01.03.17

Posted in Finance, Free/Libre Software, IBM, Patents at 11:22 am by Dr. Roy Schestowitz

Those who have mastered monopolisation, not sharing, cannot be expected to behave as trusted partners

Part of the duopoly (with Visa)

Summary: Free/Open Source software in the currency and trading world promised to emancipate us from the yoke of banking conglomerates, but a gold rush for software patents threatens to jeopardise any meaningful change or progress

ANY company that built its presence/niche/empire on proprietary software sooner or later finds out that it is not sufficient in the face of competition that is based on sharing. Proprietary software is unable to compete with Free/Open Source software. Apple’s patent war on Android (Linux and Open Source), for example, is not new. We used to write a lot about it when it started (Apple v HTC) and Apple is gradually losing more and more of its battles (the higher up they do, the lesser the success rate, as the latest Supreme Court decision served to show — a decision to be discussed tomorrow). Even so-called ‘friends’ of GNU/Linux, Amazon for instance, are pursuing loads of software patents that are occasionally being used.

At the end of last year we gave new examples of software patents being used against Free/Open Source software in finance — the very topic which got this site started in the first place. Worrying about the same type of issues (the attack on Bitcoin/Blockchain [1, 2, 3]), yet another site wrote about it just before the year ended. To quote:

Creating a ‘Blockchain Industry:’ Patenting the Blockchain

Patent filings for blockchain technology have more than tripled since 2014; this spike includes patents filed by cryptocurrency exchanges such as Coinbase, payment processors like Mastercard, and banks like Goldman Sachs and the Bank of America.

According to a report conducted by law firm Reed Smith, the most popular areas for these patent applications are payment systems: both for traditional forms of money and for systems that will be used to trade cryptocurrencies or digital tokens. Mastercard, by way of example, recently filed four blockchain patents for separate steps along authenticating a transaction on the blockchain.

Given the behaviour of IBM as of late and its ambitions in this space (not to mention clients such as Goldman Sachs), it wouldn’t shock us if Big Blue too became not just a participant in the patent gold rush but also a serial patent bully (recall TurboHercules v IBM). This isn’t a wish but a growing concern; all that patent hoarding, as noted in a variety of Bitcoin-themed news site, will likely culminate in some legal wars and out-of-court settlements, leaving the same old oligopolies in tact. That’s just protectionism, not innovation. These patents are not trophies to them; they intend to use them one way or another (they’ll probably claim “defensively”). █

Permalink

Send this to a friend

Send this to a friend

12.17.16

Posted in Bill Gates, Finance, Microsoft at 7:07 am by Dr. Roy Schestowitz

“Bill Gates praises Donald Trump, another multibillionaire,” Yuval Levental writes. “How shocking.”

Background: Donald Trump Thinks He Can Call Bill Gates To Shut Down The Internet

Reference: Super Rich Hide $21 Trillion Offshore, Study Says

Summary: How Bill Gates shifts sides when it suits his financial agenda, this time with President-elect Trump

According to CNBC, Gates recently spoke with Trump, supposedly talking about innovation. Gates then claimed that Trump is a big supporter of innovation, saying that Trump would revolutionize America and get rid of regulatory barriers. He claimed that Trump likes to point out weaknesses in the American system and that he wants to improve on them.

Maybe he will even start an opportunistic partnership with Trump. Interesting Gates should claim this, when in June 2016 he said “Donald hasn’t been known for his philanthropy. He’s been known for other things.” Furthermore, Gates also implied that Trump was behind the other candidates.

He even portrayed Trump as unscientific, stating “Science in general, whether it’s GMOs or vaccines, there’s a lot of people out there who don’t give science the benefit of the doubt”. “In terms of experience, Hillary Clinton and Bill Clinton have more experience on global health.”

Bill Gates has been innovative like many billionaires: he has created a charitable foundation and still manages to profit in the billions every year, and Microsoft as a whole profits from monopolizing software. █

Permalink

Send this to a friend

Send this to a friend

12.13.16

Posted in Europe, Finance, Patents at 7:44 am by Dr. Roy Schestowitz

Turning a blind eye, still

Summary: Yet another large institution can be listed as appalled by the management of Battistelli, who repels talent and turns the EPO into Europe’s source of shame

THE EPO has already driven away many of its talented staff (examiners and judges) and is currently seeking to recruit interns because the EPO is no longer an attractive employer. More institutions across Europe, recently CERN for example, blast the EPO for this utter failure. Abuse against staff led to all this and Battistelli’s horrific leadership made it the official policy.

Joining the growing number of bodies that besiege Battistelli now we have staff of the European Central Bank (ECB). In SUEPO’s words: “IPSO is a staff union, founded by staff of the European Central Bank (ECB) to represent the professional interests of persons working for the ECB and other international institutions and agencies in Germany.”

The “ECB Union,” told us one reader about IPSO, “issues a support message to SUEPO and EPO staff [...] In Frankfurt ECB Union – IPSO – issues a support message to SUEPO and EPO staff [...] IPSO expresses support for colleagues at the European Patent Office Office, with Heardquarter in Munich…”

Here is the original that says:

IPSO expresses support for colleagues at the European Patent Office Office, with Heardquarter in Munich

Like many international organisations, the European Patent Office (EPO) has been given full autonomy to determine the legislative framework applicable to its staff. This creates a situation of high concentration of power, leading to risks of abuses.

Since the arrival of Mr. Battistelli at the helm of the organisation, the level of tensions within the EPO has met unprecedented levels. The matter has been widely reported in the media (SZ, FAZ, die Welt, Le Monde, Médiapart, Libération, De Volkskrant, NRC, El Mundo etc, see also a reportage broadcast by BR on 21 March 2016).

A good overview of the toxic atmosphere has been published by Politico in August 2015.

Unfortunately, since then the situation has deteriorated further. IPSO is deeply saddened to learn that Mr Battistelli dismissed two union officials and elected staff representatives based in Munich, In January 2016. A third one was dismissed on 4th November, in The Hague without a fair trial. Two more union officials and staff representatives are currently being targeted.

