08.16.16

Posted in America, Europe, Patents at 12:22 pm by Dr. Roy Schestowitz

“James Logan freely admits that he’s never made a podcast,” according to USA Today (source of the photo below)

Summary: Jim Logan of Personal Audio (a notorious Texas-based patent troll) is still fighting with his bogus patent, having already caused enormous damage with a single software patent that should never have been granted in the first place (due to prior art, not just Alice)

THE USPTO‘s examiners have been so eager to grant patents and perhaps so out of touch that they granted a patent on podcasting to some parasite, in spite of extensive evidence of prior art (even the Patent Office has acknowledged this by now). As a result, many innocent people with a podcast had been hit (extorted) until the EFF stepped in to help. We last wrote about this earlier in the month and it turns out that after years of disputes the patent troll (which is the patent holder) is still not giving up. Just look what a monumental mess just one single erroneous grant by the USPTO has caused!

“Just look what a monumental mess just one single erroneous grant by the USPTO has caused!”Joe Mullin says that the “[p]odcasting patent troll fights EFF on appeal, hoping to save itself” (this patent is pretty much its entire capital/existence*). To quote:

The owner of a patent on podcasting is hoping to snatch victory from the jaws of defeat.

Personal Audio and its owner, Jim Logan, lost their patent last year after lawyers from the Electronic Frontier Foundation showed the US Patent and Trademark Office that various types of Internet broadcasts pre-date the patent, which claims a 1996 priority date.

The podcasting patent became famous and received national media attention after it was used to sue several high-profile podcasters, including Adam Carolla, who raised $500,000 and fought back for a time before reaching a settlement in 2014. Personal Audio had also sued several big TV networks, and its case against CBS went to a jury in September 2014. The jury found the patent valid and awarded Personal Audio $1.3 million, a victory that Personal Audio’s lawyers have noted in their appeal arguments.

The controversy is now in the hands of the US Court of Appeals for the Federal Circuit, the court that handles all patent appeals. A three-judge panel heard arguments over the matter earlier this month.

Let this become a famous example of why software patents are a great menace to everyone, not just to developers. Sites of patent lawyers continue to advocate for software patents under the guise of ‘analysis’ (cherry-picking by patent lawyers who still resort to Enfish, despite admitting that it changed little or nothing at all) and WatchTroll, a vocal proponent of software patents, asks a loaded question in his latest headline, “Would Monopoly® be patent ineligible under Alice?”

“There should be absolutely no software patents in Europe (no matter what Battistelli does to ruin the EPO and crush the EPC these days), especially now that the USPTO demotes these.”Here again is the regression/resort/retreat to Enfish and BASCOM hype, as if two decisions among many hundreds will somehow salvage software patents as a whole. To quote WatchTroll: “The application of the Supreme Court’s decision in Alice v. CLS Bank by the Federal Circuit has been disappointing, to say the least. There have been some rays of hope for innovators with decisions in DDR Holdings, Enfish and BASCOM, but these bright spots shine so radiantly because they are scattered in a sea of despair.”

Despair to who? To patent law firms, i.e. not to actual development powerhouses and/or programmers.

We regret to see the Battistelli-run EPO being lured into software patenting in spite of the EPC. There are already misplaced priorities which favour large US-based companies at the EPO and the EPO increasingly uses the term “ICT”, which some can interpret as a vague insinuation/synonym of software patenting. See this pair of new tweets [1, 2] that ask: “Know how US & European practice differs for ICT applications?”

There should be absolutely no software patents in Europe (no matter what Battistelli does to ruin the EPO and crush the EPC these days), especially now that the USPTO demotes these. “Ever been to EPOPIC? Here are this year’s topics,” the EPO now writes in relation to an upcoming event. Looking at the sidebar under “key events” we see “ICT seminar 2016″ and “Indo-European conference on ICT-related patents 2016″, so there’s clearly some kind of a trend developing. The UPC threatened to bring software patents to Europe (so said multiple domain experts) and also bring patent trolls like Jim Logan. It’s a true danger when people like Battistelli race to the bottom in the name of “production” (even if it’s faked). █

_______

* Wikipedia says the firm, which is a “Texas-based company,” was “formed to enforce two patents applied to podcasting.” It’s described as a “patent holding company” (euphemism for troll).

Permalink

Send this to a friend

Send this to a friend

Posted in America, Patents at 11:24 am by Dr. Roy Schestowitz

Hoping for a post-Alice software patents rebound/resurgence, obviously

Summary: Now that the actions of the Patent Trial and Appeal Board (PTAB), which have been consistently upheld by the CAFC in precedential decisions, are suddenly being questioned the patent microcosm gets all giddy and tries to undermine PTAB (again)

SEVERAL decades ago the Court of Appeals for the Federal Circuit (CAFC) officially brought software patents to the USPTO. Things have been getting a great deal worse since then, as lots of very fundamental programming ideas turned into a monopoly, potentially enforceable against anybody with a computer and low-cost keyboard (and some rudimentary coding skills or access to the Internet, e.g. BBS for source code).

Well, as we noted the other day, based on early birds like Patently-O (typically ahead of the curve), PTAB (which is hostile towards software patents) is now being challenged by CAFC. WIPR has just published an article about it:

The US Court of Appeals for the Federal Circuit has agreed to hear a dispute surrounding the rules for amending patents in Patent Trial and Appeal Board (PTAB) reviews before its full panel of judges.

In a decision handed down on Friday, August 12, the Federal Circuit decided to hear en banc a case involving a pool-cleaning product owned by Aqua Products, vacating its previous opinion.

This was then mentioned also by MIP and bigger Web sites for and by patent lawyers. “In a rare grant of a petition for rehearing en banc,” one author said, “the court decided that an appeal “warrants en banc consideration” of who bears what burden when amending in an IPR. In re: Aqua Products, No. 15-1177, slip op. at 2 (Fed. Cir. August 12, 2016). From the very beginning of IPRs, the Patent Trial and Appeal Board has required the patent owner to bear the burden on a motion to amend.”

This is an important case for defenders of the de facto ban on most software patents, especially in light of Alice. As another new article from MIP put it this morning, “The Federal Circuit has issued a rare reversal of the Patent Trial and Appeal Board” (PTAB’s use of common sense reversed in Arendi v Apple). The legitimate concern here is that CAFC, which is not exactly known for integrity (contrariwise, it’s known for mischief and abuse in recent years), will interfere in the operation of PTAB, dominated by scientists rather than lawyers or judges with a law degree and not the faintest clue about programming. Here is another lawyers’ site stating that the “Federal Circuit [is] Going En Banc on IPR Standards for Amending”. Given that many patent lawyers now equate PTAB with “death squads” (what will they call it next? Stalin? Hitler?), we’re not terribly surprised to see this kind of bias or patent jingoism. A lot of patents news sites are hard for people to comprehend, probably by design/intention (jargon and reference to sections/cases rather than explicit concepts). This way the patent microcosm can ‘monopolise’ analysis and coverage, eventually misleading the readers and making it seem as though everything is rosy for software patents.

