the case "without any prejudicial admission of guilt on his part".

By a curious coincidence, Thierry Breton is also listed as a director on the board of Carrefour the French multinational hypermarket retailer in which Groupe Arnault holds a 16 per cent stake jointly with Colony Capital of the US.

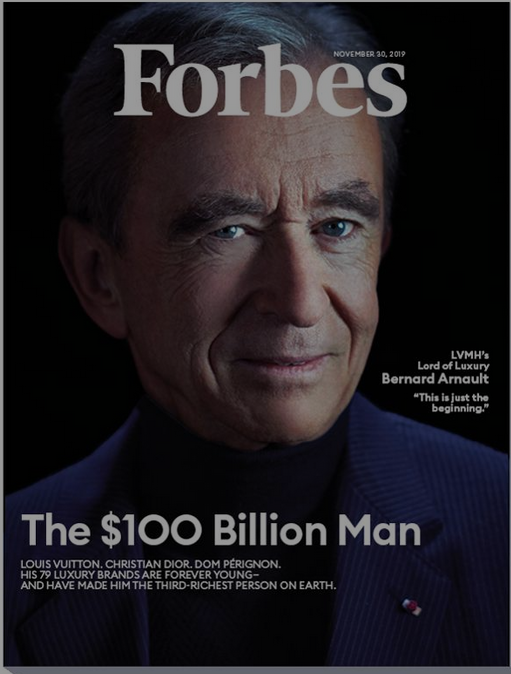

LVMH's Lord of Luxury