To try and de-escalate, the Administrative Council of the EPO adopted resolution CA/26/16 in March 2016, requesting Mr Battistelli to revise the applicable rules to ensure that justice be done and seen to be done. The Council required that, in the meantime, no further investigations or disciplinary proceedings be carried out against staff representatives and union officials. We are informed that Mr Battistelli unfortunatley ignored the resolution, thereby reinforcing the impression that the President of the EPO can act with full impunity.

As representatives of the trade union of ECB Staff, we would like to express our solidarity and support to our colleagues dismissed by Mr. Batistelli. We are not willing to accept the situation as it stands, and are currently considering further action to support our dismissed colleagues with the objective to reinstate them in their function at the EPO.

How much more of a PR disaster can the already-embattled Battistelli endure? He brought this upon himself and he keeps making things worse. It’s going to take down the European economy with it (if this persists). █

Permalink

Send this to a friend

Send this to a friend

10.06.16

Posted in Europe, Finance, Patents at 4:44 am by Dr. Roy Schestowitz

Another classic graphic on the Danish theme…

Summary: A look at the political context surrounding the Chairman of the Administrative Council of the European Patent Organisation

IN the opening part of this series and in the previous post (with addendum that contains photos) we introduced readers to the Chairman of the Administrative Council of the EPO, Mr. Kongstad. Our exploration of this topic is very much relevant to the EPO, as shall become apparent towards the end of this long series.

“Kongstad seems to be in a position of significant power as the Chairman of the EPO Administrative Council. But it’s important to remember that this position is essentially that of a “primus inter pares” in relation to the delegates of the other member states of the EPO.”Mr. Kongstad is no orodinary person. Kongstad seems to be in a position of significant power as the Chairman of the EPO Administrative Council. But it’s important to remember that this position is essentially that of a “primus inter pares” in relation to the delegates of the other member states of the EPO.

For example, under the Administrative Council’s Rules of Procedure, any delegate can raise objections to the Chairman’s conduct of business and, if the objection is not upheld, the delegate may call for a decision by the Council.

Apart from this it should not be forgotten that as Director of the DKPTO, Kongstad is effectively a mid-ranking national civil servant who is ultimately subject to the authority of his political masters back home in Denmark.

For that reason it could be interesting to have a closer look at where the buck stops back in Copenhagen.

“Apart from this it should not be forgotten that as Director of the DKPTO, Kongstad is effectively a mid-ranking national civil servant who is ultimately subject to the authority of his political masters back home in Denmark.”The Ministry responsible for oversight of the DKPTO is the Ministry of Business and Growth. The current Minister is Troels Lund Poulsen who is a member of the Venstre party.

Before scrutinising Poulsen’s colourful and chequered political career, a short digression to provide some background about the Venstre party might be useful for readers who are not familiar with Danish politics.

Venstre – a Danish political curiosity

The Danish word “Venstre” literally means “The Left” but the party which bears this name is actually a centre-right conservative-liberal party with agrarian roots.

Venstre was founded in 1870 as part of a farmers’ movement against the landed aristocracy. Traditionally it was a conservative party advocating free trade and farmers’ interests as opposed to the interests of the aristocracy which were the platform of the other conservative party Højre (The Right). In the 1960s Venstre reinvented itself as a more classical liberal party. Today it is the major party of the centre-right in Denmark, and the third largest party in the country. It espouses an economically liberal “free market” ideology and some people would classify it as belonging to the “neo-liberal” camp.

“The Danish word “Venstre” literally means “The Left” but the party which bears this name is actually a centre-right conservative-liberal party with agrarian roots.”The party has often been in government usually as a coalition partner and many Danish Prime Ministers have come from its ranks.

In the most recent Danish parliamentary elections in 2015, Venstre received 19.5% of the vote, and 34 out of 179 seats. The government which formed following the election is a minority government consisting of Venstre alone which is supported by the other right wing parties. The current party leader and Prime Minister is Lars Løkke Rasmussen.

The Minister – Troels “Troelex” Lund Poulsen

Troels Lund Poulsen was appointed as Minister of Business and Growth in June 2015.

“It espouses an economically liberal “free market” ideology and some people would classify it as belonging to the “neo-liberal” camp.”Poulsen (D.o.B 1976) is a longtime member of Venstre who became politically active at 16, when he joined Venstre’s youth organisation Venstres Ungdom (“Liberal Youth”). A few years later, he had advanced to become its national chairman.

After finishing secondary school, Poulsen started university in 1996 but he never completed his history studies and left university without a degree.

His first and only non-elected jobs were as assistant to Venstre’s press chief, Michael Kristiansen, and as press coordinator for the Danish property development firm Ørestadsselskabet — two positions where he appears to have learned the fine art of spin doctoring.

In 2001, at age 25, Poulsen was elected to the Danish Parliament. Just six years later, he was appointed to the first of four ministerial posts which he has held:

- Minister for the Environment from November 23rd 2007 to February 23rd 2010.

- Minister for Taxation from February 23rd 2010 to March 8th 2011.

- Minister for Education from March 8th 2011 to October 3rd 2011.

- Minister for Business and Growth from June 28th 2015.

Source: Troels Lund Poulsen

“After finishing secondary school, Poulsen started university in 1996 but he never completed his history studies and left university without a degree.”Despite his meteoric rise in Venstre, Poulsen’s political career has also been dogged by controversy as documented by the Copenhagen Post in an article published in December 2011 entitled “Taxgate: Just who is Troels Lund Poulsen?”.

Source: Taxgate: Just who is Troels Lund Poulsen?

The Copenhagen Post article reveals that during his first ministerial appointment as environmental minister from 2007 to 2010, he brokered a deal to import and store the poisonous waste material hexachlorbenzene (HCB), a known animal carcinogen, from Australia. HCB is banned under the Stockholm Convention on persistent organic pollutants.