“A lot of people who promote software patents also wrongly equate patents with innovation.”In my personal view, the patent systems per se are not the problem; the problem is patent maximalism and limitless scope, as advocated by those who profit from that (notably patent law firms). They have cheapened/diluted patents/innovation to the point where many patents, once scrutinised in a court of law, simply get discarded. Increasingly, with PTAB around, some or these are discarded before they even reach the court (only after USPTO ‘examiners’ rubberstamp these). Notably, unassertible patents (because these patents are crap and their assignee/owner knows it) are not safe anymore.

A lot of people who promote software patents also wrongly equate patents with innovation. They have never implemented a single computer program in their entire life; they’re just armchair marketing people (shameless self-promotion) harping about “protection” or “innovation”, as if patents are not a two-edged sword that impedes and discourages development, usually impacting the smallest developers most profoundly because these developers cannot afford going to court. █

Permalink

Send this to a friend

Send this to a friend

Posted in Courtroom, Europe, Patents at 10:28 am by Dr. Roy Schestowitz

Summary: Things are becoming ever more troublesome at the EPO as the Administrative Council enjoys inaction from the International Labour Organization (ILO), in spite of its role in destroying much-needed oversight at the behest of Battistelli

Summary: Things are becoming ever more troublesome at the EPO as the Administrative Council enjoys inaction from the International Labour Organization (ILO), in spite of its role in destroying much-needed oversight at the behest of Battistelli

IN our only article about the EPO yesterday we mentioned the RFPSS meeting. Things are eroding if not disintegrating at the EPO and it’s taking its toll on staff while no effective oversight exists anymore. Someone in IP Kat‘s comments remarked on the contents of yesterday’s material as follows:

On the subject of pensions, there is some interesting commentary from the CSC on the latest RFPSS meeting.

http://techrights.org/wp-content/uploads/2016/08/sc16129cp.pdf

“The Office thus unnecessarily lowers the probability of reaching our long-term objective for the return on investment, thereby deliberately creating a situation that could be used to trigger further major reforms.

The governance in terms of risk monitoring is still unclear through inadequate role clarity, while such governance deficiencies are recognised as often leading to under performance”.

If one were inclined to believe in conspiracies, the actions of the Office (including eliminating independent oversight of finances, and seemingly ensuring “underperformance” of the pension reserve fund) could all be interpreted as preparation for an attempt to sequester the approx. EUR7,000 million in the reserve fund.

In such a hypothetical conspiracy, the Office would “manufacture” excuses to cut / eliminate pension benefits to those who should be the beneficiaries of the RFPSS fund, only to then conduct a new study that miraculously discovers a massive surplus in that fund. The conspiracy would then conclude with the pension fund surplus being “liberated” by the Office.

Of course, this is all very far-fetched and so ought to easy to dismiss as nothing more than pure speculation. Indeed, a far more plausible explanation is that there is no plan for a cash-grab, just an attempt to deal with the pension liability issue that I have discussed before. Still, the effectively lawless behaviour of the Office in recent years (especially when it comes to matters of staff rights / benefits) does make one wonder…

Someone then responded to that as follows:

I have been entertaining similar suspicions since before Mr. Battistelli’s too office, when his immediate predecessor generously spouted expressions like “fit for the future”, “doing nothing is not an option” (in other words: TINA — but what is the problem in the first place?) and imposing the IFRS charade. I would however employ a much stronger word than “sequester”.

The questions are IMO: who would be the happy beneficiaries of that heist, how would the loot be split among them, and how would it be transferred out of the EPOrg while maintaining appearances?

As we stated yesterday, we have no accounting expertise here (not even in our IRC channels), so we need to rely on input from those who understand such matters and can interpret the financial reports of the EPO. The following remark bemoans Battistelli's political background, which basically makes him unfit (as per qualifications) for the post he has held for over half a decade. To quote:

Don’t forget that there is a French Presidential election campaign coming up in 2017.

https://en.wikipedia.org/wiki/French_presidential_election,_2017

“Primaire à droite : les Amis de Sarkozy lancent un appel aux dons”

http://www.leparisien.fr/politique/primaire-a-droite-les-amis-de-sarkozy-lancent-un-appel-aux-dons-11-04-2016-5704991.php

This is why people who hold elected office for political parties should never be put in change of international organisations with large cash surpluses and no effective oversight.

Right now at the EPO there is virtually no accountability, as pointed out in another thread in relation to a subject we first covered here 2 years ago:

Perhaps we will never know. With the full knowledge and approval of the AC, one of BB’s first actions as president was to disband the only body (the Audit Committee) that could have provided transparency / independent oversight in connection with the EPO’s finances.

The ILOAT also placed its seal of approval on this dastardly act in Judgment 3698:

http://www.ilo.org/dyn/triblex/triblexmain.detail?p_lang=en&p_judgment_no=3698&p_session_id=122&p_language_code=EN

“The authority to establish or abolish the Audit Committee was vested in the Administrative Council alone, and these decisions did not infringe the complainant’s rights in any way, regardless of his role in the EPO.”

Judgment No. 3698 (originally in French) is dated a month ago (when many decisions came out, more than 80% of which rules against the EPO's management) and it relates to a decision we covered here last month. It’s Bernard Paye's complaint to ILO, which gave him a Pyrrhic victory many years too late. Here is the text of this decision with highlights in yellow. The complaint was made by “the principal author of the proposal to establish [the A]udit [C]ommittee,” based on the text:

Organisation internationale du Travail

Tribunal administratif

International Labour Organization

Administrative Tribunal

Registry’s translation,

the French text alone

being authoritative.

P.

v.

EPO

122nd Session

Judgment No. 3698

THE ADMINISTRATIVE TRIBUNAL ,

Considering the complaint filed by Mr B. Y. P. against the European Patent Organisation (EPO) on 15 March 2013 and corrected on 7 May 2013, the EPO’s reply of 5 March 2015, the complainant’s rejoinder of 24 April and the EPO’s surrejoinder of 31 July 2015;

Considering Article II, paragraph 5, of the Statute of the Tribunal; Having examined the written submissions and decided not to hold oral proceedings, for which neither party has applied;

Considering that the facts of the case may be summed up as follows: The complainant challenges the abolition of the Audit Committee of the EPO’s Administrative Council.

On 30 June 2011, following a proposal by the President of the European Patent Office, the Administrative Council adopted decision CA/D 4/11 abolishing the Audit Committee, one of its subsidiary bodies, with immediate effect. On 28 September 2011 the complainant, who was then Head of Internal Audit (Principal Directorate 0.6 of the European Patent Office), and Ms H., who chaired the Staff Committee, filed an internal appeal against this decision. They complained, inter alia, that the General Advisory Committee had not been consulted prior to the adoption of the challenged decision. In November 2012 Ms H. withdrew her appeal. Having heard the complainant, the Appeals Committee of the Administrative Council unanimously recommended on 11 December 2012 that his appeal be dismissed, considering, in particular, that the challenged decision had not been taken in breach of any “applicable legal provision”. By a letter of 20 December 2012, which constitutes the impugned decision, the complainant was notified that the Administrative Council had decided to dismiss his appeal.