It was also during that time that Poulsen was widely criticised for accepting the gift of a 65,000 DKK (approx. 8,700 EUR) Rolex watch from the king of Saudi Arabia, the leader – and for then refusing to release his tax return to prove that he had declared the expensive gift. Poulsen finally decided to return the watch in order to silence his critics.

“The Copenhagen Post article reveals that during his first ministerial appointment as environmental minister from 2007 to 2010, he brokered a deal to import and store the poisonous waste material hexachlorbenzene (HCB), a known animal carcinogen, from Australia.”This incident earned him the nickname “Troelex” in the Danish media.

From 2010 to early 2011, Poulsen was Minister of Taxation – a job which he appeared to carry out without controversy until the so-called “Taxgate affair” surfaced in late 2011 some time after he had moved on to the Education Ministry.

Poulsen’s appointment to the Education Ministry in March 2011 was the result of another Venstre-government embarrassment which forced the then-PM Rasmussen to fire his Immigration Minister Hornbech and reshuffle the cabinet. During his seven months as education minister, Poulsen – who left university without a degree – was lampooned in the media as the “uneducated education minister”.

However, the incident which seems to have been most damaging to his reputation was the “Taxgate affair” which had been simmering in the background for some time previously but only really began to attract public attention in November 2011.

A timeline of the case can be found in an article entitled “Taxgate: How it all went down” which was published in the Copenhagen Post in December 2011 as an official enquiry was beginning.

Source: Taxgate: How it all went down

“During his seven months as education minister, Poulsen – who left university without a degree – was lampooned in the media as the “uneducated education minister”.”In December 2011 an official investigation was ordered into allegations that Poulsen and officials from the Taxation Ministry had been involved attempts to influence a tax audit of the opposition Social Democratic leader Helle Thorning-Schmidt and her husband Stephen Kinnock. At the same time Poulsen announced that he was taking a six month leave of absence from Parliament. One Danish journalist quipped that Poulsen might soon have the opportunity to complete his history degree now that his future in politics was looking less promising.

The Taxgate investigation went on for 16 months and involved the hearing of a total of 45 witnesses. The final cost to the Danish taxpayer was estimated in excess of 19 million DKK (approx. 2.5 million EUR) as reported by the Copenhagen Post in an article entitled “As Taxgate finally wraps up, total tab hits 19 million” published in December 2013.

Source: As Taxgate finally wraps up, total tab hits 19 million

“Poulsen is reputed to be fully loyal to his superiors “above and beyond the call of duty” and it seems that his loyalty to the party has been rewarded in spite of the many controversies which have overshadowed his career to date.”Political commentators have described “Taxgate” as one of the biggest scandals to hit Danish politics in recent times. Politiken newspaper’s editor-in-chief Bo Lidegaard has said that the case reeked of “political corruption” and “abuse of power”.

Although Poulsen’s reputation was undoubtedly damaged by the affair, he nevertheless managed to make a political come-back in June 2015 when he was appointed as Minister of Business and Growth in the newly formed Venstre minority government.

Poulsen is reputed to be fully loyal to his superiors “above and beyond the call of duty” and it seems that his loyalty to the party has been rewarded in spite of the many controversies which have overshadowed his career to date.

The “éminence grise” – Permanent Secretary Michael Dithmer

A significant figure in the chain of command between Kongstad and his Minister appears to be the Permanent Secretary at the Ministry of Business and Growth, Michael Dithmer.

“Bendtsen came under investigation for corruption in 2009 as a result of allegations that large Danish companies had paid for 23 hunting trips and 25 golf tours for Bendtsen and officials from his Ministry.”A long-serving career civil servant, Dithmer is also reputed to have strong Venstre connections. Both of his parents were lawyers and were Venstre members who sat on the Copenhagen City Council. It is suspected that Dithmer might also be a party member but this has not been confirmed.

In his role as a senior civil servant Dithmer is normally less exposed to the limelight than politicians like Poulsen but it turns out that he has also been involved in a fair share of controversies during his career.

From 2001 to 2008, Bendt Bendtsen, a member of the Conservative Party, acted as Deputy Prime Minister and Minister for Economic and Business Affairs under Prime Minister Anders Fogh Rasmussen. During this time Dithmer’s duties as Permanent Secretary included advising the Minister about potential conflicts of interest in relation to gifts and benefits in kind.

Bendtsen came under investigation for corruption in 2009 as a result of allegations that large Danish companies had paid for 23 hunting trips and 25 golf tours for Bendtsen and officials from his Ministry.

“It was also reported that in 2007 Dithmer used his official BMW 730i with chauffeur to buy a new hunting rifle during a trip to Jutland.”The total amounts of the benefits alleged to have been received were reported to be of the order of 250,000 DKK (approx. 33,500 EUR).

Source: Bendt Bendtsen meldt for bestikkelse

During the investigation into Bendtsen’s affairs it emerged that Dithmer himself had been a willing participant in a number of hunting trips which had been paid for by DHH (Det danske Hedeselskabet), a business foundation which is one of Denmark’s biggest firms in private forest management and is involved in the commercial trade of forest properties in Denmark and the Baltic region. It was also reported that in 2007 Dithmer used his official BMW 730i with chauffeur to buy a new hunting rifle during a trip to Jutland.

Source: Bendtsens højre hånd fik selv jagtture”

“By 2009 the Danish press was already reporting that the cumulative losses associated with Roskilde Bank had reached the level of DKK 10 billion (approx 1.35 billion EUR) and were expected to climb even higher.”Dithmer also came under fire in connection with the collapse of Roskilde Bank, a regional lender that had existed since 1884. During the years preceding the recent global financial crisis the bank became a test laboratory for “innovative accounting”. It was later found to have grossly exaggerated the value of its assets, while the management indulged in self-enrichment by awarding itself millions in stock options and bonuses. After unsuccessful government-backed attempts to find a buyer, Roskilde Bank was finally declared insolvent in August 2008. By 2009 the Danish press was already reporting that the cumulative losses associated with Roskilde Bank had reached the level of DKK 10 billion (approx 1.35 billion EUR) and were expected to climb even higher.