In his complaint filed on 15 March 2013, the complainant asks the Tribunal to quash the impugned decision as well as decision CA/D 4/11 and to order the EPO to submit the initial proposal of the President of the Office to the General Advisory Committee. He also seeks compensation in the amount of 30,000 euros for the moral injury that he considers he has suffered and an award of costs.

The EPO submits that the complaint is irreceivable, in particular on the grounds that the complainant is impugning a general decision that does not adversely affect him. In the alternative, it asks the Tribunal to dismiss the complaint as unfounded.

CONSIDERATIONS

1. The Tribunal has jurisdiction under Article II, paragraph 5, of its Statute to hear complaints alleging “non-observance, in substance or in form, of the terms of appointment of officials and of provisions of the Staff Regulations”. In consequence, when “[t]he complainant does not allege the non-observance of any of the terms of his appointment or of any of the Staff Regulations applicable to him”, his complaint must be held to be irreceivable (see Judgment 2952, under 3).

2. The Tribunal observes that the complainant does not allege any violation of the terms of his appointment or of staff regulations that are applicable to him. His case does not relate to his administrative status but rather to the organisation of the EPO, his employer, for which he is plainly not responsible. The fact cited by the complainant that he was “the principal author of the proposal to establish [the A]udit [C]ommittee” that was subsequently abolished does not grant him any right to intervene in a decision to maintain that subsidiary body or not.

The authority to establish or abolish the Audit Committee was vested in the Administrative Council alone, and these decisions did not infringe the complainant’s rights in any way, regardless of his role in the EPO.

3. It ensues from the foregoing that the complaint, which the Tribunal is not competent to hear, is irreceivable and must be dismissed.

DECISION

For the above reasons,

The complaint is dismissed.

In witness of this judgment, adopted on 28 April 2016, Mr Claude Rouiller, President of the Tribunal, Mr Patrick Frydman, Judge, and Ms Fatoumata Diakité, Judge, sign below, as do I, Dražen Petrović, Registrar.

Delivered in public in Geneva on 6 July 2016.

(Signed)

CLAUDE ROUILLER

PATRICK FRYDMAN

FATOUMATA DIAKITÉ

DRAŽEN PETROVIĆ

The above relates to our previous post about complicity of the Administrative Council, in this particular case actively removing accountability or oversight from Battistelli, which the Council appears to be in bed with.

Citing another case, we have already shown how Battistelli worked against the European Patent Convention (EPC). How Battistelli can get away with all this isn’t something we can now defer to the Founding Fathers of the EPO anymore (most of them are deceased by now). █

Permalink

Send this to a friend

Send this to a friend

Posted in Europe, Patents at 9:35 am by Dr. Roy Schestowitz

Like FIFA coverups but much broader

Like FIFA coverups but much broader

Summary: A recollection of events prior to the latest Administrative Council meeting, where Benoît Battistelli’s failings and accountability for failing to correct them never even came up

“COMPLICITY” is increasingly becoming the correct term by which to describe the Administrative Council with its national delegations (who are supposed, at least in principle and in theory, to hold the EPO accountable). Disinterested or self-interested would be a more polite way to put/frame it. If they cared, they would have fired Battistelli already. Even if they kept their word or promise, he would be sacked by now. No secret endowments to this autocrat.

“Watch what Erdoğan is doing in Turkey right now (against military generals, judges, journalists etc.) to better understand how Battistellites (Benoît along with his largely French circle) are running the EPO.”Like in most autocratic regimes, control is exerted through fear and the Erdoğan- or Duterte-like Battistelli scares people at all levels, including delegates whom he bullies in plain sight (maybe to make an example). No wonder some top managers are leaving and others, who reportedly (based on rumours) thought about leaving, say the darnest things on TV in order to cover Battistelli's back.

Watch what Erdoğan is doing in Turkey right now (against military generals, judges, journalists etc.) to better understand how Battistellites (Benoît along with his largely French circle) are running the EPO. It’s something to be expected from third-world nations, but it’s happening in Bavaria, traditionally known for class and sophistication. Fear of Battistelli, including fear of firing him (long overdue), is apparent. Developments prior the latest Administrative Council meeting suggest that there was not a reversal of their position but rather abstinence from the topic of Battistelli’s abuses (breaking rules, including his own).

“The last B28 [Board 28, which privately admits there's an EPO crisis] meeting took place just ahead of the BFC meeting at the end of May,” we learned. “The B28 focused once again on following-up on the consequences of the resolution adopted by the Administrative Council on 16 March 2016. Of particular interest and importance for staff was whether there was any progress in the disciplinary matters, which should be fair and seen to be fair. According to the summary of conclusions of this meeting (B28/8/16), no tangible progress could be reported on then. In June, the President rejected the requests for review of Malika Weaver and Ion Brumme and thereby reconfirmed their disciplinary sanctions. Later the same month, the President apparently interfered with the independence of the Enlarged Board of Appeal proceedings, thereby preventing them from ruling on the merits in the case of the Judge accused of misconduct. Just a few days ahead of the Council meeting, the President suspended Laurent Prunier in The Hague, a further staff representative and SUEPO official to be sanctioned.”

“How convenient for Battistelli, who is no longer so far from his retirement anyway (maybe he will join Sarkozy with his political career thereafter).”One might expect, based on any of the above actions, that Battistelli would be considered in violation/deviance from the requirement set to him by the overseers. How can they possibly reconcile all this? Simple; just don’t mention any of that at all. That is precisely what happened at the meeting, as we wrote at the time. Based on text that was shown to us: “During the AC [Administrative Council] meeting, the Council was informed by both internal and external stakeholders on the flawed consultation process leading to the documents presented for their approval. As for the proposals themselves, among the more obvious deficiencies in the Boards of Appeal reform, the theme had been expanded to include post service employment restrictions and relocation and, according to the President, to be treated as a package. Finally, a review of the Investigation and Disciplinary Procedures which were originally on the agenda were postponed.”

That’s right. Postponed. 3 months! How convenient for Battistelli, who is no longer so far from his retirement anyway (maybe he will join Sarkozy with his political career thereafter). To quote further: “The circumstances leading to the disciplinary cases against staff representatives and Union Officials have been repeatedly raised with the delegations before and after the confidential Council session. [...] The only mention made in the summary of the C-session was that “the Council resolution will be followed up in one of the next meetings”.

This incredible procrastination shows that the Council is not at all interested in restoring stability to the Office. Put another way, the delegates are complicit; they’re a bunch of obedient cowards, maybe some of them paid for it.