Source: Roskilde Bank – taxpayers’ nightmare

Following the Roskilde insolvency, about one-third of Denmark’s banks either collapsed or were absorbed by bigger rivals.

In September 2009, the Danish Social Democrats called for an investigation into what Bendtsen had known about Roskilde back in 2006 at a time when the Danish Financial Supervisory Authority (FSA) was already aware that the bank was in trouble.

“In January 2012, reports appeared in the Danish press that Dithmer had been the main inspiration behind economic measures which had cost the treasury at least 2.1 billion DKK (approx. 280 million EUR).”It was claimed that although the Ministry had been repeatedly briefed about the situation at Roskilde, officials in the Ministry had failed to pass the relevant information on to the Minister. Dithmer’s role in the affair came under scrutiny and questions were asked about what was claimed to be his close personal relationship with the Director of the FSA, Henrik Bjerre-Nielsen.

Source: Kendte Bendtsen til Roskilde Banks problemer?

In January 2012, reports appeared in the Danish press that Dithmer had been the main inspiration behind economic measures which had cost the treasury at least 2.1 billion DKK (approx. 280 million EUR). According to one report, in his role as Permanent Secretary he had pushed through a special government guarantee of 13.6 billion DKK (approx. 1.83 billion EUR) to Amagerbanken under Brian Mikkelsen, Bendtsen’s successor as Minister of Economic and Business Affairs. The measure was approved despite the fact that the Ministry had been advised against issuing a guarantee by Finansiel Stabilitet, a state-owned public limited company which was responsible for winding up the activities taken over from distressed banks.

Source: This page about Michael Dithmer

“In the next installment we shall start to look at Mr. Kongstad’s private entrepreneurial activities which he seems to pursue with almost as much enthusiasm as his day-job as Director of the DKPTO.”As a seasoned political operator Dithmer managed to weather these storms and to hold on to his position as the ” éminence grise” of the Ministry of Business and Growth. It has been rumoured that his connections to Venstre may have helped him to emerge relatively unscathed from the various controversies in which he has been implicated but this cannot be confirmed.

That concludes our little excursion through the corridors of power in Copenhagen where the political masters of the DKPTO reside. In the next installment we shall start to look at Mr. Kongstad’s private entrepreneurial activities which he seems to pursue with almost as much enthusiasm as his day-job as Director of the DKPTO. █

Permalink

Send this to a friend

Send this to a friend

08.15.16

Posted in Europe, Finance, Patents at 4:34 am by Dr. Roy Schestowitz

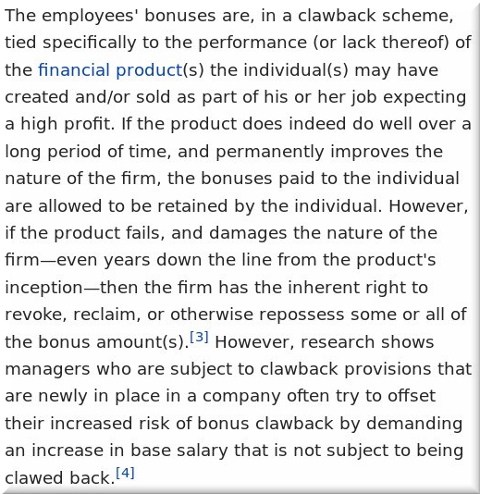

Clawback under Battistelli assures reduction in quality of staff (reduction in patent quality aside)

Summary: Staff of the EPO is leaving (or retiring) in droves as abusive management continues to be the norm and staff benefits are being taken away or gradually revoked

CRACKDOWNS at the EPO carry on, even when staff is (mostly) on holiday. Don’t be misled by the silence. Things are not rosy at all. Some representatives appear to have gotten exhausted, whereas others are too afraid or away on holiday. Some are on permanent leave or effectively suspended. In the coming weeks we shall reveal some more information, potentially about individual stories as well. It’s not pretty and it serves to show what kind of management runs the European Patent Office these days. Rather than value staff, this management does a fine job driving staff away. Cherishing and respecting people (“assets” or “human resources” as management typically refers to them) is the key to an institution’s long-term success. Highly educated people have plenty of employment options, so they don’t tolerate abuse from their superiors. They have other career possibilities (private and public sectors) and they tend to be principled, not judgmental or overly opinionated. They also know their rights and actively defend these.

“Rather than value staff, this management does a fine job driving staff away.”Earlier this year we mentioned the attack on the pension of Els Hardon — probably an illegal move which Battistelli later had to withdraw/revoke. What kind of justice is that? Hardon was dismissed from the Office for her duties as a staff representative and she wasn’t alone. It is very sad that Battistelli’s war on the staff union left much-appreciated staff having to support their representatives with Broodfonds (literally bread funds). Some of them have entire families to support! What happened to human decency?

The crackdown is far from over as EPO management, notably Bergot (the wife of Battistelli’s former INPI colleague), still threatens staff representatives, even while they’re on holiday. Mr. Topić, for instance, blocked the publication of essential reading material in The Hague, without even notifying the Local Staff Committee The Hague. This was censored using threats of disciplinary measures. So the atmosphere of fear clearly prevails at the EPO and people are rightly afraid of communicating with one another. That’s a recipe for disaster that would certainly drive away the high-profile examiners. They would have no problem seeking and finding alternative employment, e.g. in fine universities or in the industry.

“Cherishing and respecting people (“assets” or “human resources” as management typically refers to them) is the key to an institution’s long-term success.”EPO management, moreover, is trying to punish strikers (perfectly lawful activity) even more severely. The management is getting pretty vicious right now, raising the ‘fine’ by 50% by essentially withdrawing a twentieth (instead of a thirtieth) of one’s salary. They are just taking away more and more of people’s money, so no wonder people flee or formally retire early. Watch what they’re doing to people’s investments, pension changes aside. Based on this document [PDF], workers’ interests are trampled and stomped on. Quoting from the summary in the PDF: “lowering the probability of reaching the long-term objective for the investment returns, but instead supported initially unfounded and expensive reforms.”