In the mean time, judging by the spammy activity of the Twitter account this summer* (the PR team just keeps spamming for EIA 2017 e.g. [1, 2, 3, 4]), there is the assumption that Battistelli will survive another year. If that actually happens, how many workers will even stay at the Office now that resignations and early retirements skyrocket? Rumours we heard say that Battistelli wants to extend the term of Topić’s EPO appointment in spite of the criminal charges against him (not to mention extreme unpopularity among staff, whom he attacks like he attacked staff in Croatia). █

_____

* Or just talking to everyone in general, e.g. [1, 2].

Permalink

Send this to a friend

Send this to a friend

Posted in Courtroom, Europe, Patents at 8:49 am by Dr. Roy Schestowitz

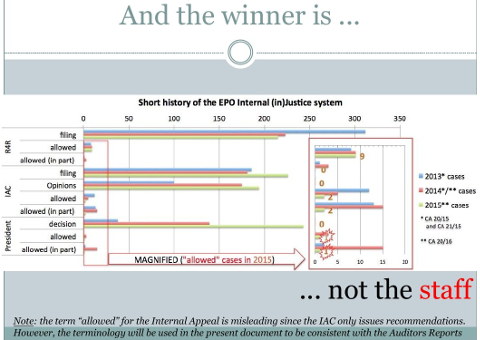

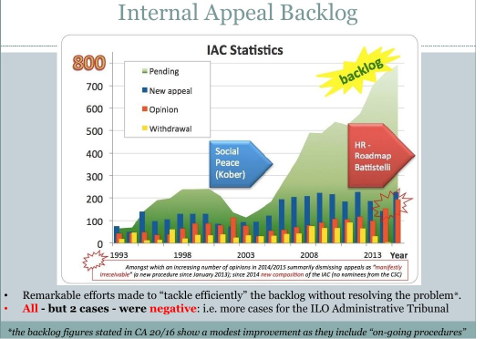

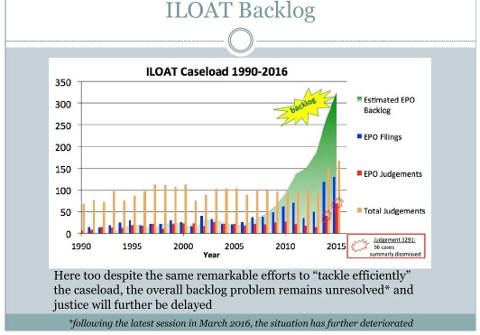

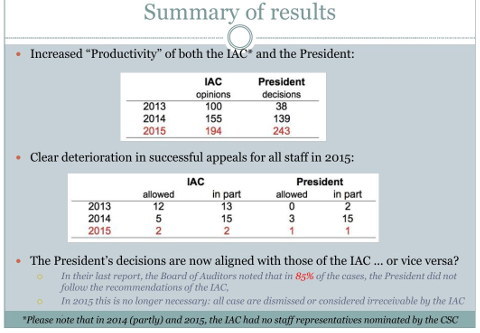

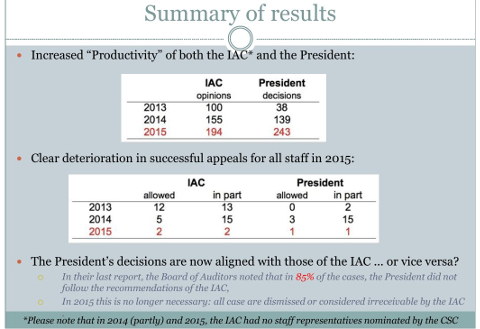

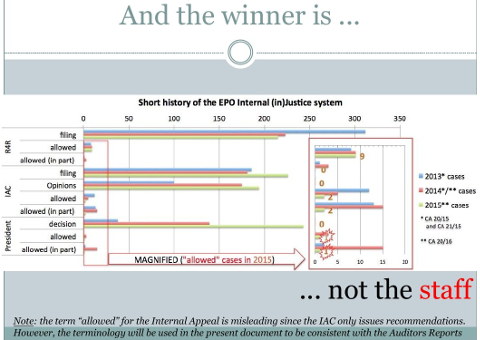

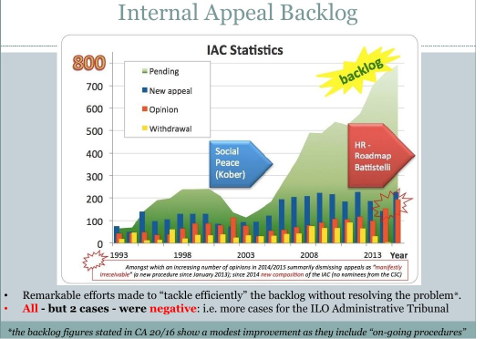

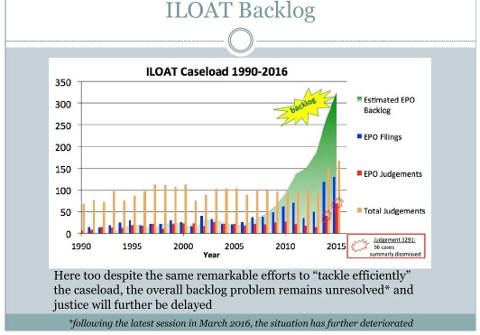

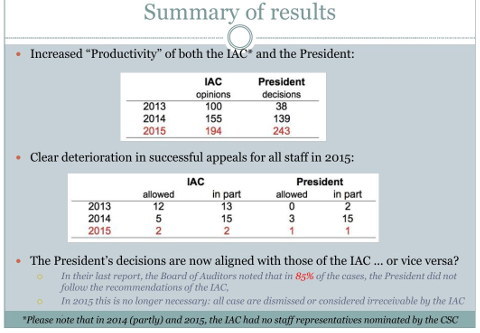

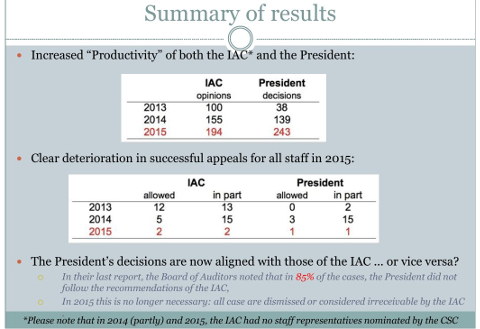

Summary: Self-explanatory graphs about the state of the justice [sic] system which is prejudiced towards/against EPO workers, based on internal reports

If EPO management cannot guarantee justice to its own staff, will it ever guarantee justice to patent holders (defendants and plaintiffs)?