“Therefore,” it also says, “the Office representative’s reasoning appears to be so ill-founded and misaligned with the interests of the main stake-holders that one might conclude that it serves instead to realise another hidden (or at least undisclosed) agenda.”

There is also a part about Bergot: “Further statements made by Ms. Bergot left Staff representatives with the impression that the Office may also try to influence the investment return assumptions made by the three independent actuaries of the AAG. If successful, this might lead to pushing for a reduction in the assumed rate of return on investment in the actuarial study, which could consequently trigger a recommendation by the actuaries either to increase the contributions which the Office could follow and/or lower the benefits.”

“A lot of people are leaving.”“Unfortunately,” they conclude, “whatever the outcome, it is the staff (and only the staff) who will have to pay the bill.”

Well, they might not stick around to even pay the bill. A lot of people are leaving. Consider the aforementioned changes to pensions, which came under criticism in a report commissioned by SUEPO. These pension changes were recently assessed in a legal opinion (mentioned [PDF] here before [PDF]) and it’s just one among all sorts of ‘reforms’ that breach the fundamental rules and treat staff like dispensable machine operators. The EPO apparently suffers from a lack of money, as it is operating at a massive loss, which makes one wonder if the pensions will be reduced or become some kind of a Ponzi scheme one day. Later this summer we are going to give more examples of where money gets wasted by the millions (for little and sometimes no benefit/gain). Battistelli is terrible on fiscal terms and even some delegates openly speak about it nowadays (a subject to be explored in depth another day). Some say there is even financial fraud.

“What will their retirement mean in terms of pensions?”The brain drain at the EPO is measurable and it is not a matter of ‘gut feeling’ or intuition. One report we saw gives us a rough idea of who left (or is leaving) other than top management. The report says that numbers are made apparent from the EPO’s own reports. To quote: “The social report shows that the Office could not maintain staffing levels at their overall target despite a vigorous recruitment campaign. 2015 saw a net decrease of 77 staff members; in particular the BoA saw a reduction of 15. Furthermore, there were no new recruits from a number of countries including Sl, CZ, CH, NO, and GB. While up to 2014 typically around 100 staff members would retire, in 2015 this number had nearly doubled. The average retirement age has also decreased from around 63 years to about 61 years.”

What will their retirement mean in terms of pensions? Well, to be frank, I’m no accountant and my knowledge regarding accounting is scarce, but the subject was recently explored in IP Kat comments. For record and future reference, here is what one person wrote about the pensions:

The benefits are not over-generous. I can explain the situation about pensions. I’ll try to do that in non-accounting terms. I’ll use round numbers out of my head to make calculations simpler.

The offices self insures the pensions. It simply pays the pensions out of the budget and write the pensions off the salaries as “contributions”. So if we have, say, 1000 examiners with a salary of 10000€/month and 200 pensioners with a pension of 5000€/month, every examiner needs to contribute 1000€/month for the system to be in balance. They can pay that out of their 10000€ salary.

If suddenly, the office lowers the average pay to 5000€, each examiner still needs to pay 1000€ a month, but out of a lower salary. It looks as if the pension contribution is doubled for them.

If suddenly, the office improves efficiency massively and only needs half the examiners (but they keep their pay), we have the same effect: each examiner needs to contribute 2000€ (out of a 10000€ salary).

If we both halve the salary and the number of examiners, contributions quadruple.

Is the office planing to lower both the number of examiners and their salaries? I don’t know. But it does not appear to be planning to lower the fees on patent or the number of granted patents. So the budget would stays the same and the capacity to pay the pensions out of the budget would also stay the same. The office would just need to keep the contributions of salaries at the same level for the examiners and meet the old obligations out of its budget. They would still save massively on salaries by having less active examiners and paying them less in that hypothesis.

But, if the office says “pensions must be a fixed percentage of the salaries” (10% in the above example) and then lowers the total salary mass, there is a problem. It is an artificial problem, but would be called “increase percentage of liabilities” in accountant speak.

Then we have the so called “pension reserve fund”. This was never designed to be a pension fund, but designed to smooth things in case of changes. It was created because in the first years of its existence, the Office had no pensioners (where would they have come from). So the contributions were put aside in that RESERVE fund. This reserve fund is invested in state bonds, its regulation prevent using investments which would be to volatile. The so called “losses” are simply “smaller gains”, because the interest rates are now very low. 10 years ago, we expected a return of maybe 5%, now we don’t have that.

This reserve fund is massive. I think I have read that it could pay the pensions completely for the next 20 years or so. So it can hardly be described as bankrupt.

Then there is that vision floating around that the office would have a “pension fund”. Like some massive amount of money from which only the interests would be enough to pay pensions forever. That is completely wrong: the pension reserve fund was originally designed to pay the benefits out of the fund itself, when necessary.

RFPSS is then mentioned as follows:

Would the “RESERVE” fund you mentioned happen to be the “RFPSS” fund mentioned in the EPO’s financial statement? If so, I note that the assets of that fund were EUR6,600 million at the end of 2015 (with only EUR1,300 million being in bonds). Is that enough to pay pensions completely for the next 20 years or so? If so, what on earth does the EPO’s financial statement mean when it refers to a “Defined benefit liability” of EUR15,800 million? Could that be a projected total spend on pensions over the lifetime of all current and former employees?

Apologies for all of the questions. Like I said, I am no accountant, and so this is all a bit of a mystery to me.

More on the same subject:

Indeed, as stated above, the sum shown is the pension Reserve fund to cover the eventuality that the EPO is unable (or unwilling?) to pay pensions. Indeed originally, the final burden was to be shared between the member states as a sort of guarantor grouping. As is their won’t, the AC simply decided they didn’t agree anymore and passed the honour to the EPO – I’m not sure the legality of that was ever clarified as it didn’t fall within their right to simply dump the agreement of a international treaty.