Permalink

Send this to a friend

Send this to a friend

08.15.16

Posted in Europe, Finance, Patents at 4:34 am by Dr. Roy Schestowitz

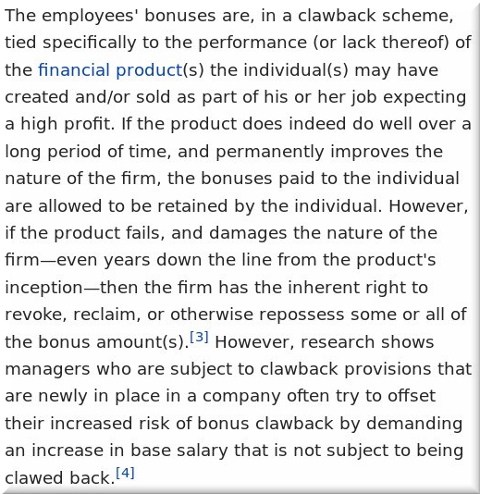

Clawback under Battistelli assures reduction in quality of staff (reduction in patent quality aside)

Summary: Staff of the EPO is leaving (or retiring) in droves as abusive management continues to be the norm and staff benefits are being taken away or gradually revoked

CRACKDOWNS at the EPO carry on, even when staff is (mostly) on holiday. Don’t be misled by the silence. Things are not rosy at all. Some representatives appear to have gotten exhausted, whereas others are too afraid or away on holiday. Some are on permanent leave or effectively suspended. In the coming weeks we shall reveal some more information, potentially about individual stories as well. It’s not pretty and it serves to show what kind of management runs the European Patent Office these days. Rather than value staff, this management does a fine job driving staff away. Cherishing and respecting people (“assets” or “human resources” as management typically refers to them) is the key to an institution’s long-term success. Highly educated people have plenty of employment options, so they don’t tolerate abuse from their superiors. They have other career possibilities (private and public sectors) and they tend to be principled, not judgmental or overly opinionated. They also know their rights and actively defend these.

“Rather than value staff, this management does a fine job driving staff away.”Earlier this year we mentioned the attack on the pension of Els Hardon — probably an illegal move which Battistelli later had to withdraw/revoke. What kind of justice is that? Hardon was dismissed from the Office for her duties as a staff representative and she wasn’t alone. It is very sad that Battistelli’s war on the staff union left much-appreciated staff having to support their representatives with Broodfonds (literally bread funds). Some of them have entire families to support! What happened to human decency?

The crackdown is far from over as EPO management, notably Bergot (the wife of Battistelli’s former INPI colleague), still threatens staff representatives, even while they’re on holiday. Mr. Topić, for instance, blocked the publication of essential reading material in The Hague, without even notifying the Local Staff Committee The Hague. This was censored using threats of disciplinary measures. So the atmosphere of fear clearly prevails at the EPO and people are rightly afraid of communicating with one another. That’s a recipe for disaster that would certainly drive away the high-profile examiners. They would have no problem seeking and finding alternative employment, e.g. in fine universities or in the industry.

“Cherishing and respecting people (“assets” or “human resources” as management typically refers to them) is the key to an institution’s long-term success.”EPO management, moreover, is trying to punish strikers (perfectly lawful activity) even more severely. The management is getting pretty vicious right now, raising the ‘fine’ by 50% by essentially withdrawing a twentieth (instead of a thirtieth) of one’s salary. They are just taking away more and more of people’s money, so no wonder people flee or formally retire early. Watch what they’re doing to people’s investments, pension changes aside. Based on this document [PDF], workers’ interests are trampled and stomped on. Quoting from the summary in the PDF: “lowering the probability of reaching the long-term objective for the investment returns, but instead supported initially unfounded and expensive reforms.”

“Therefore,” it also says, “the Office representative’s reasoning appears to be so ill-founded and misaligned with the interests of the main stake-holders that one might conclude that it serves instead to realise another hidden (or at least undisclosed) agenda.”

There is also a part about Bergot: “Further statements made by Ms. Bergot left Staff representatives with the impression that the Office may also try to influence the investment return assumptions made by the three independent actuaries of the AAG. If successful, this might lead to pushing for a reduction in the assumed rate of return on investment in the actuarial study, which could consequently trigger a recommendation by the actuaries either to increase the contributions which the Office could follow and/or lower the benefits.”

“A lot of people are leaving.”“Unfortunately,” they conclude, “whatever the outcome, it is the staff (and only the staff) who will have to pay the bill.”

Well, they might not stick around to even pay the bill. A lot of people are leaving. Consider the aforementioned changes to pensions, which came under criticism in a report commissioned by SUEPO. These pension changes were recently assessed in a legal opinion (mentioned [PDF] here before [PDF]) and it’s just one among all sorts of ‘reforms’ that breach the fundamental rules and treat staff like dispensable machine operators. The EPO apparently suffers from a lack of money, as it is operating at a massive loss, which makes one wonder if the pensions will be reduced or become some kind of a Ponzi scheme one day. Later this summer we are going to give more examples of where money gets wasted by the millions (for little and sometimes no benefit/gain). Battistelli is terrible on fiscal terms and even some delegates openly speak about it nowadays (a subject to be explored in depth another day). Some say there is even financial fraud.

“What will their retirement mean in terms of pensions?”The brain drain at the EPO is measurable and it is not a matter of ‘gut feeling’ or intuition. One report we saw gives us a rough idea of who left (or is leaving) other than top management. The report says that numbers are made apparent from the EPO’s own reports. To quote: “The social report shows that the Office could not maintain staffing levels at their overall target despite a vigorous recruitment campaign. 2015 saw a net decrease of 77 staff members; in particular the BoA saw a reduction of 15. Furthermore, there were no new recruits from a number of countries including Sl, CZ, CH, NO, and GB. While up to 2014 typically around 100 staff members would retire, in 2015 this number had nearly doubled. The average retirement age has also decreased from around 63 years to about 61 years.”

What will their retirement mean in terms of pensions? Well, to be frank, I’m no accountant and my knowledge regarding accounting is scarce, but the subject was recently explored in IP Kat comments. For record and future reference, here is what one person wrote about the pensions:

The benefits are not over-generous. I can explain the situation about pensions. I’ll try to do that in non-accounting terms. I’ll use round numbers out of my head to make calculations simpler.

The offices self insures the pensions. It simply pays the pensions out of the budget and write the pensions off the salaries as “contributions”. So if we have, say, 1000 examiners with a salary of 10000€/month and 200 pensioners with a pension of 5000€/month, every examiner needs to contribute 1000€/month for the system to be in balance. They can pay that out of their 10000€ salary.

If suddenly, the office lowers the average pay to 5000€, each examiner still needs to pay 1000€ a month, but out of a lower salary. It looks as if the pension contribution is doubled for them.

If suddenly, the office improves efficiency massively and only needs half the examiners (but they keep their pay), we have the same effect: each examiner needs to contribute 2000€ (out of a 10000€ salary).

If we both halve the salary and the number of examiners, contributions quadruple.

Is the office planing to lower both the number of examiners and their salaries? I don’t know. But it does not appear to be planning to lower the fees on patent or the number of granted patents. So the budget would stays the same and the capacity to pay the pensions out of the budget would also stay the same. The office would just need to keep the contributions of salaries at the same level for the examiners and meet the old obligations out of its budget. They would still save massively on salaries by having less active examiners and paying them less in that hypothesis.