With regard to the mysterious 4 billion euros appearing from nowhere, that relates to the future liabilities which are referred back to the current date by applying the notionally agreed interest rate. In good times, the rate is high, in bad times, less so. In layman’ terms,if I need to pay 1000 euros in 12 months time and I can get 10% interest, then I need to have 909 euros or so today. If I can only get 1%, then I need 990.1 today. Of course, the sums and time spans are far greater so that compound interest applies. 2 years at 10% would mean I need about 827 today but 1% means 981 etc.

In practice the rate has been falling quickly from 2011 to 2014 and in 2014 the rate was about 1.65% if my memory serves (you can find it in that link). In 2015 the rate rose and thus the liability of 19 billion in 2015 fell back to 15 billion. The rate changes regularly but is applied long term so that the biggest change to liabilities comes from small interest rate changes! In fact the fund has outperformed the rate (and its target) for 30 years.

Yes, the Reserve fund is the “RFPSS”.

I am not an accountant either, but as far as I understood from suepo documents of the time, the “Defined benefit liability” of EUR15,800 million indeed means that the office closes down today, has no incoming revenue whatsoever (no renewal fees on already granted patents) and still has to pay all liabilities. If memory serves, this liability first appeared under Brimelow who insisted that the office use the IFRS accounting system. The choice of that accounting system was criticised at the time. It makes more sense for, say, a car factory which has to put money aside for the goods it orders (e.g. steel, car parts) in case it goes bankrupt.

If my memory is correct, the idea that the reserve fund could pay pensions for 20 years comes from simply dividing the assets by the pensions that the office pays each year at present, possibly correcting by the expected number of pensioners in future years (I am not sure).

All this is to show that there is a large amount of interpretation in the financial statement. Depending on the chosen accounting rules, one can make the office look very rich or very poor. What is clear, however, is that in the past years the office generated several hundred millions euros profit per year (while paying salaries and pensions and constructing new buildings regularly). This money was partially paid to the reserve fund in “extra payments” (in addition to what is paid each year according to the pension scheme). There have been several documents from suepo analysing the situation, but I am not sure whether they are on the public section of the suepo website.

Last but not least, I insist that the regulation for pensions are not any different than in most companies: accrue benefits each year till one is 65 and then get a percentage of your salary. Early pensioners get a discount corresponding to the projected additional pension years, etc… The pensions are also taxable. There are no “lavish benefits” as one sometimes reads.

“The EPO changed the pension system from “defined benefit” to “defined contribution”,” explains the comment below.

I would not know the precise meaning of the expressions used in the Financial Statements. What I do know is that the discount rate is a key factor.

To my best knowledge, every fund promising a certain return, not just the EPO fund, projects how much money will be needed in the future, usually split by calendar year. The fund normally has already some cash, and every fund manager would like to know whether this cash is sufficient to cover the future obligations. To check this, these future obligations are converted in the currently needed amount of money, to cover them fully or as is frequently the case, to 80%.

This conversion considers how much interest you will get on the cash in the fund. This interest is called “discount rate”, implying that you need less than say 100 euro today if you want to have 100 Euro in 20 years. With the current EU politics, the interest you can get is pummeling down, lowering the discount rate. This, in turn, requires you to have more money today. If the European Central Bank changed their strategy next week, this would impact the finances and funding ratios of all funds relying on discount rates.

The catch of the story is that small variations in the discount rate will have a massive impact. A simple 0.2% more or less of the discount rate, over a projection of say 25 years, will make you bankrupt or filthy rich.

The EPO changed the pension system from “defined benefit” to “defined contribution”. The “old guys” get a percentage of the salary as pension, and the EPO carries the risk if the fund “underperforms”. The “new guys” get what the fund delivers, they carry the risk.

Giving lots of crappy patents to applicants is a recipe not to financial success, as the following comment notes:

I now realise that this has all been discussed before.

http://ipkitten.blogspot.co.uk/2014/11/the-finances-of-european-patent-office.html

With the benefit of hindsight, the predictions at the end of the 3rd (anonymous) comment on that thread now look to have been startlingly accurate. Perhaps the BB phenomenon really is all about balancing the books after all.

Whilst it may be that income from renewal fees represents a missing part of the puzzle, there is one thing I don’t understand. Where is the financial benefit to the EPO in rushing applications through to grant (which appears to be the current mantra)? Does this imply that the EPO gets more (on average) from its share of national renewal fees than it does from a full share of its own internal renewal fees? If not, then is the push for earlier grant all about BB keeping the Member States sweet by giving them an ever increasing share of renewal fees?

Perhaps we will never know. With the full knowledge and approval of the AC, one of BB’s first actions as president was to disband the only body (the Audit Committee) that could have provided transparency / independent oversight in connection with the EPO’s finances. So I guess that those affected (current and former EPO employees, patent applicants and the public) will just have to trust that the EPO’s finances are being handled with the utmost propriety by BB and his cronies… what could possibly go wrong?

Another person added:

My original comment related to the problem created (in many countries) where defined benefit (eg final salary) pension schemes were offered without the companies concerned ensuring that they had adequate funds in hand to cover the anticipated liabilities (eg taking into account increases in average life expectancy). Current examples of where things have gone badly wrong with pension funds are BHS and British Steel.

A similar issue applies to state pensions. In that instance, there is no “pension fund” as such, just a country’s GDP. For those countries offering (relatively) generous pensions and (generally) free healthcare, an ageing population will command an ever increasing proportion of public spending.

Please note that I am not placing any blame at the door of the (soon to be) pensioners concerned. I am merely making the observation that bad judgements made by companies, countries and organisations (ie failing to set aside sufficient resources to cope with the retirement of the “baby boomers”) has led us to the situation where the current workforce is lumbered with the problem of making up the shortfall.