But, if the office says “pensions must be a fixed percentage of the salaries” (10% in the above example) and then lowers the total salary mass, there is a problem. It is an artificial problem, but would be called “increase percentage of liabilities” in accountant speak.

Then we have the so called “pension reserve fund”. This was never designed to be a pension fund, but designed to smooth things in case of changes. It was created because in the first years of its existence, the Office had no pensioners (where would they have come from). So the contributions were put aside in that RESERVE fund. This reserve fund is invested in state bonds, its regulation prevent using investments which would be to volatile. The so called “losses” are simply “smaller gains”, because the interest rates are now very low. 10 years ago, we expected a return of maybe 5%, now we don’t have that.

This reserve fund is massive. I think I have read that it could pay the pensions completely for the next 20 years or so. So it can hardly be described as bankrupt.

Then there is that vision floating around that the office would have a “pension fund”. Like some massive amount of money from which only the interests would be enough to pay pensions forever. That is completely wrong: the pension reserve fund was originally designed to pay the benefits out of the fund itself, when necessary.

RFPSS is then mentioned as follows:

Would the “RESERVE” fund you mentioned happen to be the “RFPSS” fund mentioned in the EPO’s financial statement? If so, I note that the assets of that fund were EUR6,600 million at the end of 2015 (with only EUR1,300 million being in bonds). Is that enough to pay pensions completely for the next 20 years or so? If so, what on earth does the EPO’s financial statement mean when it refers to a “Defined benefit liability” of EUR15,800 million? Could that be a projected total spend on pensions over the lifetime of all current and former employees?

Apologies for all of the questions. Like I said, I am no accountant, and so this is all a bit of a mystery to me.

More on the same subject:

Indeed, as stated above, the sum shown is the pension Reserve fund to cover the eventuality that the EPO is unable (or unwilling?) to pay pensions. Indeed originally, the final burden was to be shared between the member states as a sort of guarantor grouping. As is their won’t, the AC simply decided they didn’t agree anymore and passed the honour to the EPO – I’m not sure the legality of that was ever clarified as it didn’t fall within their right to simply dump the agreement of a international treaty.

With regard to the mysterious 4 billion euros appearing from nowhere, that relates to the future liabilities which are referred back to the current date by applying the notionally agreed interest rate. In good times, the rate is high, in bad times, less so. In layman’ terms,if I need to pay 1000 euros in 12 months time and I can get 10% interest, then I need to have 909 euros or so today. If I can only get 1%, then I need 990.1 today. Of course, the sums and time spans are far greater so that compound interest applies. 2 years at 10% would mean I need about 827 today but 1% means 981 etc.

In practice the rate has been falling quickly from 2011 to 2014 and in 2014 the rate was about 1.65% if my memory serves (you can find it in that link). In 2015 the rate rose and thus the liability of 19 billion in 2015 fell back to 15 billion. The rate changes regularly but is applied long term so that the biggest change to liabilities comes from small interest rate changes! In fact the fund has outperformed the rate (and its target) for 30 years.

Yes, the Reserve fund is the “RFPSS”.

I am not an accountant either, but as far as I understood from suepo documents of the time, the “Defined benefit liability” of EUR15,800 million indeed means that the office closes down today, has no incoming revenue whatsoever (no renewal fees on already granted patents) and still has to pay all liabilities. If memory serves, this liability first appeared under Brimelow who insisted that the office use the IFRS accounting system. The choice of that accounting system was criticised at the time. It makes more sense for, say, a car factory which has to put money aside for the goods it orders (e.g. steel, car parts) in case it goes bankrupt.

If my memory is correct, the idea that the reserve fund could pay pensions for 20 years comes from simply dividing the assets by the pensions that the office pays each year at present, possibly correcting by the expected number of pensioners in future years (I am not sure).

All this is to show that there is a large amount of interpretation in the financial statement. Depending on the chosen accounting rules, one can make the office look very rich or very poor. What is clear, however, is that in the past years the office generated several hundred millions euros profit per year (while paying salaries and pensions and constructing new buildings regularly). This money was partially paid to the reserve fund in “extra payments” (in addition to what is paid each year according to the pension scheme). There have been several documents from suepo analysing the situation, but I am not sure whether they are on the public section of the suepo website.

Last but not least, I insist that the regulation for pensions are not any different than in most companies: accrue benefits each year till one is 65 and then get a percentage of your salary. Early pensioners get a discount corresponding to the projected additional pension years, etc… The pensions are also taxable. There are no “lavish benefits” as one sometimes reads.

“The EPO changed the pension system from “defined benefit” to “defined contribution”,” explains the comment below.

I would not know the precise meaning of the expressions used in the Financial Statements. What I do know is that the discount rate is a key factor.

To my best knowledge, every fund promising a certain return, not just the EPO fund, projects how much money will be needed in the future, usually split by calendar year. The fund normally has already some cash, and every fund manager would like to know whether this cash is sufficient to cover the future obligations. To check this, these future obligations are converted in the currently needed amount of money, to cover them fully or as is frequently the case, to 80%.

This conversion considers how much interest you will get on the cash in the fund. This interest is called “discount rate”, implying that you need less than say 100 euro today if you want to have 100 Euro in 20 years. With the current EU politics, the interest you can get is pummeling down, lowering the discount rate. This, in turn, requires you to have more money today. If the European Central Bank changed their strategy next week, this would impact the finances and funding ratios of all funds relying on discount rates.

The catch of the story is that small variations in the discount rate will have a massive impact. A simple 0.2% more or less of the discount rate, over a projection of say 25 years, will make you bankrupt or filthy rich.

The EPO changed the pension system from “defined benefit” to “defined contribution”. The “old guys” get a percentage of the salary as pension, and the EPO carries the risk if the fund “underperforms”. The “new guys” get what the fund delivers, they carry the risk.

Giving lots of crappy patents to applicants is a recipe not to financial success, as the following comment notes:

I now realise that this has all been discussed before.

http://ipkitten.blogspot.co.uk/2014/11/the-finances-of-european-patent-office.html

With the benefit of hindsight, the predictions at the end of the 3rd (anonymous) comment on that thread now look to have been startlingly accurate. Perhaps the BB phenomenon really is all about balancing the books after all.

Whilst it may be that income from renewal fees represents a missing part of the puzzle, there is one thing I don’t understand. Where is the financial benefit to the EPO in rushing applications through to grant (which appears to be the current mantra)? Does this imply that the EPO gets more (on average) from its share of national renewal fees than it does from a full share of its own internal renewal fees? If not, then is the push for earlier grant all about BB keeping the Member States sweet by giving them an ever increasing share of renewal fees?

Perhaps we will never know. With the full knowledge and approval of the AC, one of BB’s first actions as president was to disband the only body (the Audit Committee) that could have provided transparency / independent oversight in connection with the EPO’s finances. So I guess that those affected (current and former EPO employees, patent applicants and the public) will just have to trust that the EPO’s finances are being handled with the utmost propriety by BB and his cronies… what could possibly go wrong?