I remember people in the 1980s warning us all about the coming “demographic crisis” in Europe. Well, now that the crisis is upon us, I can honestly say that it is almost impossible to identify any national government that has ever done anything significant in the intervening 30 years to defuse the problem.

At least the EPO has the reserve fund… though, curiously, it appears that it has no intention to use that fund to pay pensions. I would have thought that the whole point to having a reserve fund is to ensure that the pension “tail” does not wag the “dog” that is the everything else that the EPO does. However, I have my suspicions that the tail is indeed beginning to “wag the dog”…

“Anonymous” wrote: “I thought that an actuarial study last year showed that the EPO would only need to resort to the reserve fund briefly at some point in the future and that the amount required would be met by the annual return on the fund rather than depleting its capital. I’ll try to find it – I think Suepo got a copy and published it. Cannot imagine BB would let any good news be released – keep the stick and hide the carrot…”

“As to the future of the EPO,” the following commenter said, “the new career system is a net loss for the majority of the employees,” which is probably true. Here is the full comment:

I don’t think ageing of the population is significant for the EPO. Actually, we will have a younger “population”, because we only hire younger staff. On the other hand, the effect I explained about reduced salaries is probably significant.

It is also interesting that you cite British Steel. The steel industry used to employ lots of people but with modern production techniques a lot less people were needed: productivity per person increased considerably (and we could make a parallel with patent examination here, especially if examination is “streamlined”). What also happened is that the industry was privatized and a select small party of people made huge financial gains by keeping the usable parts and refusing to bear the liabilities, including pensions.

As to the future of the EPO all I can say is that:

-the new career system is a net loss for the majority of the employees and huge gains for the select few

-if someone tells me on disputable short term interest rate projections that a fund is bankrupt when this fund has increased regularly in the past 30 years and covers at least a decade of liabilities, I consider that a political message and not a financial analysis.

For those who are into accounting and care to explain this to us, feel free to get in touch or leave a comment below. The consensus appears to be that things are getting worse — not better — for EPO pensioners and verified figures show that the number of retirements have doubled in just one year. This doesn’t bode well for Battistelli. He’s ruining the Office he was entrusted to manage. Why was he not fired in June? █

Permalink

Send this to a friend

Send this to a friend

08.09.16

Posted in Europe, Finance, Rumour at 8:40 pm by Dr. Roy Schestowitz

Summary: Successor of Benoît Battistelli at the Administrative Council, Jesper Kongstad, is rumoured to be hiding something from tax authorities, but lack of transparency in “Eponia” prevents actual verification

THE EPO is no stranger to controversy and scandals. There is virtually no oversight there, no transparency, no accountability. This breeds distrust and often abuse as well. The USPTO is an angel in comparison as it doesn’t enjoy exemptions from European or US laws. There is no “USponia”, only “Eponia”.

“We just read your article with the title "Rumours About Secret EPO Salary of Benoît Battistelli",” some readers told us. “We’re surprised that you didn’t give any mention to the “Rumours About Secret EPO Salary of Jesper Kongstad”…

“If these rumours were true, then as a Danish civil servant he could be in serious trouble if the Danish tax authorities ever happened to investigate the matter.”

–Anonymous“At the end of an interview published by MIP in March of this year Kongstad was quoted as claiming that he does not receive any remuneration for his work at the EPO: “I am now spending about half of my time on EPO-related work, but I do not receive any remuneration for that.”

“In the MIP interview Kongstad was emphatic about the “pro bono” nature of his work for the EPO but not everybody is prepared to buy that storyline.”

Recall this embarrassing recent story. The readers continue: “In fact for some time now there have been persistent rumours circulating that he is somehow “on the payroll” at the EPO although nobody seems to know the precise details about this. Evil tongues have even been heard to say that he does not disclose this additional remuneration for tax purposes in Denmark. If these rumours were true, then as a Danish civil servant he could be in serious trouble if the Danish tax authorities ever happened to investigate the matter.

“It is important to emphasise that these are just rumours.”

–Anonymous“According to this report from 2010, under Danish law intentional and systematic tax evasion can lead to 8 years imprisonment and penalties of twice the unpaid tax liability. However, given the lack of effective oversight at the EPO it’s unlikely that Kongstad has anything to fear. Even if there was an investigation he would probably be whitewashed by the Internal Audit department which operates the EPO’s Investigative Unit and only answers to Battistelli. We are unlikely to see a truly independent audit of Kongstad’s financial relationship with the EPO any time soon.

“It is important to emphasise that these are just rumours. The close symbiosis between Kongstad and Battistelli and the fact that Kongstad is one of the few people privy to the details of Battistelli’s contract lends a certain amount of plausibility to the rumours. But in the absence of an independent audit nobody can say for certain how much substance there is to them. The fact that Kongstad went on record in March to specifically deny that he receives any remuneration for his EPO activities might be an indication that he felt a need to say something in public to counteract these rumours.” █

Permalink

Send this to a friend

Send this to a friend

Posted in Europe, Finance, Patents at 10:47 am by Dr. Roy Schestowitz

Benoît Battistelli is wasting money and is driving the EPO into a wall

And with the UK’s diminishing hopes of UPC, what would he have left to show for it?

Summary: Based on the latest financial statements of the EPO, Benoît Battistelli would have to declare bankruptcy if he wasn’t so unaccountable and dismissive of accounting

THE EPO does not appear to be doing too well under Battistelli’s management, even from a fiscal point of view. He made his contract a closely-guarded secret with some saying that he doubled (or more) his salary (a massive salary in the context of any public office in the EU), he is wasting millions of Euros on his ludicrous lobbying events, he hired PR agencies even from the US (over a million dollars on that alone for just one year), and he pretends all is well and the money flows in like water while many senior examiners take early retirement to escape him.

“Benoît Battistelli will surely be remembered as one who crashed the EPO as we once knew it, emitting lots of worthless patents in haste like Robert Mugabe printing lots of worthless banknotes…”Extensive surveillance (Control Risks) and militarised forces including unnecessary bodyguards that cost a fortune are among other ‘luxuries’ of Battistelli, even if some of these defy European laws. Then there are the massive contracts without tenders (even tens of millions of Euros for each contract), the terrible IT spendings that make it into a black hole, and other budgetary issues that we have covered here over the years.

Suffice to say, those who will pay the price are past and present (and maybe future) employees; none of that stuff, as listed above, is free/gratis after all. Battistelli runs the EPO like Bush ran the US (into debt, into totally avoidable war, and into the ground on grounds of credibility). Here is a comment that showed up today, claiming (with evidence) that “the EPO shows an operating loss (of EUR 145 million), largely due to an increase of over EUR 260 million in “Employee benefit expenses”.” Here is the full comment:

What do you mean by a surplus? I am no accountant, but it appears to me that the latest financial statement (for 2015) produced by the EPO shows an operating loss (of EUR 145 million), largely due to an increase of over EUR 260 million in “Employee benefit expenses”.

http://documents.epo.org/projects/babylon/eponet.nsf/0/6C4CC693A4FAA752C1257FE2004A2CE8/$File/financial_statements_2015_en.pdf

I know that the figures presented need to be taken with a pinch of salt, especially due to the lack of oversight in the preparation of the figures. However, even the “sanitised” figures show what appears to be a huge hole in the pension fund. That is, there are liabilities of EUR15,828 million relating to “defined benefits”, which completely dwarfs the EPO’s current equity of less than EUR8,000 million. It also dwarfs the current assets of the pension, which were reported as just under EUR6,600 million.

I would be keen to know what “Remeasurement defined benefit obligations” means, though. This is because the EPO appears to have found over EUR4,750 million down the back of the sofa in 2015 thanks to that little accounting trick.

This does raise an interesting question, though. Has BB been brought in to deal with the black hole in the pension fund? Can the major effects of his policies be understood as being aimed at maximising current operating profit and minimising pension liability? If so, it would appear that EPOnia is a microcosm of society at large, with current workers (and users of the system) effectively paying the price for the over-generous benefits awarded to the generation that preceded them.

A lot of these expenses are associated with early departures — something which, as we pointed out yesterday, happened a lot in the past two years because of Battistelli and his ‘reforms’.

Benoît Battistelli will surely be remembered as one who crashed the EPO as we once knew it, emitting lots of worthless patents in haste like Robert Mugabe printing lots of worthless banknotes (“231 million percent peak hyperinflation in 2008,” according to Wikipedia). █

Permalink

Send this to a friend

Send this to a friend

04.08.16

Posted in America, Europe, Finance, Patents at 4:39 am by Dr. Roy Schestowitz

English/Original

Publicado en America, Europe, Finance, Patents at 7:51 pm por el Dr. Roy Schestowitz

“En orden de ayudaa a proteger acountabilidad el Banco Mundial GAP monitorea las actividades prestamistas y prácticas corporativas del Banco al proveer refugio y protección a personas se denuncien malas prácticas dentro del Banco. El Banco al igual que otras instituciones internacionales goza de inmunidad de las leyes nacionales mientras persigue su objetivo de desarollo substancial en países medianos y pobres. El Banco como resultado no puede ser enjuiciado por sus empleados y si es sujeto a retalaciónes después de denunciar corrupción un soplón queda sin protección fundamental. Acountabilidad en el Banco requiere libertad de expresión de sus empleados, sin miedo a represalias. Sin efectiva protección para aquellos que denuncian corrupción los fondos pueden ser divergidos y los objetivos del Banco ignorados.”

Banco Mundial. Fuente/GAP. El Banco Mundial es famoso (or notorio) por muchos déstapes.

Sumario: Una mirada al marco de la revisión externa de las investigaciones en la Oficina Europea de Patentes, donde las investigaciones son un innuendo para atacar al síndicato y la eliminación de puntos de vista diferentes

La EPO continúa mostrando un perfil de militarización (vean algunos reciéntes ejemplos), incluso cuando el Jurado y el Consejo solicitan amistad y reconciliacion. Otro punto de vista digno de notar es que unos pocos en la gerencia de Battistelli (si alguno) son actuálmente científicos.

¿Es esta una oficina de patentes (científica) o simplemente una brigada de multinacionales con antecedentes en financias¿ ¿Es acerca de imposición y dominación o verdadero liderazgo que acompañe a los interéses de los ciudadanos y sus empleados?

“La revisora externa de las Investigaciones de la EPO es Olivia Graham,” nos dijo alguién. “¿Dónde/Cuándo ha sido ella una investigadora?

“Es digno de notar que Sebastian Bauer de la Unidad Investigativa fue “Oficial de Etica” para el Banco Mundial en Washington.”Olivia Graham se llama a sí misma (tengan cuidado, las URL de LinkedIn pueden exponer la identidad de uno a la persona mientras esté conectado) “Consejero de Ética en el Fondo Monetario Internacional, en Washington” y dice haber pasado 8 años de su vida con los Militares de los US, luego el Banco Mundial, UN, el Fondo Internacional Para Desarrollo Agrícol (IFAD), y finalmente el IMF.

Es digno de notar que Sebastian Bauer de la Unidad Investigativa fue “Oficial de Etica” para el Banco Mundial en Washington. Si sólo ética fuese el objetivo… la conección con el IMF (si existe alguna) con la EPO o Pinocho Battistelli ess Christine Lagarde [1, 2, 3, 4, 5, 6].

La UPC no debería caernos como un shock total, parece como si gente en posiciones de poder en la EPO y alrededor de ella están más interesados en intereses corporativos que en ciencia y ellos están dispuestos a usar la fuerza para detener aquellos que se crucen en el camino o cortesmente cuestionen su agenda. █

Permalink

Send this to a friend

Send this to a friend

« Previous entries Next Page » Next Page »

Content is available under CC-BY-SA

Content is available under CC-BY-SA