Another person added:

My original comment related to the problem created (in many countries) where defined benefit (eg final salary) pension schemes were offered without the companies concerned ensuring that they had adequate funds in hand to cover the anticipated liabilities (eg taking into account increases in average life expectancy). Current examples of where things have gone badly wrong with pension funds are BHS and British Steel.

A similar issue applies to state pensions. In that instance, there is no “pension fund” as such, just a country’s GDP. For those countries offering (relatively) generous pensions and (generally) free healthcare, an ageing population will command an ever increasing proportion of public spending.

Please note that I am not placing any blame at the door of the (soon to be) pensioners concerned. I am merely making the observation that bad judgements made by companies, countries and organisations (ie failing to set aside sufficient resources to cope with the retirement of the “baby boomers”) has led us to the situation where the current workforce is lumbered with the problem of making up the shortfall.

I remember people in the 1980s warning us all about the coming “demographic crisis” in Europe. Well, now that the crisis is upon us, I can honestly say that it is almost impossible to identify any national government that has ever done anything significant in the intervening 30 years to defuse the problem.

At least the EPO has the reserve fund… though, curiously, it appears that it has no intention to use that fund to pay pensions. I would have thought that the whole point to having a reserve fund is to ensure that the pension “tail” does not wag the “dog” that is the everything else that the EPO does. However, I have my suspicions that the tail is indeed beginning to “wag the dog”…

“Anonymous” wrote: “I thought that an actuarial study last year showed that the EPO would only need to resort to the reserve fund briefly at some point in the future and that the amount required would be met by the annual return on the fund rather than depleting its capital. I’ll try to find it – I think Suepo got a copy and published it. Cannot imagine BB would let any good news be released – keep the stick and hide the carrot…”

“As to the future of the EPO,” the following commenter said, “the new career system is a net loss for the majority of the employees,” which is probably true. Here is the full comment:

I don’t think ageing of the population is significant for the EPO. Actually, we will have a younger “population”, because we only hire younger staff. On the other hand, the effect I explained about reduced salaries is probably significant.

It is also interesting that you cite British Steel. The steel industry used to employ lots of people but with modern production techniques a lot less people were needed: productivity per person increased considerably (and we could make a parallel with patent examination here, especially if examination is “streamlined”). What also happened is that the industry was privatized and a select small party of people made huge financial gains by keeping the usable parts and refusing to bear the liabilities, including pensions.

As to the future of the EPO all I can say is that:

-the new career system is a net loss for the majority of the employees and huge gains for the select few

-if someone tells me on disputable short term interest rate projections that a fund is bankrupt when this fund has increased regularly in the past 30 years and covers at least a decade of liabilities, I consider that a political message and not a financial analysis.

For those who are into accounting and care to explain this to us, feel free to get in touch or leave a comment below. The consensus appears to be that things are getting worse — not better — for EPO pensioners and verified figures show that the number of retirements have doubled in just one year. This doesn’t bode well for Battistelli. He’s ruining the Office he was entrusted to manage. Why was he not fired in June? █

Permalink

Send this to a friend

Send this to a friend

08.14.16

Posted in America, Patents at 1:31 pm by Dr. Roy Schestowitz

A growing sense of panic among those who profit from software patents bureaucracy

Summary: A look at recent developments in the software patents scene in the United States, with increased focus on (or fear of) the Patent Trial and Appeal Board

THE USPTO has been coming under greater scrutiny for patent scope as of late. Even branches of the government [1, 2] have chastised the Office for abandoning patent quality in favour of greater profits — the same error which many patent offices are tempted to make for short-term gains. David Kappos was a terrible Director at the Office and now he is a corporate lobbyist for software patents in the US because Alice, which came to the Supreme Court after he had departed, effectively ended a lot of software patenting. This post is an outline of several of the latest developments in this area, gathered over the past week as part of our ongoing 10-year (almost decade-long) research.

We start this outline with several pointers to articles from Patently-O, a site which in spite of the long summer vacation has been very active this past week. Watch Professor Dennis Crouch ranting about PTAB, the large (and growing) group of people who trash software patents. He wrote: “Decisions by the Patent Trial & Appeal Board are rarely overturned on appeal. I expect that result is largely due to the fact that the Patent Office has staffed the Board with highly trained and skilled patent law experts. The other important factor though, is the standard of review. Factual findings made by the Board are reviewed for “substantial evidence” — meaning that the findings need not be “correct” but rather rather merely supported by “more than a mere scintilla of evidence.” Thus, patentees are hard-pressed to get a reversal based upon erroneous factual conclusions.”

Considering the utterly bad quality of patents granted by the USPTO in recent years, it oughtn’t take much for the PTAB to correctly and justifiably invalidate these. PTAB is just cleaning up the mess left behind by Kappos et al. It’s well overdue. In reference to Cuozzo [1, 2, 3] and PTAB Patently-O says:

Following Cuozzo, I largely wrote-off GEA Process (“GPNA”) v. Steuben as having any chance for certiorari. However, the petitioner’s newly filed reply brief offers an opportunity for revival.

In its decision on an IPR appeal, the Federal Circuit held that it lacked jurisdiction to review claims that the PTAB exceeded the PTO’s statutory authority by “terminating and vacating five instituted and near-final IPR proceedings, without determining patentability vel non as Congress had intended.”

In another (probably last) article in this series about PTAB and IPRs, Patently-O said that “[i]n a timely motion, Aqua moved to amend three of the claims to include the limitations found in the non-instituted claims. (In particular, the patentee asked to substitute claims 1, 8, and 20 with claims 22-24 respectively. The PTAB agreed that these new claims satisfied the formal requirements of Section 316(d), but refused to enter the amendment – finding that the patentee’s motion had failed to show that the substitute claims were distinguishable over the prior art.”

Good. So the PTAB staff has a backbone and unlike the examiners of the USPTO, there’s no overt bias in favour of granting (even if in doubt). Strictness would serve the USPTO in the long run as it can help enforce/reintroduce the perception of patent quality, suggesting that it is being improved and things are being tightened or cleaned up retroactively as well.

According to this new article titled “Has Rochester lost its patents edge?” — an article which was published a couple of days ago — “patents granted to Rochester-area inventors fell by 21 percent last year, from 1,537 to 1,217.”

It sounds like patent quality is improving then. The number of patents is a very poor indicator of innovation. Now, see the part where patent lawyers interject their bias:

“The law in this area swings back and forth,” said Justin Petruzzelli, a patent lawyer and partner with the Rochester firm Rossi, Kimms and McDowell. He points to a 2014 case, Alice Corporation v. CLS Banking, where the Supreme Court laid out the criteria for computer-related inventions to be considered patent eligible.

“Some of the drop we’ve seen is from uncertainty created by the Alice decision,” Perruzzelli said, “and perhaps an overreaction on applying for patents related to software and business methods.”

It is not an “overreaction”, Mr. Petruzzelli, but you would rather mislead people so that you get more business, right? This is just propaganda/marketing interjected into a so-called ‘article’. People have got common sense and they know that being granted software patents is nowadays very hard. That’s why Petruzzelli is a little nervous. That’s why he wants articles like these.

The statement from Petruzzelli is overshadowed by facts and we see similar statements from others who are in the patent microcosm. Mind a patent attorney who says “Patent for Recording and Indexing Images Survives Alice: http://assets.law360news.com/0825000/825427/show_temp%20(53).pdf” (this is the case between Iron Gate and Lowe’s Companies in a District Court, which is a relatively low and Alice-hostile level; Alice is mentioned a lot in this 31-page decision). Also mind the most vocal pro-software patents site out there. It says:

Electric Power Group LLC v. Alstom S.A., 2015-1778 is a precedential case from the U.S. Court of Appeals for the Federal Circuit that holds that claims directed to collecting and presenting information from a power grid, though “lengthy and numerous,” “do not go beyond requiring the collection, analysis, and display of available information in a particular field.” Rather, the claims state “those functions in general terms, without limiting them to technical means for performing the functions that are arguably an advance over conventional computer and network technology. The claims, defining a desirable information-based result and not limited to inventive means of achieving the result, fail under §101.”

§ 101 is scary to these people. The likes of Petruzzelli know that if the public knew about it, there would not be much more business left for their firms. Here is another new article on this topic [via]. It’s titled “Section 101 Blocks Caller ID Patent” and it says that “Judge Seeborg’s decision offers some examples of considerations that will support a successful § 101 challenge—not least of which is a patentee’s allegations making a patent sound less inventive rather than more.”

So here again we have a reminder of the strength of § 101 and why software patents quickly lose their luster even in the United States.

“Thankfully, PTAB is working at an accelerated pace to undo the damage, much to the fear of the patent microcosm which dubbed PTAB “death squads” (as if patent quality assessment is the moral equivalent of mortal execution).”In Patently-O, another new article (this one by Jason Rantanen for a change) speaks about the Court of Appeals for the Federal Circuit (CAFC), which brought software patents to the US in the first place. Patently-O also refers to Halo [1, 2, 3] and reminds us that one possible takeaway from Halo v Pulse (not a CAFC case but a SCOTUS case) is that we should never read patents as more damages would be incurred as a result of that (article by Dennis Crouch). “On remand,” he notes, “the district court will be hard-pressed to find that the infringement was not willful – based upon the apparently unchallenged verdict. Still, it will be within the district court’s discretion to decide whether the willfulness warrants enhanced damages under Section 284. If enhanced damages are warranted, the district court must then determine how much to award (with an upper limit of treble damages).”

If one embraced a policy of not reading any patents, then proving lower liabilities and compellingly demonstrating this (by citing the policy) would be simple. Here is MIP’s new article about Halo v Pulse. “The Federal Circuit directs district court to decide whether “an enhancement of the damages award is warranted” in Halo v Pulse,” the summary says. Had they not bothered with reading any patents at all, they would be better off for sure.

Another last Patently-O article speaks of indefinteness and notes that “the Federal Circuit has affirmed that Icon’s asserted patent claims are invalid because they “fail to inform, with reasonable certainty, those skilled in the art about the scope of the invention.” Although indefiniteness is a question of law subject to de novo review, the starting point of that review is almost always the district court opinion – thus the court here looked for errors in the district court decision. That is especially true here where the district court decision was based in part on underlying factual conclusions that receive deference under Teva.”

Putting it in simpler terms, scope of a particular patent (how much it covers, breadth of coverage) plays an important role, not just patent scope in its own right. It sure looks like poor quality control at the USPTO left a horrible legacy where many patents are simply unfit for purpose (too broad or too abstract, even not novel). Thankfully, PTAB is working at an accelerated pace to undo the damage, much to the fear of the patent microcosm which dubbed PTAB “death squads” (as if patent quality assessment is the moral equivalent of mortal execution). █

Permalink

Send this to a friend

Send this to a friend

Posted in Europe, Patents at 12:54 pm by Dr. Roy Schestowitz

If you are not part of the UPC ‘conspiracy’ (a small self-serving group which lobbies officials), then you are not invited

Summary: The people who are profiting from patent feuds, disputes, lawsuits etc. are still trying to muscle their will into European law and they keep the general public out of it by locking down (or pricing out of reach) their meetings where they influence/lobby decision-making officials

THE EPO is an incredibly abusive institution where the rich corporations get precedence (or preferential treatment). Seeing what kind of regime now runs the EPO (Battistelli and his mostly French buddies), this should not be surprising, especially if one examines their political connections (the equivalent of the Donald Trump party in the US).

The UPC conspirators (basically a bunch of patent law firms that are still pushing for patent trolls and software patents) now charge a “registration fee for this [UPC] webcast [which] is $299.” To put it bluntly, you have to be pretty rich to just watch some silly webcast in which they strive to shape perception and steer policy. That’s just another example of the “behind closed doors” policy that we wrote about earlier this month. It’s truly appalling and it resembles TTIP or TPP.

There are other new examples of discrimination against the poor or against the general public. Several hours ago in India, which strictly disallows software patenting, the following article was published. It speaks of a company that wants to use instruments against cancer; these would only be available for the rich, which raises the same old ethical dilemmas (covered here in relation to the EPO before). To quote parts of the article:

“In the medical industry , you need to get multiple regulatory approvals. Approval from the US and EU authorities is important before you can ship products,” says Mavely, who has funding from IDG Ventures and Accel Partners. His kits cost Rs 2,500 to Rs5,000, a fifth of what his US competitors charge. Mavely , who has filed for five patents, is ready to ship across the world.

[...]

“Solid clinical data, publications and early adopters who can vouch for your technology are key before you commercialize. This always takes longer than we anticipate,” says Nandakumar Subburaman, founder and CEO of Perfint, which makes robotic devices to deliver cancer drugs directly to organs like the lungs or liver. Since 2005, the company , which holds four US patents, has shipped 100 units, and has been running on $33million in venture funding.

As we have seen at the EPO, some of these things, even if granted a patent and made “Finalist” by the EPO for EIA, turn out to be fraudulent. But the bottom line is, patent systems and their effect on (or from) the public isn’t quite what it often seems on the surface. Scepticism is needed here as this is science, not religion or dogma (like UPC). █

Permalink

Send this to a friend

Send this to a friend

« Previous Page — « Previous entries « Previous Page · Next Page » Next entries » — Next Page »

Summary: Things are becoming ever more troublesome at the EPO as the Administrative Council enjoys inaction from the International Labour Organization (ILO), in spite of its role in destroying much-needed oversight at the behest of Battistelli

Summary: Things are becoming ever more troublesome at the EPO as the Administrative Council enjoys inaction from the International Labour Organization (ILO), in spite of its role in destroying much-needed oversight at the behest of Battistelli

Content is available under CC-BY-SA

Content is available under CC-BY-SA